TradeDay Review for 2025

Last Updated: August 8, 2025

Author: Day Trading Insights Research Team

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data is investment advice. Learn more about our affiliate policies and how we get paid.

TradeDay is a futures prop firm known for clear rules and fast payouts. TradeDay has been around since 2020 and has been building a solid momentum and reputation in the prop trading industry. What makes them different is the attention to detail on what their traders wish for. They have day one payouts, up to 95% profit sharing,1-2-1 coaching, and a clear path to live funding. These few things alone make them standout as one of the

top funded trader firms in the industry. Read our full review covering TradeDay’s funding process, costs, key pros and cons, and more.

What is TradeDay?

What is TradeDay? TradeDay is a proprietary trading firm (prop firm) that funds futures traders after they pass a one-step evaluation. Founded in 2020 and based in Chicago, TradeDay was created by industry veterans James Thorpe and Steve Miley. The firm’s mission is to help traders develop skills with minimal risk to their own capital, providing a clear path to a funded account and extensive educational support.

Unlike multi-step programs, TradeDay uses a single-phase evaluation, meaning traders only need to pass one test to qualify for funding. This streamlined approach, combined with transparent rules and a supportive community, has made TradeDay a popular choice among aspiring futures day traders. TradeDay explicitly focuses on day trading – all positions must be closed by the end of the trading day, and it does not allow overnight holds or weekend positions.

The firm emphasizes that it is

not a broker or financial institution but rather a platform offering simulated evaluations and a funding program. In essence, TradeDay’s value proposition is to let you trade futures with the firm’s capital once you prove yourself,

keeping your personal risk low while sharing in any profits.

Who is TradeDay for? Given its futures focus, TradeDay primarily caters to traders interested in E-mini indices, commodities, treasury futures, and similar markets. It’s suited for beginners and intermediate traders who may lack substantial capital or wish to avoid risking their own funds.

The tone at TradeDay is educational – they offer courses, webinars, and even a community Discord channel to help traders enhance their skills. If you’re brand new to futures, TradeDay offers “zero to hero” courses to get you up to speed. Experienced traders can also benefit from the firm’s generous profit sharing and quick payouts.

Overall,

TradeDay’s prop trading program is designed to be approachable, with profit targets that are relatively low, straightforward rules, and readily available support. Next, we’ll dive into the specifics of the evaluation, account types, rules, and how TradeDay stands out in the

prop trading landscape.

TradeDay Evaluation Programs and Pricing

| Acc Type | Acc Size | Platform | Profit Target | Drawdown | Contracts | Reg Price |

|---|---|---|---|---|---|---|

| End of Day | 50K | Tradovate, NinjaTrader | $3,000 | $2,000 | 5 (50 micros) | $165 |

| Static | 50K | Tradovate, NinjaTrader | $1,500 | $500 | 1 (10 micros) | $150 |

| Intraday | 50K | Tradovate, NinjaTrader | $3,000 | $2,000 | 5 (50 micros) | $99 |

| End of Day | 50K | TradeDay X | $3,000 | $2,000 | 5 (50 micros) | $165 |

| Intraday | 50K | TradeDay X | $3,000 | $2,000 | 5 (50 micros) | $99 |

| Static | 50K | TradeDay X | $1,500 | $500 | 1 (10 micros) | $150 |

| End of Day | 100K | Tradovate, NinjaTrader | $6,000 | $3,000 | 10 (50 micros) | $275 |

| Static | 100K | Tradovate, NinjaTrader | $2,500 | $750 | 2 (20 micros) | $250 |

| Intraday | 100K | Tradovate, NinjaTrader | $6,000 | $3,000 | 10 (50 micros) | $200 |

| End of Day | 100K | TradeDay X | $6,000 | $3,000 | 10 (50 micros) | $275 |

| Intraday | 100K | TradeDay X | $6,000 | $3,000 | 10 (50 micros) | $200 |

| Static | 100K | TradeDay X | $2,500 | $750 | 2 (20 micros) | $250 |

| End of Day | 150K | Tradovate, NinjaTrader | $9,000 | $4,000 | 15 (50 micros) | $375 |

| Static | 150K | Tradovate, NinjaTrader | $3,750 | $1,000 | 3 (30 micros) | $350 |

| Intraday | 150K | Tradovate, NinjaTrader | $9,000 | $4,000 | 15 (50 micros) | $300 |

