Best Trading Software in 2025 - Top Platforms for Funded Traders

Last Updated: August 24, 2025

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice.

Selecting the right trading software is crucial for success, particularly for swing traders and futures traders seeking funded accounts. In 2025, the best platforms will combine advanced charting, customizable dashboards, and real-time data with features such as risk management tools, automated trading, and social trading elements. Below, we review the top trading software (with a U.S. focus) ideal for beginner and intermediate traders. Each mini-review highlights key features – from customization and charting to risk controls, automation, community, and demo accounts – so you can find the best fit for your trading style.

NinjaTrader

NinjaTrader is a highly popular platform among retail futures traders, renowned for its powerful charting capabilities and extensive customization options. Traders can personalize the interface with over 1,000+ third-party add-ons and indicators, and NinjaTrader’s charting is top-tier – offering 100+ built-in technical indicators and multiple chart types for in-depth analysis. The platform connects to various market data providers (e.g., CQG, Rithmic), delivering real-time futures data and even historical tick-by-tick replay for detailed practice and analysis. NinjaTrader’s workspace is modular, allowing you to create custom trading dashboards with chart windows, Depth of Market (DOM) ladders, and watchlists arranged to your preference.

NinjaTrader also excels in trading capabilities. It supports advanced order types and integrated risk management – for example, you can place bracket orders (automatic stop-loss and take-profit) and trailing stops directly through its SuperDOM or charts. The platform’s risk settings can be customized at the account level, allowing you to effectively manage drawdowns and utilize protective stops.

Automated trading is a major strength, as NinjaTrader provides the C#-based NinjaScript language for building strategies. It also includes over 1,000 pre-built automated strategies and signals. There’s also a large ecosystem of third-party developers offering add-ons for signals and even copy trading. While NinjaTrader isn’t a social network, its user community and marketplace function as a hub for sharing indicators and strategies. Beginners benefit from extensive educational resources (daily live training and an active forum), plus free demo/simulation accounts for practice – you can use NinjaTrader in simulated mode to test strategies risk-free. Overall, NinjaTrader provides a comprehensive futures trading solution with extensive customization options and professional-grade tools.

MetaTrader (MT4/MT5)

