Funded Trading Plus Review for 2025

Last Updated: November 10, 2025

Author: Day Trading Insights Research Team

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of this web page's information or data as investment advice. Learn more about our affiliate policies and how we get paid.

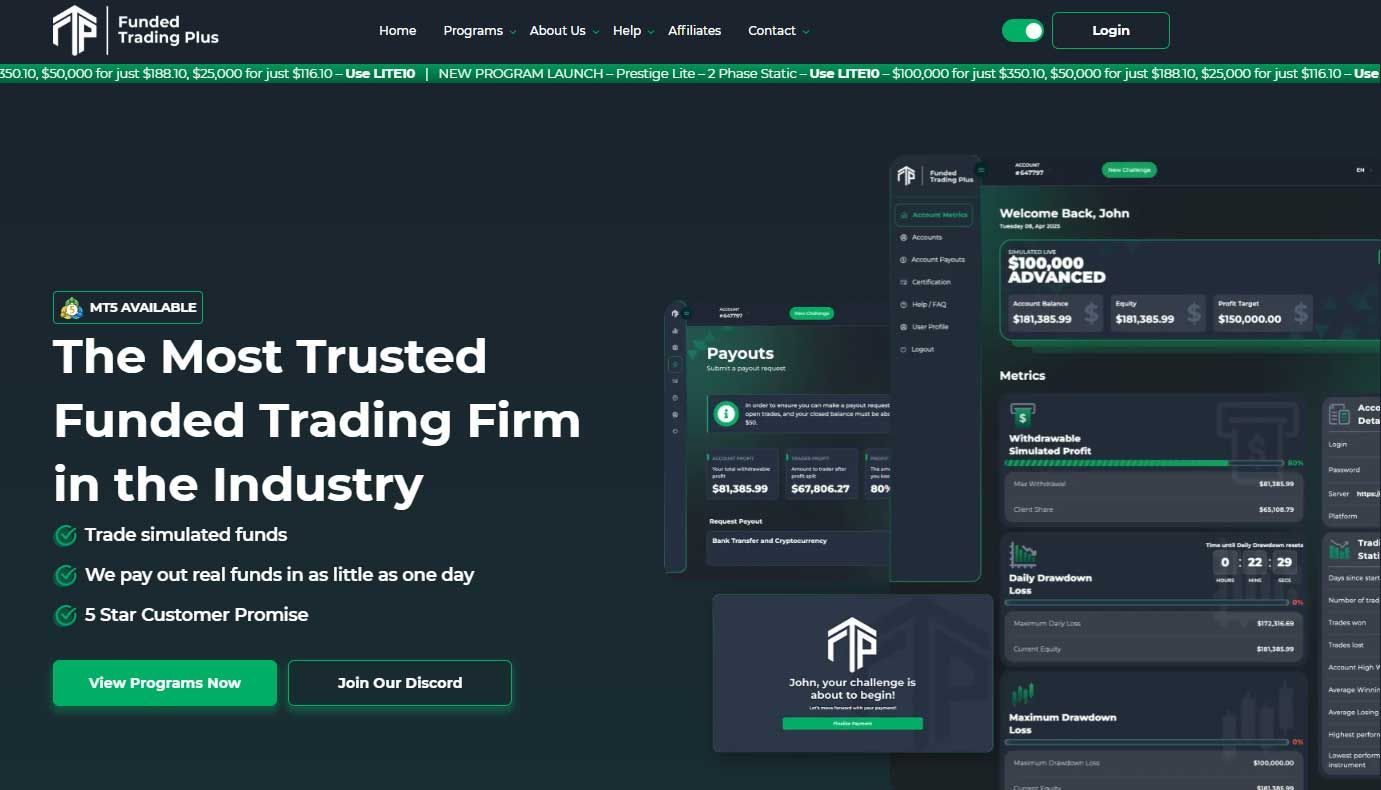

Funded Trading Plus has turned out to be a very good choice for traders looking for a prop firm in Forex world. They have maintained their solid reputation over the years and have weathered quite a few storms that claimed many other Forex prop firms.

Funded Trading Plus (FTP) originated from Trade Room Plus, a company that was started in 2013 and was one of the best UK's live trade rooms for retail traders. FTP was a spin off to help traders that may be short on funds but not short on trading knowledge and skill, to climb up the ladder in the trading world and tap into their true potential. While there are many prop trading firms that fund aspiring traders, there aren't too many that originated from real trading rooms.