| End of Day | 150K | TradeDay X | $9,000 | $4,000 | 15 (50 micros) | $375 |

| Intraday | 150K | TradeDay X | $9,000 | $4,000 | 15 (50 micros) | $300 |

| Static | 150K | TradeDay X | $3,750 | $1,000 | 3 (30 micros) | $350 |

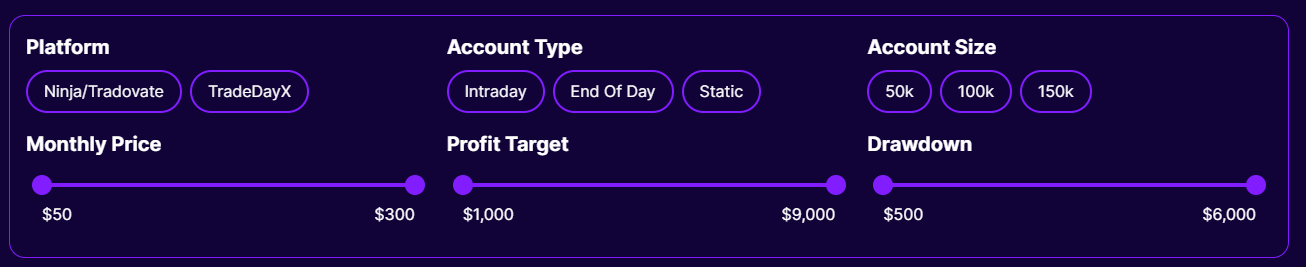

Account Sizes and Fees: TradeDay offers multiple evaluation account sizes to fit different budgets and trading styles. You can choose accounts ranging from $10,000 up to $250,000 in notional buying power.

For example, popular mid-tier options include accounts with balances of $ 50,000, $ 100,000, and $150,000. Each comes with a monthly fee that covers the evaluation and access to TradeDay’s membership resources. As of this writing, the standard price for a $100K evaluation is $275 per month (often discounted to around $165 with promotions).

Smaller accounts naturally cost less – a $ 50,000 evaluation runs about $165/month base price – while the largest, $ 250,000 account, costs around $750/month. TradeDay frequently runs a

40% off discount and waives the first month’s “activation fee”, making it more affordable to start. Notably, if you reach funding, TradeDay stops charging the monthly fee altogether.

Evaluation Structure

All TradeDay evaluations are one-step (single phase). There’s no secondary “verification” stage – hit the profit target once while obeying the rules, and you’re funded. The profit targets are refreshingly low in relation to the account size.

For instance, the $100K account has a profit target of $3,000 – that’s only a 3% gain on the account, substantially lower than many competitors that require a gain of 6% or more. Even the $50K account’s target is just $2,000 (4%). These modest profit goals make the evaluation feel achievable with disciplined trading.

Each account also has a corresponding

drawdown limit equal to the target (e.g., a $ 3,000 trailing drawdown on the $ 100,000 account). Essentially, you can’t lose more than that amount from your starting balance during the test. A big plus is that TradeDay does

not impose a daily loss cap on the evaluation. Many prop firms cut you off if you lose a certain amount in one day, but TradeDay only cares that you don’t hit the overall drawdown. This provides flexibility – you can have a rough day as long as you stay above the total loss limit.

Account Types – Intraday vs End-of-Day vs Static

Uniquely, TradeDay lets traders choose how their drawdown is calculated by offering three account types:

- End-of-Day (EOD) Drawdown: The drawdown threshold updates only after the trading day closes. This is friendlier to traders, since intra-day profits won’t immediately tighten your leash. For example, if you’re up $1,000 in a day and then give back $500, an EOD drawdown account wouldn’t penalize you until EOD (when it moves your stop to $500 above the old level). TradeDay’s EOD accounts cost a bit more monthly (e.g., $100K EOD is approximately $275) because they reduce the risk of mid-day tag-outs. Many traders prefer this option – as one user put it, “One of their biggest pluses is end-of-day drawdown. If a firm doesn’t offer it, run.”.

- Intraday Drawdown: Here, the drawdown threshold trails your highest balance in real-time. If you hit a new equity high, your allowed loss limit moves up instantly. Intraday (real-time) trailing drawdowns are stricter, but TradeDay compensates by charging lower fees (the $100K intraday eval is ~$200/month base, often ~$120 with discounts). This option may appeal to aggressive traders seeking to minimize fees, provided they manage risk tightly throughout the day.

- Static Drawdown: TradeDay also offers “Static” accounts, which have a fixed drawdown that does not trail. The catch is that the static drawdown is significantly smaller. For instance, a $ 100,000 static account has a maximum loss of $750, but the profit target is $2,500. And you’re limited to a very small position size (2 contracts on a $ 100,000 static). Essentially, static accounts challenge you to trade with ultra-tight risk (they’re the lowest-cost accounts, too). The drawdown never moves, so once you profit enough, it effectively becomes a fixed stop $750 below your starting balance. This is tough but rewarding for traders who can chip away consistently – you only need a few thousand in profit to pass. Note: The static drawdown is marked with a star (★) on TradeDay’s site to distinguish it from trailing types.

No matter the account type, TradeDay requires a minimum of 7 trading days to complete an evaluation. This means you can’t just hit the profit target on a single lucky day and stop; you must demonstrate profitability over at least a week. (TradeDay formerly required 10 days, but in response to user feedback, they lowered it to 7 days in 2023.)

There is no maximum time limit to pass – you can take it at your own pace, as long as you continue to pay the monthly fee. If you violate a rule or hit the drawdown, the evaluation ends, but you’re allowed to reset the account by paying a reset fee (approximately $59 and up, depending on account size).