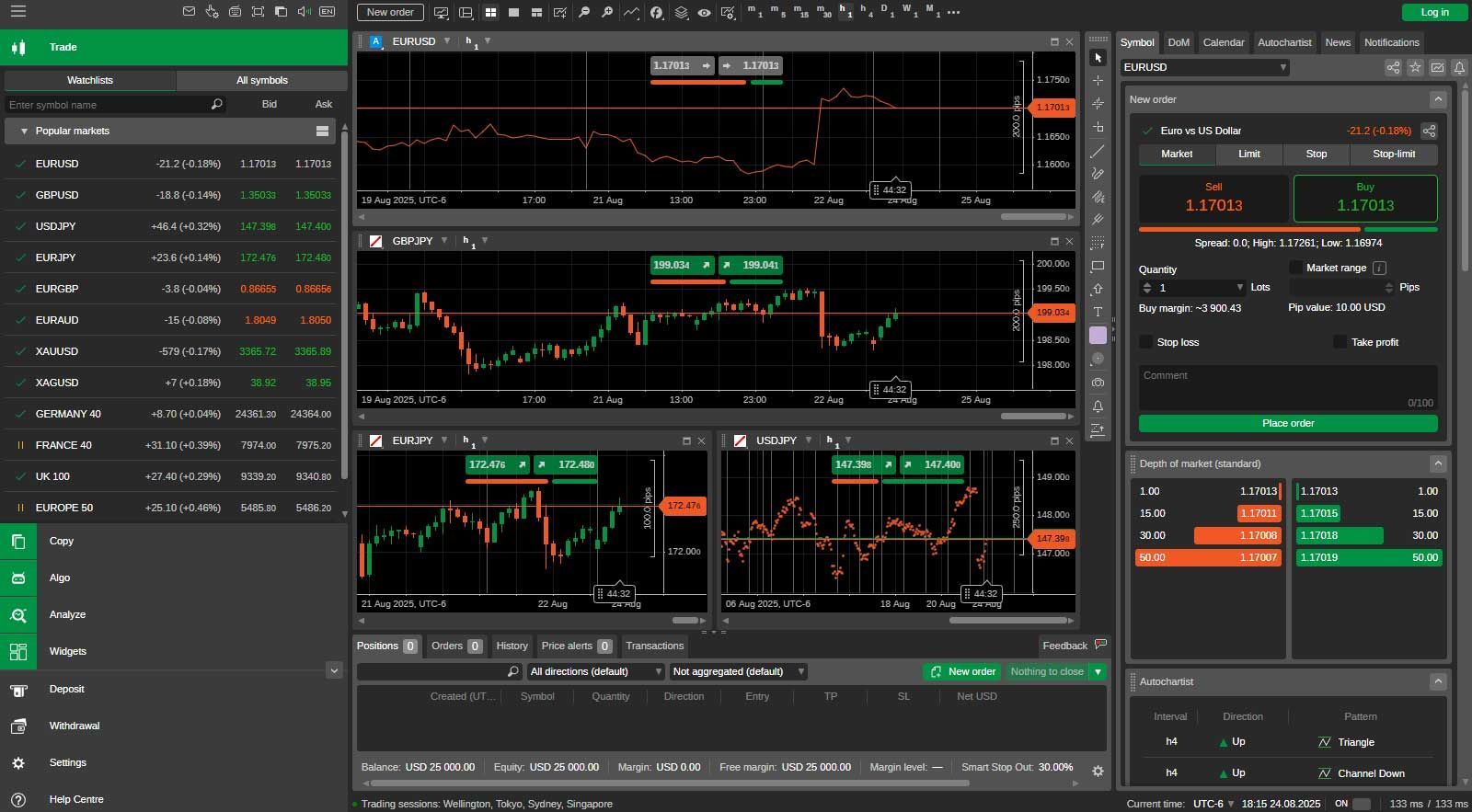

MetaTrader 4 and 5 remain among the most widely used trading platforms, especially in forex and CFD trading. Highly customizable, MetaTrader enables traders to extensively modify charts and add custom indicators or automated scripts (Expert Advisors) through its built-in MQL programming language. Charting is robust with MT5, offering 21 timeframes and 38 technical indicators by default, and thousands more indicators or signal scripts are available through the user community. The interface supports multiple charts and watchlists, which you can arrange to create your own trading dashboard. Real-time market data for currencies, commodities, and indices is provided through your broker’s servers, and execution is generally fast and reliable.

On the trading side, MetaTrader includes all standard risk management features. It’s easy to set stop-loss and take-profit orders on positions (even dragging lines on the chart to adjust), and it offers trailing stop functionality to manage risk as trades gain profit. While not as specialized as some platforms, MT4/MT5 offer solid order management tools that cater to most needs. Automated trading capabilities are a hallmark – you can deploy Expert Advisors to automate strategies 24/7, from simple trade management rules to complex algorithms.

The MetaTrader community also enables social trading: through the built-in Signals service, users can subscribe to signal providers and auto-copy their trades in MT5. This integration of copy trading is a big plus for less experienced traders who want to follow experts. MetaTrader doesn’t have a social feed like TradingView, but the MQL5 community forum is active for sharing ideas and custom tools. Every major broker offering MetaTrader provides free demo accounts, so beginners can practice on MT4/MT5 with virtual funds easily. In summary, MetaTrader is a versatile, beginner-friendly platform with advanced charting capabilities and unbeatable automation and community support, although it is slightly more geared toward forex/CFD trading than futures.

Tradovate

Tradovate is a modern, cloud-based futures trading platform (now part of NinjaTrader’s family after a 2022 acquisition). It’s designed with simplicity and accessibility in mind, making it a great choice for beginners or those in funded futures programs. Tradovate runs on web, desktop, and mobile, with your settings synced – you get custom trading dashboards and charts seamlessly across devices. The interface is clean and intuitive, yet still offers solid charting tools (drawing tools and popular indicators) for technical analysis. Real-time market data for CME and other futures exchanges is integrated (exchange fees apply), so you can trade e-minis, micros, and commodities with up-to-date quotes on all platforms.

Despite its simplicity, Tradovate includes key features for active trading. It provides advanced order management with one-click trading and bracket orders, allowing you to set up custom ATM (Advanced Trade Management) strategies that automatically place a stop-loss and profit target as soon as you enter a trade. This helps manage risk on each trade without manual effort. Tradovate’s dashboard allows multiple modules (charts, DOM, orders) to be displayed side by side, making it easy to monitor positions and risk. While it doesn’t support in-platform algorithmic trading, Tradovate can integrate with third-party tools (for example, it allows API connections and even linking TradingView for chart trading).

Social trading features are minimal – Tradovate is more focused on execution – but as part of the NinjaTrader ecosystem, users have access to the broader community if needed. Notably, demo trading is built in: Tradovate offers an integrated paper trading mode, allowing you to practice strategies or fulfill a prop firm evaluation in a simulated environment. With a commission-free membership model and a full-featured mobile app, Tradovate appeals to cost-conscious futures traders who value ease of use and cross-device trading.

TrendSpider

TrendSpider is an advanced technical analysis software known for its innovative automated charting features. It’s not a brokerage platform but rather a powerful toolkit for analyzing stocks, ETFs, forex pairs, and crypto. TrendSpider’s customization and charting capabilities are standout: you can create multiple charts with different timeframes and apply unique features, such as Raindrop Charts and auto-anchored indicators (which automatically detect and draw trendlines, Fibonacci levels, etc.).

Over 70 indicator types and countless drawing tools are available, and the system can even synchronize trendlines across timeframes. It continuously provides real-time market data for U.S. equities and forex, so your analysis is based on up-to-date information. The platform’s dashboards allow you to set up watchlists and multi-chart views, enabling a comprehensive view of market trends.

Since TrendSpider is geared toward research and analysis, its focus areas differ slightly from execution platforms. It doesn’t manage trade orders or portfolio risk directly, but it aids risk management by helping traders identify key levels and automate alerts for risk signals. For example, you can set alerts that trigger if price breaks a trendline or if an indicator condition is met – these automated alerts help you manage trades and risk proactively without constant screen-watching.

Automated trading is not a feature (TrendSpider doesn’t execute trades), but it does offer automated technical analysis – the platform’s algorithms continuously scan for chart patterns, support/resistance zones, and even backtest strategies for you. Social trading features are limited; TrendSpider isn’t a social network, though the company provides webinars and has a community of users sharing strategies externally.

Demo accounts, per se, don’t apply, but TrendSpider offers a free trial period and occasionally provides discounts. You would use TrendSpider alongside a broker (many traders use TrendSpider for analysis and another platform for actual order execution). In essence, TrendSpider is ideal for swing traders who want cutting-edge chart analysis and data-driven insights (like automated pattern recognition) to make informed decisions.

TradingView

TradingView is one of the most popular charting platforms globally, famous for its advanced charting tools and thriving social community. It’s a web-based platform (with mobile apps) that covers almost every market – stocks, forex, crypto, futures – with extensive real-time and historical data.