Funded Trading Plus Overview

After conducting an extensive research on the Funded Trading Plus trader funding company, it is clear as day that they are legit. There are barely any negative reviews online involving the brand, and even those seem to be made by traders that violated the rules or were facing user errors. Even on Trustpilot 1-star reviews are a mere 2% which in this industry is an incredibly low percentage.

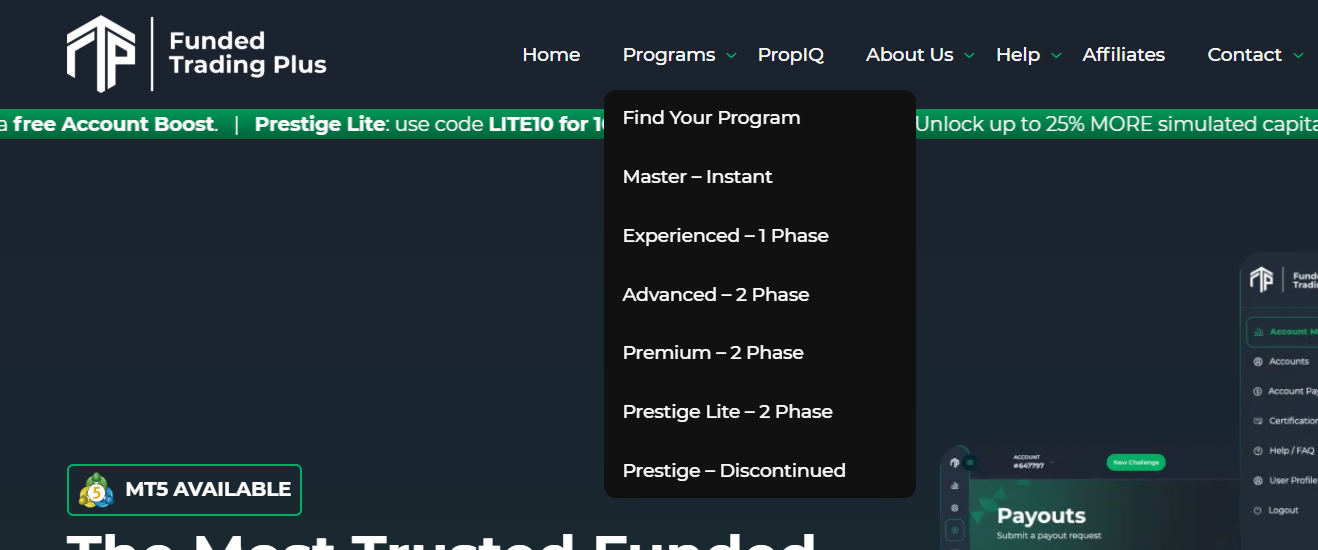

FTP offers 6 different routes that a trader looking to get funded can choose. These programs range from instant trader funding program called Master program, all the way to Prestige Lite program geared for trader that are looking for more structure.

| Feature | Master | Experienced | Advanced | Premium | Prestige Pro | Prestige Lite |

|---|---|---|---|---|---|---|

| Evaluation Type | Instant | 1 Phase | 2 Phase | 2 Phase | 2 Phase | 2 Phase |

| Phase 1 Target | N/A | 10% | 10% | 8% | 10% | 6% |

| Phase 2 Target | N/A | N/A | 5% | 5% | 5% | 6% |

| Daily Drawdown | 6% | 4% | 5% | 4% | 5% | 3% |

| Max Drawdown | 6% | 6% | 10% | 8% | 10% | 6% |

| Payout Split | Up to 100% | Up to 100% | Up to 100% | Up to 100% | 65% Weekly | 80% Bi-Weekly | 80% |

| Paid From | Day 0 | Day 0 | Day 0 | Day 7 | Day 14 | Day 7 |

| Scale | Every 10% | Every 10% | Every 20% | Every 10% | Every 20% | Every 20% |

| Program Window | Relative | Relative | Relative | Relative | Static | Static |

| Drawdown Fixed at Starting Balance | Yes | Yes | Yes | Yes | Yes | Yes |

| Max Leverage | Up to 30:1 | Up to 30:1 | Up to 30:1 | Up to 30:1 | Up to 30:1 | Up to 30:1 |

| Min Profitable Days to Trade | 0 | 0 | 0 | 0 | 3 Per Phase | 3 Per Phase |

| Weekend Holding | No | Yes | No | Yes | Yes | Yes |

| News Events | Yes | Yes | Yes | Yes | Yes | Yes |

| EAs | Yes | Yes | Yes | Yes | Yes | Yes |

| Starting Price | $225 | $119 | $249 | $247 | $139 | $129 |

What is Funded Trading Plus?