Many traders appreciate that resets are reasonably priced compared to starting a brand new evaluation. Additionally,

multiple accounts are permitted – TradeDay allows you to run up to 6 evaluations simultaneously, enabling you to diversify your strategies. They even advertise bulk discounts for multiple accounts (often 40% off) to encourage this.

TradeDay Trading Rules and Requirements

To ensure you trade responsibly, TradeDay enforces a few key

trading rules during the evaluation:

Trailing Drawdown

This is the cornerstone risk rule. The trailing drawdown (for intraday and EOD accounts) moves up as you profit, but never goes above your starting balance. In practice, if you have a $3,000 drawdown on a $ 100,000 account, your “bankruptcy level” begins at $97,000 and will trail behind your account’s high watermark until it reaches $ 100,000. Once you’ve earned enough profit that the drawdown would reach the starting balance, it “freezes” there (meaning the drawdown becomes fixed at $100K, effectively converting to a breakeven stop). This rule ensures you don’t give back too much of your gains and encourages consistent risk management.

Consistency Rule (30% Profit Cap)

TradeDay places a strong emphasis on consistency over lucky windfalls. They stipulate that no single day’s profit can exceed 30% of your total profits during the evaluation. In other words, you can’t pass the test on one or two huge trades – your gains need to be spread out.

For example, if the profit target is $3,000, the most you’re allowed to make in any one day is $900 (which is 30% of 3000). Any day that exceeds that would invalidate the consistency objective. This rule encourages traders to size their trades appropriately and trade steadily. It’s similar to the “Maintain Consistency” rule used by Earn2Trade’s Gauntlet program.

While some find it restrictive, TradeDay’s view is that

successful trading is about a repeatable process, not one-off jackpots. The 30% cap requires you to demonstrate your ability to generate profits over multiple days consistently.

No Overnight or Weekend Holding

TradeDay is strictly a day trading program. All positions must be flat by the market’s close each day. In practice, for futures, that means closing positions before the afternoon halt (around 3:55 PM CST for equity futures). You also cannot hold through the weekend. These rules protect both you and the firm from gapping risks.

News Trading

Similarly, TradeDay asks traders to avoid trading during major scheduled economic news releases. For example, you should be flat during events like Federal Reserve interest rate decisions or Nonfarm Payrolls. The idea is to prevent volatile whipsaws from blowing accounts. Some traders chafe at not being able to trade news spikes, but this is a common rule among prop firms aimed at managing risk. (If news trading is your bread-and-butter, note that a few competitors like Apex allow it – see comparison table below.)

Permitted Instruments

TradeDay’s accounts are for futures trading only – this includes equity index futures (e.g., S&P E-mini), commodities (such as crude oil, gold, etc.), treasury bond futures, currency futures, and micro futures. You can scalp, day trade, or swing trade intraday as you please. Algorithmic/automated strategies are also allowed on the platform. Essentially, any futures that trade on CME, CBOT, NYMEX, COMEX, and are supported by their broker are fair game.

One thing to be mindful of is

position limits: each account size has a maximum contract limit. For example, the $100K account allows up to 10 standard contracts (or 50 micro contracts) at a time. The $ 50,000 account allows for a maximum of 5 contracts. These limits are generous and aligned with the drawdowns – they prevent you from making oversized bets that could violate risk in one trade.

Other Rules

TradeDay’s evaluation has no quirky hidden rules. There are no restrictions on trading style (scalping vs long-term intraday trades) and no requirement to trade every day. You can even take breaks, and the evaluation will resume where you left off (just keep in mind that your monthly subscription continues).

The key is simply to follow the above rules until you hit the profit target over at least 7 trading days. To date, traders report that TradeDay’s rule set is straightforward and communicated, with “no hidden conditions”. The firm’s transparency in rules is frequently praised in customer reviews.

If a trader does break a rule (say, you accidentally hold a position into the close), the evaluation is considered failed. However, TradeDay’s support is understanding – minor accidental breaches might prompt them to reach out or give a warning, but typically, you’d need to reset the account to continue. In any case, the rules are there to instill good habits. By adhering to the profit cap, closing positions on time, and managing drawdown, you’re effectively practicing the same discipline you’ll need once funded.

TradeDay Payouts and Profit Sharing

TradeDay’s payout policy is exceptionally trader-friendly – in fact, they market it as “the best in the business”. Once you pass the evaluation and receive a funded account, here’s how payouts work:

Profit Split

In the funded stage, you keep 100% of your first $10,000 in profits. This means the firm takes no cut at all until you’ve pocketed a full 10K. After that threshold, profits are split 90/10 (90% to you, 10% to TradeDay). This is a very high payout ratio – essentially industry-leading, since many prop firms offer 80% to traders.

TradeDay even mentions that with strong performance, you have the potential to reach 95% profit share. In practice, the 95% likely comes after some milestone or time with the firm (or perhaps special scaling plans), but 90% as the standard split is already generous.

For comparison,

Earn2Trade’s funded accounts are 80/20, and

Topstep recently updated to a 90/10 split (after an initial bonus). TradeDay gives a

$10K zero-fee buffer, which sets it apart – it shows confidence that if you succeed, they’re happy for you to take the first chunk of gains in its entirety.