Chart customization on TradingView is nearly unparalleled: you can plot multiple charts, dozens of indicators (from a library of 100+ built-ins and thousands of community-created ones), and use drawing tools ranging from simple trendlines to complex harmonic patterns. Alerts are highly flexible; for instance, you can set an alert on a specific price or on a combination of indicator conditions, and even receive notifications on your phone or email.

TradingView’s interface is intuitive and highly configurable – you can arrange watchlists, news feeds, and charts as needed, and switch layouts quickly. Real-time data for many markets is either free or low-cost (some exchanges require a small fee), and the platform is known for its smooth, responsive charts, which are updated live.

A key aspect of TradingView is social trading features. TradingView has an integrated social network where traders publish trading ideas, charts, and analyses. You can follow other traders, discuss market outlooks, and even copy chart layouts. This community aspect provides a collaborative learning environment – great for beginners to pick up techniques and for all traders to gauge market sentiment. In terms of execution, TradingView supports trading directly from charts via supported brokers (you can connect broker accounts like Interactive Brokers, Oanda, Tradovate, etc., and place orders on the TradingView interface). It’s not primarily an automated trading platform, but it does allow semi-automation through its Pine Script language: you can code custom indicators or strategies and then set alerts that trigger trades on linked broker platforms.

Fully automated trading (bots running without your input) isn’t native to TradingView, which is a deliberate design to keep things user-driven. Risk management on TradingView depends on your broker connection; however, the platform provides visual risk tools, such as plotting position size and profit/loss levels on the chart, when you use the trade panel.

Finally, demo trading is available through TradingView’s Paper Trading mode. Every user gets a free paper trading account with virtual funds, so you can simulate trades on the charts to test strategies in real-time conditions. With its cross-platform availability and mix of powerful analysis tools plus social connectivity, TradingView is an excellent all-around choice for both beginners and experienced traders who value charting and community.

TrendSpider offers innovative charting features, including Raindrop Charts and automated trendline detection, enabling traders to analyze patterns with real-time market data.

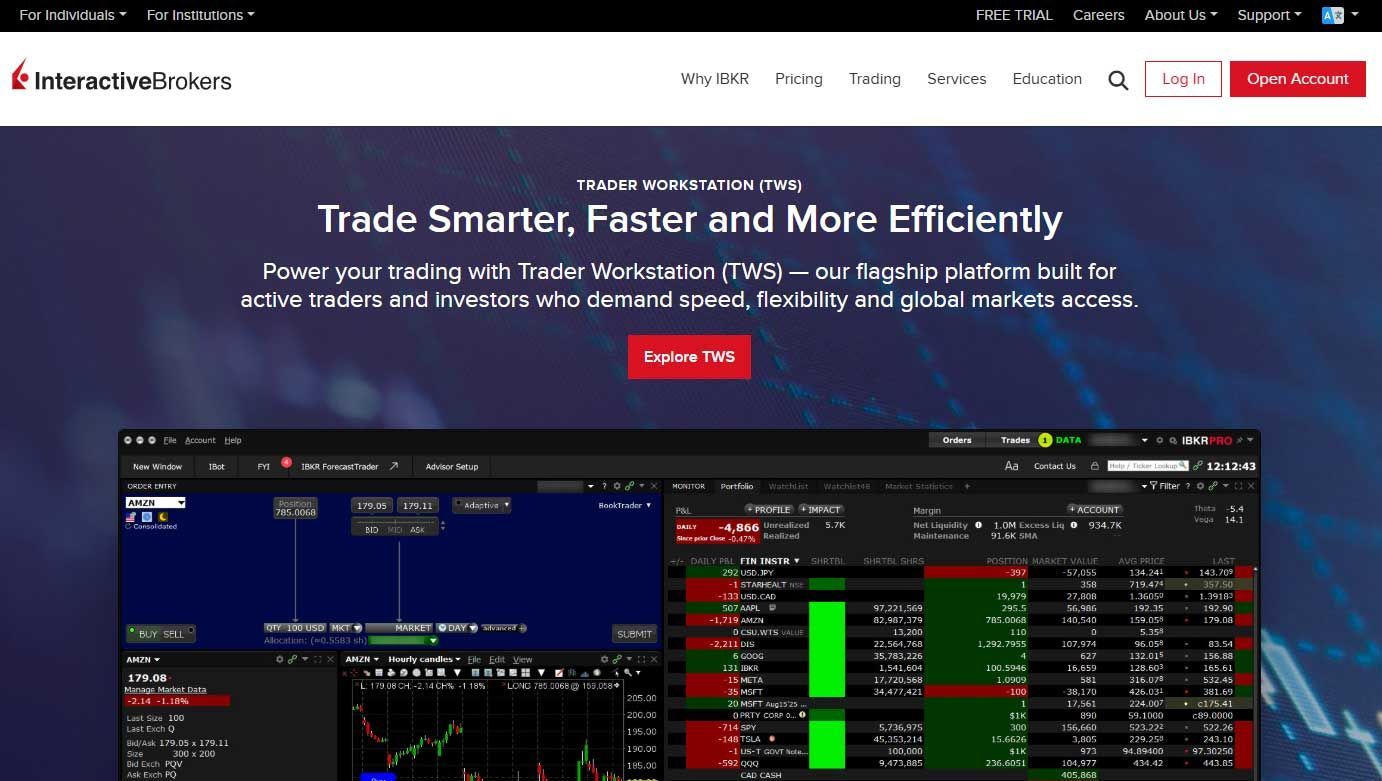

Interactive Brokers – Trader Workstation (TWS)

Interactive Brokers’ Trader Workstation is a professional-grade trading platform that supports a massive range of assets (stocks, options, futures, forex, bonds, and more) across global markets. TWS is known for its comprehensive feature set and is favored by advanced and funded traders who demand robust tools. The platform offers two interface modes: Classic TWS and Mosaic.