The firm is based in the UK and offers varied account sizes ranging from $5,000 to $200,000. These accounts are scalable based on performance, which is a great way to progress as I gain more experience and confidence. They also support different trading platforms, such as cTrader and MetaTrader/DXTrader (including options for U.S. traders), for executing trades and allow trading in diverse markets, including Forex, indices, commodities, and cryptocurrencies. This variety seems crucial for adapting to the evolving needs of modern Trading.

I'm especially drawn to their emphasis on trader education and support. Funded Trading Plus has launched an education department, led by veteran trader Andrew Lockwood, called PropIQ. Andrew has over 40 years of experience in the markets, and started his career as a a trader on the London Futures Exchange. As you can image, he has quite a bit of experience under his belt.

Discovering the firm's background has been enlightening, as it originated as an offshoot of Trade Room Plus, a recognized UK live trade room and training facility. The founders, Simon M., James F., and Michael C., possess diverse experience, adding significant insight to the firm and its mission to support traders with limited resources and open opportunities to all backgrounds. The founders of Funded Trading Plus seem to like surrounding themselves with people that have been in the trading world for a very long time and have solid experience in the industry. Very few prop trading companies have such seasoned traders running the show.

Pros and Cons

When considering Funded Trading Plus, it's essential to weigh its advantages and limitations to assess if it aligns with your trading approach and goals. Traders that know how to manage their risks properly, will love what Funded Trading Plus has to offer. Others that do not, or do not know how to work with the trailing drawdown, might struggle with this program as well.

Pros:

- Diverse Trading Programs: Funded Trading Plus offers multiple programs—instant funding, one-step, two-step, and a Master Trader option—suiting traders of all experience levels.

- Wide Asset Range: Traders can access Forex, indices, commodities, and over 250 cryptocurrencies for broad market exposure.

- Profit Sharing: The firm starts with an 80% profit split, which can rise to 90% or even 100% for top performers.

- Expert Advisors: The platform supports a wide range of Expert Advisors (EAs).

- Flexibility: There are no minimum trading days, and traders can withdraw weekly and receive regular payouts.

Cons:

- No Free Trial: Traders must commit funds to test the platform, though discounted resets are offered.

- Limited Market Access: The platform mainly focuses on Forex and CFDs, with fewer options for stock traders.

- Additional Fees: UK and EU traders incur extra VAT charges at checkout

Account Tiers and Sizes

One thing that Funded Trading Plus prop firm doesn't lack for sure, is the amount of different accounts that they let you choose from. It seems like they have an options for every single person there is. I will try to simplify for you and give you an overview of the programs before we take a deeper dive into each one of them.

Experienced Trader Program - 1 Phase Program for Non-Beginners

| Account Size | $12.5K | $25K | $50K | $100K | $200K |

|---|---|---|---|---|---|

| Platform Options | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade |

| Profit Share | 80% | 80% | 80% | 80% | 80% |

| Days Between Withdrawals | 5 Days | 5 Days | 5 Days | 5 Days | 5 Days |

| Price | $119 | $199 | $349 | $499 | $949 |

The Experienced Trader Program is tailored for traders with a solid foundation in the field, aiming to refine and enhance their trading skills. This program provides in-depth strategies and expert guidance, enabling participants to further their trading expertise and success.

- Single-phase Evaluation: Qualify for funding by meeting profit targets without exceeding drawdown limits.

- Profit Split: 80/20 and can go up to 100.

- Flexible Timing: No minimum days are required for trading; at your own pace.

- Simulated Loss: Maximum daily drawdown of 4% and a maximum relative drawdown of 6%.

- Profit Target: 10% profit to pass the evaluation and gain access to a live-funded account.

- Account Size: Can range from $12,500 up to $200,000

- Refundable Fee: Ranges from $119 up to $949 depending on the account size

- Maximum Simulated Leverage: 30:1

- Monthly Fee: None

The Advanced Trader Program - 2 Phase Evaluation with the

Most Balanced Risk Structure

| Account Size | $25K | $50K | $100K | $200K |

|---|---|---|---|---|

| Platform Options | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade |

| Profit Share | 80% | 80% | 80% | 80% |

| Days Between Withdrawals | 7 Days | 7 Days | 7 Days | 7 Days |

| Price | $249 | $399 | $549 | $1099 |

The Advanced Trader Program is an immersive experience intended for traders serious about elevating their craft to the highest standards. It is a commitment to excellence, broken down into strategic phases:

- Two-Phase Evaluation Phase: Qualify for funding by meeting profit targets without exceeding drawdown limits. You can take your time.