Fast, Flexible Withdrawals

One standout feature is instant payout eligibility. The very day your funded account is activated, you can request a withdrawal (as long as you have profits and meet a small minimum balance). There’s no waiting period, unlike some firms that require 10 or 20 trading days or a 30-day wait before the first payout.

TradeDay only asks that you maintain a “minimum profit buffer” – essentially, you can’t withdraw below your starting balance or the drawdown. In practice, traders report that you need at least $250 in profit to make a payout request. Once requested, TradeDay processes payouts extremely quickly, often within 24 hours.

There are no limits on withdrawal frequency or amount, except for maintaining the account balance above the required minimum. You could, in theory, pull profits out every day if you wanted (hence their term “daily payouts”). This is a significant advantage for those who require immediate access to their earnings.

Many competitors only pay out on a weekly or monthly basis. For example, MyFundedFutures’ payouts depend on hitting profit milestones and tend to be less frequent. TradeDay’s approach is much more flexible – you’re treated like a true independent trader who can withdraw at will once profitable.

No Consistency Rule After Funding

Notably, TradeDay’s strict 30% profit consistency rule

does not apply to the funded account. Once you’re funded, you can have big winning days – nobody will ask you to prove consistency anymore. This is explicitly noted: “No consistency required to request a payout when funded!”. So if you have a funded account and you hit a home run trade, you’re free to withdraw those gains (just mind the drawdown still in effect to keep the account open).

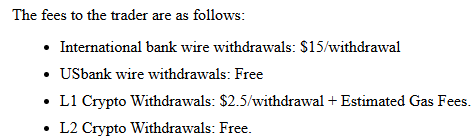

No Fees on Payouts

TradeDay does not charge any withdrawal fees, and they cover transaction costs on their end. You’ll receive the full amount you asked for, via the payment method of your choice (most likely bank wire or digital transfer). They utilize a service called RiseWorks to facilitate international transfers smoothly. There’s no profit “retention” or forced rollover of profits – some prop firms require you to leave a portion in the account, but TradeDay lets you withdraw down to just above your drawdown threshold.

To illustrate, imagine you have a $ 100,000 funded account. You make $5,000 in profits in your first week. You could withdraw, say, $4,000 immediately (keeping $1,000 in the account to stay above the drawdown).

You’d receive the full $4,000 (since it’s under the first $10K, it’s 100% yours). And you didn’t have to wait weeks – you got it the next day. This kind of immediate reward is a big morale boost and a sign that TradeDay isn’t trying to trap traders with their capital. According to user reviews,

“daily payouts and end-of-day drawdown” are two small details that “make a big difference” for traders’ experience.

TradeDay’s approach to profit sharing is aligned with their philosophy that when you succeed, they succeed. By guaranteeing funding and offering generous splits, they’re signaling that they want profitable traders to stick with them long-term. It’s worth noting that TradeDay charges no “activation fee” when you get funded (this fee is common elsewhere to cover the setup of a live account).

They’ve waived it entirely as part of their current promotion. The only cost once funded is the exchange market data fee, which TradeDay passes on to its clients. Because the funded account is a professional account, CME data can cost around $120-$130 per month for full market depth.

Several traders mention that after you pass, your monthly evaluation fee is swapped for this data fee. Essentially, you trade one fee for another – but now you’re trading with the firm’s money, and if you’re making profits, that data fee is a minor overhead. It’s good to be aware of it, though:

funded futures traders in the U.S. are typically classified as professionals for data, so the exchanges charge higher rates (not something TradeDay controls).

Platforms, Tools, and Support Resources

TradeDay provides a robust infrastructure for traders, combining technology with education. They seem to truly care about their success and operate on a model "if you win, I win" which is fantastic for traders that are looking to join their funded trader program.

What Trading Platforms Does TradeDay Work With?

You won’t be locked into a single trading platform – TradeDay supports a wide range of popular futures trading platforms. These include NinjaTrader, Tradovate, TradingView, Jigsaw Daytradr, and Quantower, among others.

NinjaTrader/Tradovate is a common choice (TradeDay integrates with those seamlessly), and many traders love TradingView’s browser-based interface for charting. By offering multiple platforms, TradeDay allows you to trade in the environment that suits you best.

They even mention a proprietary platform called

TradeDayX, which works on both web and mobile, although most will likely stick to the established third-party platforms. The key point: whether you trade on a desktop setup or a mobile device,

TradeDay has you covered – their system is stable and cross-compatible. As they put it, “trade from your phone to your desktop, from your home to the beach” (though we’ll caution against beach trading without a solid Wi-Fi!).

Education and Mentoring

This is where TradeDay really shines. Unlike some prop firms that simply sell you a challenge and disappear, TradeDay actively invests in making you a better trader. Upon joining (even before you’re funded), you get access to a rich members' area that includes:

- Courses for Beginners: If you “don’t know anything about trading futures,” they have structured courses to take you from beginner to competent. These cover futures basics, trading strategies, and risk management fundamentals.