Mosaic is a modern, customizable workspace where you can arrange panels for trading, charting, watchlists, and portfolio monitoring to create your own dashboard. Charting in TWS has improved over the years – you have interactive, customizable charts with a variety of technical studies and drawing tools. While perhaps not as flashy as TradingView, TWS charts cover most needs and integrate with features like the market scanner and Risk Navigator. Real-time market data and news are built into the platform (with subscriptions as needed), allowing you to view streaming quotes and breaking news headlines directly within your workspace.

Where TWS truly shines is in advanced trading and risk management features. The platform supports over 100 order types and algorithms, including all standard stops, limits, bracket orders, multi-leg spreads, and algorithmic order routing for optimal execution. This means you can, for example, create an order that simultaneously sets a stop-loss and profit-taker (one-cancels-the-other), or use IB’s algos to split a large order into smaller chunks.

TWS has a built-in Risk Navigator tool that provides portfolio-level risk analysis and stress testing – a powerful feature for managing risk across multiple positions. You can set custom alerts for margin or P&L triggers and monitor your real-time risk metrics in real-time. Automated trading is supported via the Interactive Brokers API, which allows you to connect custom software or algorithms to TWS. Many quantitative traders use IB’s API in Python, Java, or C++ to automate strategies. Within TWS itself, you can also create conditional orders and simple algorithmic rules (although more complex automation typically goes through the API or third-party integrations).

Social trading isn’t part of TWS (IB is a direct trading platform without chat feeds), but Interactive Brokers offers an online community and extensive educational content for users. For those starting or testing new strategies, IBKR provides a Paper Trading account that simulates the live trading environment with real market conditions. This demo mode is free for clients and provides an excellent opportunity to practice on TWS, as the platform can be complex. Overall, Trader Workstation is one of the most powerful multi-asset platforms, offering flexibility, in-depth analytics, and low-latency execution, which is suited for serious traders. However, beginners might face a learning curve due to its vast array of features.

Bookmap

Bookmap is a cutting-edge trading software specializing in order flow visualization and analysis. It offers a very different perspective from standard price charts: Bookmap displays the real-time order book (Level 2 market depth) in an innovative heatmap format. Liquidity shown on the heatmap utilizes color intensity (e.g., yellow/orange for large resting orders at a specific price) to enable traders to instantly identify where significant buy/sell orders are positioned in the market.

As trades occur, Bookmap plots volume dots on the chart – larger dots for higher volume – to indicate executed trades at specific price levels. This combination of historical depth (heatmap) and transaction data provides an X-ray view of market dynamics, helping traders identify support and resistance levels, as well as shifts in supply and demand.

The software updates at up to 40 frames per second, meaning it captures extremely real-time data, down to the microsecond level if the feed provides it. It doesn’t filter out any ticks, so you’re truly seeing every market action, which is crucial for scalpers and order flow enthusiasts. Bookmap’s interface is essentially a single, comprehensive trading dashboard for order flow, and it can connect to various data providers or broker APIs (for example, Rithmic, CQG, and Coinbase for crypto, among others).

In terms of features, Bookmap includes several add-ons and analytical tools: for example, an Iceberg Detector to reveal hidden orders, a Large Lot Tracker (LLT) to spot big players, and a replay mode that lets you record and replay market sessions to practice reading the order flow. You can trade directly from the Bookmap interface as well – with the Global+ version, one-click trading is enabled on the heatmap chart, including support for OCO brackets (e.g., you can click to place a limit order and automatically attach a stop and target). However, traditional technical indicators are not its focus (it’s not the platform for moving average crossovers or multi-timeframe indicators – it’s all about the order book and volume).

Risk management in Bookmap stems from the insight it provides; it helps you identify evolving risks (such as big sellers appearing on the ask) and manage your trades accordingly. It doesn’t have account risk limit settings – those would be handled by your broker – but it does allow very fast manual execution of exits if you see something concerning in the order flow. Automated trading on Bookmap is possible only via API or plug-ins (advanced users sometimes use the API to feed Bookmap data into their own algos).

Most Bookmap users are discretionary traders who prefer manual control. There’s a strong community around Bookmap, with a Discord server featuring thousands of traders and frequent webinars where professionals trade live using the tool. For newcomers, Bookmap offers a free version (Digital edition) that provides a taste of crypto data and free trial periods for the paid plans.

Additionally, the simulated trading aspect is covered by its Replay mode and the ability to connect to demo feeds, allowing you to practice reading and trading the order flow without risking capital. In summary, Bookmap is the best-in-class tool for order flow and market depth visualization, ideal for futures scalpers or any trader who wants to “feel” the market’s supply and demand in real-time.

Bookmap’s heatmap displays full market depth in real time, with warm colors highlighting large buy/sell limit orders and volume dots indicating trade size – providing insight into order flow that standard charts can’t match.

TradeStation

TradeStation is a broker and trading platform well-regarded among active traders, especially those who employ systematic strategies. The TradeStation 10 desktop platform offers a rich feature set. For customization, TradeStation offers workspace tabs and windows that you can arrange to display charts, order entry, watchlists, option chains, and more.

Advanced charting is a core strength – you can overlay hundreds of technical indicators on a chart (including all the classics and many proprietary ones), and the platform gives access to decades of historical price data for backtesting. Chart types and drawing tools are plentiful, and you can have multiple charts with linked symbols/timeframes to create a personalized trading dashboard.

TradeStation also integrates a tool called RadarScreen, which is a dynamic market scanner. RadarScreen lets you monitor dozens of symbols in real-time with custom criteria and technical filters – great for swing traders scanning for setups. Real-time market data is provided for all instruments (stocks, futures, options, cryptocurrencies, etc.), along with streaming news, ensuring you have up-to-the-second information.

A hallmark of TradeStation is its support for automated trading and the development of trading strategies. TradeStation invented the EasyLanguage programming language, which allows traders to create custom indicators and automated trading strategies relatively easily. You can backtest your strategies on historical data and then deploy them live through the platform’s Strategy Automation feature.

This capability is why TradeStation is favored by many algorithmic swing traders – the platform can handle complex strategy rules and execute trades on your behalf. In terms of day-to-day trading, TradeStation has a robust order management and risk management system. It supports all advanced order types (brackets, OCO, OSO, trailing stops, etc.) to manage trade risk. For example, you can place a trade with a pre-defined stop loss and profit target attached, ensuring you have protection in place from the moment you enter.

TradeStation also offers matrix views (DOM) for futures trading, which short-term traders appreciate. While TradeStation doesn’t have in-platform social trading, it does maintain a TradingApp Store where users and third parties share indicators and strategy templates – a form of community support. There’s also an online user forum for discussion.

For new traders, TradeStation provides simulated trading accounts (sometimes called the “Simulated Trading Mode” in TradeStation). This allows you to practice trading with virtual money in a realistic market environment. Combined with a wealth of educational content (including tutorials and a Trading University), TradeStation can cater to beginners as they progress.

TradeStation is a powerful, all-in-one solution: it’s a brokerage with very low commissions and a platform featuring complex charting and automation tools that are loved by active traders. The only downside is that such a feature-rich platform can be somewhat complex at first, but it’s well worth it for traders who want to develop and execute sophisticated trading strategies.

Jigsaw Trading

Jigsaw Trading is a specialized platform focused on order flow trading education and tools. It’s especially popular among futures prop traders and those learning to read the “tape” (time and sales) and DOM. Jigsaw’s Daytradr software isn’t about fancy charts; instead, it provides a powerful Depth & Sales (DOM) module, reconstructed tape, and other order flow visuals that experienced traders use to interpret market activity in real time.

The premise is to provide a clearer view of order book dynamics than traditional brokers offer. With Jigsaw, you connect it to your data feed (which supports popular feeds like CQG, Rithmic, and IQFeed) and use its interface to monitor how bids and offers change and large orders execute. It’s a highly configurable layout – you might have a DOM for the S&P E-mini, alongside a correlated market DOM (like Nasdaq or bonds), plus a time & sales window and a summary of large trades. You can customize colors and alerts (for example, highlighting when a big lot hits the market).

Traditional charting is minimal in Jigsaw; it assumes you’re using other charting tools or don’t need them for your trading method. Instead, the platform’s value is in its proprietary order flow tools and training resources. Jigsaw provides not just software but also extensive training on how to trade using order flow, with courses and live webinars included for customers.

From a risk management perspective, Jigsaw is all about enhancing the trader’s ability to manage risk by interpreting the market’s real-time cues. The platform itself offers standard trading functionality – you can place trades through it (market/limit orders on the DOM, etc.) – and you can set presets for stops and targets. But it doesn’t have automated risk limit enforcement; it’s expected that you manually adhere to risk rules (or use broker settings).

Automated trading is not Jigsaw’s purpose; in fact, their philosophy leans toward helping human traders make informed, discretionary decisions by providing real-time order flow. They intentionally do not provide algorithmic strategy features, as the goal is to avoid black-box trading and instead sharpen your own execution timing. Social and community features are a strong point: Jigsaw has a very active user community and a “lively trading community” forum where traders share experiences. They also have a public chat during live streams and support mentorship programs.

Many funded trading programs recommend Jigsaw to their candidates to improve their order flow skills. For newcomers, Jigsaw offers a 14-day money-back guarantee and a simulation mode that allows you to practice with historical or live simulated data. You can use Jigsaw connected to a demo feed (like Rithmic Paper Trading) to practice reading the DOM without risking money – this is hugely beneficial for skill development. In essence, Jigsaw Trading is ideal for those who want to elevate their day trading to the next level by mastering order book analysis. It’s a niche tool – not a full broker platform – but within its niche, it’s highly respected and widely used by prop firm traders to gain an edge in fast markets.

Tradytics

Tradytics is a unique entry on this list – it’s an AI-driven trading toolkit rather than a conventional trading platform. Tradytics provides web-based and mobile app dashboards to help traders (especially stock and options traders) make sense of big data and market flows. It essentially bridges the gap between retail traders and Wall Street-level data.

Key features of Tradytics include: AI-powered trade ideas and predictions, live options flow analysis, market scanners, and detailed ticker dashboards. For example, Tradytics will sift through millions of options transactions to highlight unusual options activity or “smart money” trades, which can tip you off to big moves. It also offers dark pool data, insider trading trackers, and even crypto analysis on the same platform.

The interface is user-friendly, displaying charts and graphics for features such as option flow sentiment, most active calls/puts, sector rotation, and more. You can customize watchlists and see AI-generated bullish or bearish signals for various timeframes. Tradytics effectively serves as a trading dashboard for analysis, which you can use in conjunction with your execution platform.