- Daily Webinars & Live Streams: TradeDay hosts daily morning meetings and regular live webinars where experienced traders discuss market outlooks, trading techniques, and answer questions. This “virtual trading room” environment helps reinforce good habits. It’s like having a coach checking in with you each day.

- Market Analysis and News: They provide 24-hour market commentary and institutional-grade research through partnerships (for example, they feature analysis from The Market Chartist, an award-winning research provider). Traders get live news feeds and market analysis around the clock. This can give you an edge by keeping you informed of key market drivers.

- Discord Community: TradeDay maintains an active Discord chat and forums where members can engage in discussions. This community aspect means you’re not alone – you can bounce ideas off peers or seek help if you’re struggling. Successful traders and even the founders sometimes chime in to answer questions. According to TradeDay, “we have successful traders waiting to answer your questions” in the community.

- One-on-One Coaching: They highlight “1-2-1 coaching” as part of how TradeDay compares to other firms. This suggests that traders can book personal mentoring sessions (possibly after funding, or maybe as part of the CoPilot program). Having seasoned traders mentor you individually is a huge value-add that few prop firms provide.

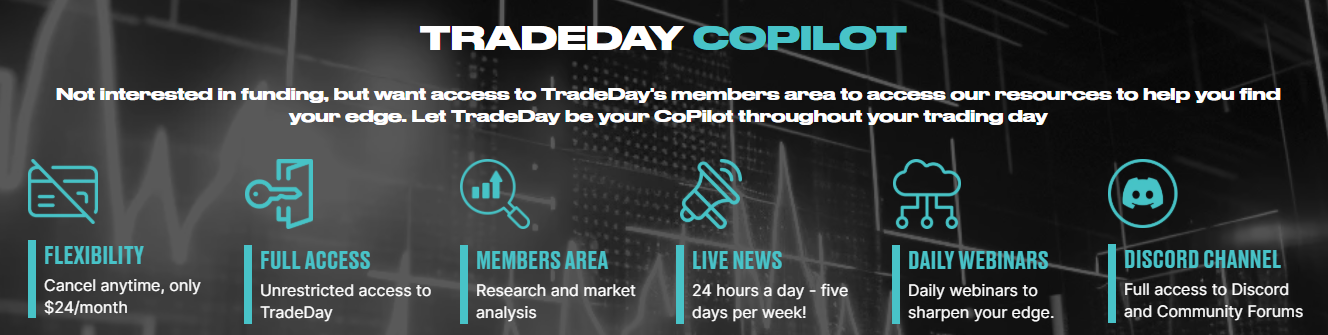

All these resources are funded by the monthly membership fee you pay. TradeDay explicitly contrasts this with others who “sell trading courses for thousands of dollars” – instead, they bundle education into the affordable monthly subscription. They offer a standalone TradeDay CoPilot membership for $24/month, which gives access to all resources and the community without requiring participation in an evaluation.

That’s an option for those who want the learning aspect. But for evaluation participants, know that your fee isn’t just for a simulation account – you’re getting a quasi-educational package. Many user reviews praise TradeDay’s commitment to trader growth. TradeDay’s owners bring decades of experience building and mentoring prop desk traders, and it shows in how they’ve structured the program.

Customer Service

In line with the supportive vibe, TradeDay’s support team is responsive and helpful. Traders frequently mention receiving thoughtful and timely replies from TradeDay’s customer service. Whether it’s via email, support ticket, or even phone (they list a Chicago phone number), the company seems to take customer care seriously.

They also have an extensive FAQ knowledge base on Freshdesk. On Trustpilot, many 5-star reviews highlight the “efficient response and help” from customer service, which gives traders peace of mind. Having a prop firm that listens and adapts to trader feedback is invaluable.

Some of TradeDay’s improvements (like reducing the minimum days to 7, introducing multi-account support, and eliminating activation fees) have come after listening to their user base. The founders even engage on social media and forums to gather input. Overall, TradeDay’s platform and support form an ecosystem

geared toward trader success, combining solid technology (multi-platform, stable data), education, and human support. It feels less isolating than just trading a sim on your own.

Pros and Cons of TradeDay Prop Firm

Pros

- One-Step Evaluation with Low Profit Targets: There is only a single phase to get funded, and profit targets are typically around 3–4% of the account (e.g., $ 3,000 on $ 100,000), which is more attainable for newbies than for firms requiring 8–10%. No second stage or extended gauntlet – pass the first test and you’re done.

- Fair and Transparent Rules: TradeDay’s rules are straightforward and publicly stated – no surprise conditions. There’s no daily loss limit to micromanage, and they offer the favorable end-of-day drawdown option that many traders prefer. The consistency rule, although strict, is clearly defined (a 30% cap per day) and aimed at encouraging good habits.

- Generous Payout Policy: Funded traders retain 100% of the first $ 10,000 profit and 90% thereafter, with a potential payout of up to 95%. You can withdraw profits from Day One of funding – no waiting period – and payouts are processed within 24 hours. There are zero payout fees or limits, and TradeDay allows very frequent withdrawals (even daily) as long as a minimum balance is maintained. This is among the best payout schemes in the industry.

- Strong Educational Support: TradeDay offers extensive resources, including futures trading courses for beginners, daily webinars and market analysis, one-on-one mentoring, and a community Discord for traders. This “learn and earn” approach helps traders improve their skills during the evaluation. It’s essentially a built-in trading academy at no extra cost.

- Responsive Customer Service and Community: The company has a reputation for listening to traders. Support queries get quick, helpful responses. The founders and team actively engage with users (e.g., implementing suggestions like 7-day minimums and new account types). Plus, being part of an active trader community means you can get peer advice and not feel alone in the process. Many reviewers praise TradeDay’s supportive environment.

- Multiple Account Flexibility: For those who want to scale up or try different strategies, TradeDay allows up to 6 simultaneous accounts. They even provide discounts on additional accounts. You could, for example, run a conservative and an aggressive strategy in parallel. Upon funding, you could also potentially have multiple funded accounts to increase overall capital, since TradeDay doesn’t appear to prohibit that.

Cons

- No Overnight or News Trading: If your strategy involves holding futures positions beyond the day session or playing economic news releases, TradeDay’s rules won’t accommodate that. All trading must be flat before the market closes each day, and high-impact news windows are off-limits. This could be a limitation for swing traders or news-event scalpers.

- Strict Consistency Rule: The 30% max profit-per-day rule can frustrate traders who have an occasional big day. You’ll need to consciously scale out or stop trading once up ~30% of the target in a day to avoid breaking the rule. While it fosters good practice, it may feel stifling to those who rely on one or two major successes to achieve a goal. Competitors like Topstep or Apex Trader Funding do not have this specific rule (though they manage risk in other ways).

- Higher Costs for Larger Accounts: TradeDay’s monthly fees for large accounts (e.g., $150K or $250K) are on the pricey side – for example, $350/month for $150K and $750 for $250K. Smaller budget traders might opt for the $ 50,000 or $ 100,000 accounts, which are more reasonable. By contrast, some rivals run one-time fee models or cheaper specials for large accounts. However, frequent 40%-off discounts at TradeDay do help mitigate this.

- Exchange Data Fee After Funding: Once you’re funded, you’ll be responsible for professional market data fees (approximately $120+ per month for CME exchanges). This is standard across futures prop firms, but it’s an added ongoing cost to be aware of. TradeDay covers all sim data during the evaluation, but in a live funded account, the trader pays for real-time data from the exchange.

- Mixed Reports on Billing: A minority of users have reported issues with billing or refunds, such as forgetting to cancel a subscription and being charged, or experiencing delays in refunding duplicate charges. While overall sentiment on support is positive, ensure you manage your subscription actively. If you decide to quit the program, cancel before the next billing cycle to avoid any hassle.

- Limited to Futures Only: TradeDay is focused solely on futures trading. Unlike some prop firms, it doesn’t offer forex or stock CFD programs. For most in the target audience, this is fine (they want to trade futures). But if you ever wished to try other asset classes, you’d need a different firm. Also, within futures, the program doesn’t permit options on futures or spreads – it’s geared to outright futures positions.

In weighing these pros and cons, it’s clear TradeDay’s strengths heavily favor the trader – especially the payout structure and educational support. The cons are mostly the standard constraints that come with a serious futures funding program (risk controls like no overnight trading). For many traders, the benefits of TradeDay, such as not having to worry about arbitrary daily loss limits and being able to withdraw profits quickly, will far outweigh the downsides. Next, we’ll look at what actual users have been saying about their experience with TradeDay.

User Reviews and Reputation

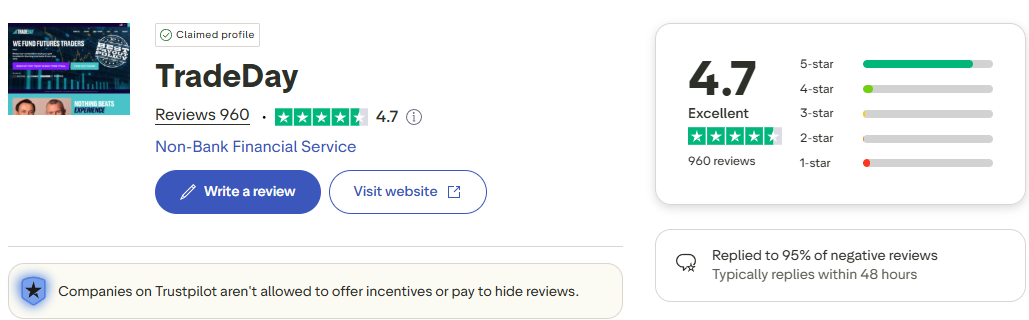

TradeDay has quickly established a strong reputation in the prop trading community, despite being a relatively new firm (operating since 2020). On Trustpilot, TradeDay holds an Excellent rating of 4.7 out of 5, based on over 950 user reviews.

This high score indicates a very satisfied customer base. Reviewers often highlight the fairness and transparency of TradeDay’s evaluation. According to an AI-generated summary of Trustpilot feedback, “customers appreciate the company's commitment to supporting trader growth through fair evaluation processes and transparent rules”. Traders feel the rules are straightforward with no hidden catches, and that TradeDay truly wants them to succeed.