Since Tradytics isn’t executing trades, its contributions to risk management and trading execution are indirect. It lacks order placement and portfolio management features. Instead, it helps you manage risk by providing institutional-grade data – for instance, showing you where big traders are positioning (so you can align or avoid risk accordingly).

There’s no automated trading in Tradytics, but there is a degree of automation in analysis: it continuously runs machine learning models on historical data to find patterns and will adjust its algorithms over time. This means traders get updated signals and pattern recognition without having to manually crunch numbers. Tradytics also features a social/community element through Discord – in fact, one of its notable features is the “Bullseye” Discord bot, which posts trade ideas and analysis for users.

The Tradytics Discord community is quite large (65,000+ users) and active, which is great for learning and sharing insights. You won’t find copy trading here, but you will find many like-minded traders discussing the AI signals. For beginners, Tradytics can be very educational, as it simplifies complex AI/ML outputs into easy-to-read formats. Tradytics is a paid service (subscription-based), but it’s relatively affordable (~$15/month for individual plans), and they often offer a trial or a limited free tier.

Tradytics is an excellent supplementary software for traders – especially swing traders in stocks and options – who want to leverage AI and big data to inform their trading decisions. It doesn’t replace a trading platform (you’d still execute trades on something like TWS or Thinkorswim), but it can give you a significant edge in market analysis and idea generation.

Tradytics’ dashboard provides AI-driven market insights (like options flow, AI trade ideas, and market health indicators) across web and mobile, helping traders spot opportunities using big data.

cTrader

cTrader is a powerful trading platform popular among forex and CFD traders as a modern alternative to MetaTrader. Offered by many brokers (Spotware is the developer), cTrader is known for its sleek, highly customizable interface and advanced features. The platform delivers enhanced charting with a variety of chart types (candlesticks, Renko, Heikin-Ashi, etc.) and over 50 technical indicators and oscillators included.

Chart objects and templates can be customized extensively (colors, layouts, multiple charts per tab), giving traders the ability to create a personalized workspace. cTrader’s charts are also praised for their clarity and ease of use, making technical analysis a more enjoyable experience. In addition, cTrader offers features such as Level II quotes, time & sales information, and an integrated economic calendar to keep traders informed. Real-time market data is streamed from your broker, and cTrader is built for speed – order execution is very fast, and the “QuickTrade” buttons allow one-click trading from charts or the DOM with minimal latency. The platform is accessible on Windows, web, and mobile devices, allowing you to seamlessly switch between them.

For risk management and order control, cTrader offers a rich set of tools. It offers advanced order types and risk management features, including server-side stop-loss and take-profit (meaning that even if you disconnect, your stops are maintained on the server), as well as a built-in trailing stop that operates server-side as well. This is a big advantage – you can set trailing stops without keeping your platform open. The platform also supports partial order closes, multiple take-profit targets, and an “Equity Stop Loss” for copy trading accounts (more on cTrader Copy shortly) to limit drawdown.

cTrader includes cTrader Automate (cAlgo), which enables automated trading using C#. Traders can code custom robots and indicators in C#, test them using the backtesting module, and optimize strategies – similar to how MetaTrader EAs work, but with the added robustness of the C# language. This makes cTrader very attractive for algorithmic traders who prefer a more modern API. Moreover, cTrader has a native copy trading service called cTrader Copy. This social trading feature allows traders to become Strategy Providers or Investors.

Providers can broadcast their strategies, and other users can copy them for a fee or a share of the profit. Importantly, cTrader Copy integrates risk management tools – as an investor copying someone, you can set an Equity Stop Loss so that if your balance drops to a certain level, copying stops automatically. This built-in social trading, with transparency (you can see providers’ history and stats), is a significant advantage for cTrader, effectively creating a community within the platform.

Regarding demo accounts, cTrader shines: it offers unlimited demo accounts through brokers, and you can even run multiple demo accounts to test different strategies simultaneously. The platform’s Market Replay feature (for certain instruments) lets you practice trading on historical data as well. To sum up, cTrader in 2025 stands out as a user-friendly yet sophisticated platform with excellent charting, reliable trade execution, comprehensive risk tools, and an integrated copy-trading ecosystem – a compelling choice for both beginners and experienced traders in the forex/CFD space.

DXtrade

DXtrade is a trading platform solution by Devexperts, notable for being used by many prop trading firms and brokers to power their offerings. It’s a multi-asset platform designed with flexibility in mind, supporting forex, CFDs, stocks, futures, cryptocurrencies, and more in a single system. If you’ve participated in a forex or futures prop firm, you may have encountered a branded version of DXtrade (some firms white-label it). DXtrade’s interface allows both brokers and traders to configure layouts extensively.

Traders benefit from trading layout customization: you can arrange panels for charts, watchlists, order entry, and account info to build a custom workspace. The platform includes an advanced charting library with all common chart types and drawing tools (trend lines, Fibonacci retracements, channels, etc.). It’s not as flashy as TradingView, but it covers the bases for technical analysis.

Charts can display multiple timeframes and indicators, and you can detach windows for use with multi-monitor setups. DXtrade also uniquely features a Performance dashboard and Trading journal right in the platform. This means as you trade, the platform can track your win rate, risk-reward ratios, average hold times, etc., and you can log notes on each trade – very handy for trader development (especially for prop firm participants who need to review their performance).

DXtrade’s strengths align with the needs of risk management and prop firms. The platform features an admin side where prop firms can set rules (such as maximum daily loss and maximum position size), and on the trader side, those risk limits will be enforced automatically. For example, DXtrade can automatically close positions if a drawdown limit is reached, turning the account read-only – a feature that mirrors how many prop firms manage risk.

As an end-user, you might see this as your account’s risk settings in place (and it’s good protection). For manual trading, DXtrade offers all standard order types and a quick one-click trading interface. You can manage trades from the chart or a DOM-like panel, with stop-loss and take-profit easily applied (including directly clicking on chart levels to set SL/TP).

Automated trading isn’t a built-in focus for DXtrade’s frontend (there’s no public indicator scripting like MT5 or cTrader), since it’s more of a broker-side platform. However, some brokers may extend API access to clients. Where DXtrade really differentiates itself is in its ecosystem: it’s designed to handle trading competitions and prop evaluations – for instance, it features contest leaderboards and metric sharing.

Social trading isn’t inherently integrated into DXtrade by default, but firms can integrate a copy trading module if they wish. On its own, DXtrade is primarily about providing each trader with a solid, professional platform. Of course, paper trading is supported – prop firms use DXtrade’s simulation mode for their evaluations, and as a trader, you can have a demo to practice.

The platform’s “Paper trading environment” is full-featured and can simulate trading conditions for contests or practice. In conclusion, DXtrade is like an all-in-one prop trader’s platform: it’s reliable, with good charting and order execution, combined with built-in performance tracking and risk management tailored to meet prop firm rules. If you join a prop firm in 2025, there’s a decent chance their trading interface might actually be DXtrade under the hood.

Rithmic (R|Trader Pro)

Rithmic is a bit different from the other names here – it’s primarily known as a high-performance data feed and trade execution system for futures trading, rather than a fancy graphical platform. Many futures prop firms and professional traders choose Rithmic because of its exceptional execution speed and reliability.

Rithmic’s network provides ultra-low latency connections directly to futures exchanges, which means when you place an order, it hits the exchange in milliseconds or less – critical for scalpers and high-frequency traders. The Rithmic infrastructure is broker-neutral, allowing you to use it with multiple brokers. On the user side, Rithmic offers a basic platform called R|Trader Pro.

R|Trader Pro features a somewhat utilitarian interface, but it does include integrated charting, a DOM, and one-click trading capabilities. The charts on R|Trader are basic yet functional, featuring technical indicators and allowing for direct trading from the chart. However, most people using Rithmic often connect it to a third-party platform (such as NinjaTrader, Sierra Chart, or Bookmap) because Rithmic is compatible with over 20 platforms. Essentially, Rithmic can be thought of as the engine under the hood that you might connect to a nicer dashboard.

For traders in funded programs, Rithmic is frequently the default choice because it handles risk management at the server level and guarantees data accuracy. Prop firms using Rithmic can set precise daily loss limits, and Rithmic will automatically freeze trading if those limits are hit, preventing further losses – this protects both the firm and the trader from blowing up accounts. The server-side order management means even if your platform disconnects, your stops/profits resting on Rithmic’s servers will still execute.

Rithmic’s focus isn’t on providing social features or visually appealing designs; it’s all about performance and flexibility. You have the flexibility to choose whichever front-end suits you (because of wide compatibility). Automated trading with Rithmic is possible through its API (Rithmic offers an API called R|API). Many quant and algo traders love this, as they can write algorithms that interface directly with Rithmic for the fastest execution. Some third-party algorithmic platforms (like MultiCharts or custom C# apps) use Rithmic as the backend for placing trades.

As for demo trading, Rithmic supports that as well – prop firms typically provide users with a Rithmic Paper Trading login during evaluations, which utilizes live market data but routes orders in simulation. This means you can practice or test your strategy on a Rithmic simulation that closely resembles the real thing. Keep in mind, Rithmic is not aimed at beginners learning technical analysis; it’s aimed at traders who say, “I need my order filled as fast and reliably as possible”.

Choosing Rithmic means prioritizing execution speed, data fidelity, and professional-grade stability. Pair it with a platform of your choice (or use R|Trader Pro’s no-frills interface) and you have one of the best setups for serious futures trading and prop firm challenges.

Sierra Chart

Sierra Chart is a long-standing professional trading platform known for its extreme robustness, customizability, and advanced technical features. Many day traders and algorithmic traders in futures and forex swear by Sierra Chart for its efficiency and one-time purchase model (although it’s subscription-based, it's very affordable).

When it comes to charting, Sierra Chart is second to none. It allows you to create charts of virtually any type or timeframe – standard time-based bars, ticks, volume bars, range bars, Renko, Point & Figure, even custom spread charts – you name it. All charts update tick-by-tick in real time with no aggregation delay, and Sierra stores all your downloaded data locally, meaning you can do extensive historical analysis offline whenever you want.

The platform features a vast library of technical studies (indicators) and supports custom studies through its proprietary Sierra Chart Language (ACSIL) or spreadsheets. You can essentially program anything – from a simple indicator to a complex trading system – and have it displayed on your charts. Notably, Sierra Chart offers Market Profile (TPO) charts and Volume Profile analysis tools built in, which many platforms charge extra for. You can detach charts to multiple monitors, use multiple synchronized charts in one layout, and create Chartbooks (Sierra’s name for a workspace file) with dozens of charts and studies if needed. The level of customization is a dream for power users: colors, scaling, keyboard shortcuts, custom alerts – everything can be tweaked.

Sierra Chart is also a comprehensive trading platform, offering both manual and automated trading support. It connects to numerous brokers and data feeds (CQG, Rithmic, Interactive Brokers, Teton order routing, and even crypto exchanges) – so you can trade directly from Sierra’s charts or DOM. The Trading DOM in Sierra is very advanced and highly configurable. You can place limit/stop orders by clicking in the DOM or on the chart trading interface, and you have attached orders for brackets with multiple targets, auto-break-even triggers, and various types of trailing stops. All these can be set up to function server-side if your broker supports it.