Many users praise specific features:

- “Daily payouts and EOD drawdown...make a big difference” – The ability to get paid quickly and not worry about intraday drawdown pop up as a favorite aspect.

- Support Team Responsiveness: People have noted the “thoughtful and timely replies” from TradeDay support, even saying “customer service was very efficient with their response and help”. Any problems (like a technical glitch or a rule clarification) were handled quickly to their satisfaction.

- Platform Features: Traders enjoy the platform’s clarity and absence of gimmicks. One review mentioned “straightforward nature of the rules, absence of hidden conditions, and clarity of communication” as key positives. The variety of platforms (Tradovate, TradingView, etc.) and the stability of their data feed also get good feedback – there are few complaints of platform downtime or execution issues.

- Trader Resources: Several reviews mention the value of TradeDay’s educational content. Users liked the daily live meetings and the fact that “TradeDay’s comprehensive resources support beginners and experienced traders”. The community aspect – having other traders and mentors to talk to – is a morale booster that came through in some testimonials.

Of course, no firm is perfect. There are also some critical voices, though they’re relatively rare. A few themes from less-positive reviews or comments:

- Consistency Rule Frustration: A handful of users who failed the evaluation due to the 30% rule expressed frustration, feeling it was an unnecessary hurdle. (This tends to come from those used to more lenient firms. In fairness, TradeDay advertises this rule upfront, so it’s usually traders who are not fully aware who get caught out.)

- Billing/Subscription Issues: As noted earlier, some traders experienced difficulties canceling or obtaining a refund in a timely manner if they were dissatisfied. For example, one might sign up and then change their mind, but forget to cancel the recurring payment – leading to a charge. TradeDay does have a cancellation process outlined in its FAQs, but it’s wise to be proactive in this matter.

- Payout Procedure for Big Withdrawals: While day-one payouts are a plus, one or two users on forums noted that if you try to withdraw all your profits and leave nothing in the account, you can effectively “starve” your account below the required balance, and it might be closed. This isn’t a complaint per se (it’s common sense – you can’t withdraw below the trailing drawdown or you’d violate your account). But it’s something new that funded traders learned: always leave a cushion in the account if you want to keep trading. TradeDay’s rule of maintaining a minimum balance covers this.

- General Skepticism of Prop Firms: In broader trading forums, such as Reddit, some traders are naturally skeptical of newer prop firms. Early on, people questioned if TradeDay was “legit or just making money off fees.” However, sentiment has shifted positively as more success stories have emerged. A Reddit user remarked that TradeDay is “one of the few that seem legit and not hoping you fail just to get more money for more evaluations. They have a proven track record.”. The fact that TradeDay’s founders are known trading professionals and that the firm has been trusted by thousands of traders since 2020 (as their site claims) gives credibility.

TradeDay’s Trustpilot profile also shows that the company is engaged – they have replied to 95% of negative reviews. This means if someone has an issue, TradeDay often reaches out to resolve it or clarify, which is a good sign of customer care. Additionally, TradeDay is ranked in multiple categories on Trustpilot (such as #13 in Coaching Center, #18 in Education Center), indicating they’re seen as more than just a funding provider but also an educational service.

In summary, user sentiment on TradeDay is overwhelmingly positive. Traders appreciate that it “does what it says on the tin” – funds traders who prove themselves, without making the process overly complicated. The combination of fair rules, high payout share, and solid support has led many to call TradeDay

one of their top choices in the prop firm space.

Regulation and Tax Considerations

Regulatory Status: TradeDay is neither a broker-dealer nor a financial advisor; it’s essentially an educational and funding service that utilizes simulated accounts. This model is generally unregulated (aside from basic business and compliance laws) because traders initially trade on simulated accounts and later trade the firm’s capital in a proprietary arrangement.

TradeDay’s website makes clear that they “do not promote or sell financial products or services”. When you get funded, you will typically sign an agreement (Independent Contractor or Profit Share Agreement) with TradeDay or its brokerage partner. The brokerage partner for order execution is listed as CQC on one site – likely an intermediary that clears trades. For the trader, no license is required to join TradeDay’s program. However, normal trading regulations still apply (for instance, U.S. persons must abide by exchange rules, and TradeDay won’t allow trading on inside information or anything illegal).

One important consideration is that TradeDay cannot accept residents of certain countries. Like most U.S.-based prop firms, they exclude individuals from sanctioned or high-risk regions for legal reasons. For example, citizens of countries like North Korea, Cuba, Iran, and a long list of others are not eligible. This is standard due to U.S. sanctions compliance. For the vast majority of international traders, TradeDay is available, with members from Europe, Asia, Africa, and beyond. Please be prepared to provide identification documents for identity verification when signing up, as they will verify your residency.

Taxes: Whether you’re in the U.S. or abroad, profits you earn from TradeDay are considered taxable income. Even though you’re trading TradeDay’s funds, the payouts you receive are income to you – essentially compensation for your trading performance. According to tax experts, “the income you receive from profit splits or performance bonuses is still considered taxable income… treated just like any other self-employment earnings”.