For risk management, Sierra Chart offers a Trade Risk Management settings panel, where you can define parameters such as daily loss limits and maximum position sizes. The system can then warn or block trades if these criteria are met. It also features detailed trade statistics that track your performance over time. Automated trading can be performed via two methods: the built-in Spreadsheet Trader (which allows you to create logic in a spreadsheet format) or by writing code in C++ using ACSIL. Many users have built fully automated systems running on Sierra Chart because it’s stable (Sierra can run for weeks without issues) and efficient in terms of CPU/memory usage.

Although Sierra Chart doesn’t have a social network, its user forum is active, and there’s a wealth of shared custom indicators and systems from the community. Finally, simulation and backtesting are key features: Sierra offers a Trade Simulation Mode, allowing you to simulate trading on live data or utilize the replay feature to replay historical days and practice trading them. The simulated environment is highly realistic, taking into account factors such as order queue position in the DOM, among others.

For a beginner, Sierra Chart may feel overwhelming due to its utilitarian interface and the sheer number of settings, but for an intermediate or advanced trader (especially one in a futures-funded program or engaged in algorithmic trading), Sierra Chart remains one of the most powerful and cost-effective trading platforms available in 2025.

Quantower

Quantower is a newer entrant that has quickly gained respect as a versatile, broker-neutral trading platform with professional features. Quantower’s appeal lies in its modular and flexible interface, as well as its strong support for futures and cryptocurrency trading. It allows connection to 60+ different brokers and data feeds simultaneously.

For example, you could connect Quantower to your futures broker, your crypto exchange, and a forex broker all at once – and either view them separately or even create synthetic spreads between assets. The platform is highly customizable: you can open up to 40+ types of panels (charts, DOM, time & sales, options analyzer, news, etc.) and arrange or dock them as you wish to build your ideal trading workstation. If you prefer a clean layout, you can keep it minimal; if you’re a power user, you can utilize multiple monitors to display different instruments and tools.

Charting on Quantower is excellent – it offers multiple timeframes and various chart types, including Range, Renko, Point & Figure, Tick charts, Volume charts, as well as advanced order flow charts such as Footprint (volume profile per price) and Heatmap (with an add-on). The indicator library is comprehensive and includes all the staples, as well as the option to add custom ones.

One particularly useful feature is the ability to create synthetic instruments on the chart (e.g., plotting a custom spread or an index you define). This is useful for pair trading or futures spreads. Real-time data is as good as your connections – Quantower itself doesn’t supply data, but it leverages the direct feeds you set up (such as CQG, Rithmic, Binance, etc.). In terms of reliability, it’s built to handle the heavy load of multiple data streams and is known to be stable.

Quantower’s trading and analysis tools are extensive, particularly for order flow enthusiasts. It has a Depth of Market (DOM) panel and a unique DOM Surface feature that visually plots the recent DOM changes over time (somewhat similar to Bookmap’s concept). It also offers a Power Trades tool, highlighting areas of unusually high trading volume that occur in a short time (which can signal the activity of big players). These help active futures traders spot momentum shifts or absorption in real time.

Risk management on Quantower is handled at order entry – you can configure default stops and targets as templates and use the one-click trading on the DOM or chart for speedy entries with pre-set risk limits. Because you can connect multiple accounts, advanced users might watch, say, the order flow on one feed while executing on another.

Automated trading is supported through Quantower’s open API. It offers a .NET API for C# developers to create custom add-ons or integrate their algorithms, and recently introduced a Python API as well. This means if you have coding skills, you can script your strategy to work on Quantower and still use the platform’s visuals as a monitor. There isn’t a built-in strategy builder UI, so it’s more for programmers or connecting external algos.

Social trading features aren’t present in Quantower; it’s more of a standalone platform (though its multi-connection nature is “social” in that it allows you to aggregate data). However, some brokers that use Quantower have introduced features such as trading journals or community trade ideas (for example, Optimus Flow – a white-label of Quantower – has added a journal and community resource).

Quantower offers a Trading Simulator mode and a History Player for manual backtesting. You can simulate trades on past data to see how you would have done, which is great for training. Pricing-wise, Quantower has a free version with limited features and a paid version (around $70/month for the full package), but note that many futures brokers (like AMP) offer the full Quantower to their clients for free, which makes it extremely attractive.

In essence, Quantower in 2025 is a comprehensive multi-asset platform that particularly shines for futures and crypto traders who want advanced charting, order flow analysis, and multi-broker flexibility without being tied to a single broker’s software.

Bottom Line

In 2025, traders have an impressive array of software to choose from. Futures and funded-account traders might gravitate toward platforms like NinjaTrader, Sierra Chart, or Quantower for their powerful analytics and direct market access, often supplemented by Rithmic’s ultra-fast feed for execution. Forex and CFD traders may prefer the sleek experience of cTrader or the automation of MetaTrader 5, whereas stock and options swing traders can leverage analysis tools like TrendSpider and Tradytics in combination with execution platforms such as Interactive Brokers' TWS or TradeStation.

For beginners, user-friendly solutions with strong communities – such as TradingView for charting and Tradovate for easy futures trading – can provide an accessible starting point, all while utilizing demo accounts to practice. Ultimately, the “best” trading software is one that fits your specific trading style and needs. Each platform reviewed above excels in certain areas (be it customization, advanced charting, risk management, automation, or social features). By considering the features that matter most to you and taking advantage of free trials or demo accounts, you can find the ideal trading software to elevate your trading in 2025.