TradeDay (and similar firms) typically classify traders as independent contractors, rather than employees. In the U.S., if you’re a citizen or resident who earns more than $600 from TradeDay in a year, expect to receive a 1099-NEC tax form from them or their payment processor, reporting that income to the IRS. You’ll then report it on your tax return (usually as business income on Schedule C, since it’s self-employed income). This means you’ll owe ordinary income tax on the payouts, and possibly self-employment tax (Medicare/Social Security) as well, just as if you earned consulting or freelance income. One implication: prop trading income doesn’t get the special 60/40 capital gains tax treatment that direct futures trading might get, because legally it’s not your capital at risk. It’s effectively contract income. So factor that into your tax planning.

For non-U.S. traders, TradeDay typically does not withhold any U.S. taxes (since you’re not a U.S. person). You might not receive a formal tax form at all. But that doesn’t mean it’s tax-free – you are usually expected to self-report the income to your own country’s tax authorities. Many countries will treat it as either self-employment or miscellaneous income. Always consult a local tax professional to understand your obligations. If you’re in a country with a tax treaty with the U.S., generally you won’t be double-taxed by the U.S. on this income; you’ll handle it in your home country. Keep records of all your payouts (TradeDay provides an account of payouts, but keep your logs too).

Bottom line: Plan for taxes. A good practice is to set aside a percentage of each payout for taxes so you aren’t caught off guard at year’s end. Treat your trading like a business – because in the eyes of the IRS and most tax agencies, that’s effectively what it is when you’re trading on a prop firm’s behalf. On the bright side, as an independent contractor, you may be able to

deduct certain expenses related to trading (office equipment, internet, perhaps the evaluation fees) against your income. This can help reduce your taxable profit. Always seek professional advice if you are unsure, as tax laws can be complex.

Final Verdict: Is TradeDay Worth It?

TradeDay has emerged as a top-tier prop firm for futures traders, particularly those who value a supportive and educational environment. The firm strikes a great balance between being trader-friendly (with easy-to-pass targets and high payouts) and instilling discipline (with rules like drawdowns and consistency that reinforce good trading habits). If you’re an aspiring futures trader with limited capital or someone who wants to sharpen their skills under real market conditions, TradeDay offers a compelling proposition.

Who would benefit most from TradeDay? Beginners will appreciate the wealth of educational content and the lower profit targets, which give them a realistic chance at funding while learning. Intermediate traders who may have struggled at other firms might find TradeDay’s rules more forgiving (no daily loss limit, option for end-of-day draw) and the quick payouts rewarding for their effort. Even advanced traders can leverage TradeDay to access more capital – with the ability to run multiple accounts and a profit split that eventually rivals trading on your own, it can be a smart way to scale up without taking on personal risk.

TradeDay’s strengths are clear: a single-step evaluation in which you only need to demonstrate roughly 3% profit in a week or two of trading; no profit share taken until you’ve made a considerable chunk; and the ability to actually enjoy your profits immediately via day-one withdrawals. The emphasis on consistency means those profits are likely to be repeatable, not flukes. Moreover, TradeDay’s founders and team seem genuinely invested in traders’ success – a refreshing attitude in an industry where some firms only care about collecting fees. The continuous improvements (such as lowering minimum days and adding new account types) and high customer satisfaction scores demonstrate that TradeDay is here for the long haul and stands by its traders.

A few considerations: If your personal trading style requires holding positions overnight or if you strongly dislike any profit cap rules, TradeDay might feel limiting. In that case, a different firm (or trading your own account) might be a better fit. Also, the monthly subscription model means if you need many months to pass, costs can add up (though the same is true for any evaluation with monthly fees). Fortunately, TradeDay’s low targets mean that many traders won’t need to hold positions for too many months if they trade carefully. And remember, once you’re funded, that monthly cost goes away – you’re just paying exchange fees at that point.

All things considered,

TradeDay earns a thumbs up. It has positioned itself as an honest, transparent prop firm that provides real value beyond just a “challenge”. The combination of fair odds to succeed and a rich support system makes it stand out in the crowded prop firm market. If you’re serious about building a track record in futures trading and want a partner that’s invested in your growth, TradeDay is definitely worth a look. As always, be sure to thoroughly read their rules, take advantage of their educational tools, and approach the evaluation with discipline. Trading with a prop firm is not a get-rich-quick scheme – but with firms like TradeDay, it can be a viable pathway to trading professionally with minimal personal risk.

Disclaimer: Trading futures, forex, or any leveraged product involves substantial risk and is not suitable for all investors. This content is for educational purposes only and does not constitute financial advice.

Day Trading Insights Research Team

Day Trading Insights Research Team publishes articles written by active day traders, financial market researchers, or aspiring traders who are actively learning and investing on a regular schedule. Our research team brings formal training in finance and computer science, blending market theory with code-driven testing and tools. We’re passionate about understanding how trading works, how markets evolve, and how technology can sharpen professional decision‑making. Our content is education‑first and independently produced, free from outside bias.