- Profit Split: 80/20, which can go up to 90/10 and then 100.

- Flexible Timing: No minimum days are required for trading; complete the challenge at your own pace.

- Simulated Loss: Maintain a maximum daily drawdown of 5% and a maximum relative drawdown of 10%.

- Profit Target: Achieve 10% for Phase 1 and 5% for Phase 2.

- Account Size: Can range from $25,000 up to $200,000

- Refundable Fee: Ranges from $199 up to $949 depending on the account size for Phase 1, Phase 2 is Free.

- Maximum Simulated Leverage: 30:1

- No weekend holding rule - close by Friday 4:30 PM

The Advanced Trader Program offers a higher maximum simulated loss limit than the Experienced Trader Program, requiring the completion of two evaluation phases for risk management and capital allocation for successful traders. The program retains the straightforward rules of the Experienced Trader Program.

The Premium Trader Program - Most Flexible Two-Phase Program

| Account Size | $25K | $50K | $100K | $200K |

|---|---|---|---|---|

| Platform Options | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade |

| Profit Share | 80% | 80% | 80% | 80% |

| Days Between Withdrawals | 7 Days | 7 Days | 7 Days | 7 Days |

| Price | $247 | $397 | $547 | $1097 |

The Premium Trading Program is for experienced traders who want slightly easier targets, smaller drawdowns and more freedom to hold trades longer.

- Two-Phase Evaluation Phase: Same as Advanced Trader Program, but with easier profit targets and tighter drawdowns.

- Profit Split: 80/20, which can go up to 90/10 and then 100.

- Fixed Timing: First withdrawal after 7 days of profit.

- Simulated Loss: 8% max. relative drawdown; 4% on daily drawdown on evaluation accounts.

- Profit Target: 8% profit in Phase 1, 5% in Phase 2.

- Account Size: Can range from $25,000 up to $200,000

- Maximum Simulated Leverage: 30:1

- Weekend holding : Allows for weekend and overnight holdings.

The Master Trader Program: Fastest Path to Live Trading - Instant Trader Funding Program

| Account Size | $5K | $10K | $25K | $50K | $100K |

|---|---|---|---|---|---|

| Platform Options | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade | Match-Trader / DXtrade |

| Profit Share | 80% | 80% | 80% | 80% | 80% |

| Days Between Withdrawals | 7 Days | 7 Days | 7 Days | 7 Days | 7 Days |

| Price | $225 | $450 | $1125 | $2250 | $4500 |

Likely the most advanced program offered, this could be aimed at traders seeking the highest level of expertise, providing comprehensive education and resources to achieve mastery in trading.

- Instant Evaluation Phase: Qualify for instant funding without evaluation. Maintain your account above the set drawdown limit to preserve it.

- Profit Split: 80/20, which can go up to 90/10 and then 100.

- Flexible Timing: No minimum days are required for trading; complete the challenge at your own pace.

- Simulated Loss: Maintain a maximum daily and relative drawdown of 6%.

- Profit Target: None.

- Account Size: Can range from $5,000 up to $100,000

- Fee: Ranges from $225 to $4,500 depending on the Account Size.

- Maximum Simulated Leverage: 30:1

- No weekend holding rule - close by Friday 4:30 PM

This program features a simple goal: reach a 5%-6% profit, and they will stop tracking your max loss. This means you can grow your capital faster once you hit your target.

Prestige Lite - 2 Phase Program with Easiest Profit Targets

| Account Size | $25K | $50K | $100K |

|---|---|---|---|

| Platform Options | Match-Trader | Match-Trader | Match-Trader |

| Profit Share | 80% | 80% | 80% |

| Days Between Withdrawals | 7 Days | 7 Days | 7 Days |

| Price | $129 | $209 | $389 |

Designed for traders who value structure and consistency, the Prestige Lite program offers a static drawdown framework with reduced profit targets and tighter risk controls. This program is ideal for disciplined traders seeking to demonstrate steady performance while maintaining the flexibility to hold positions over weekends.

- Two-Phase Evaluation: Navigate through two phases with a 6% profit target in each phase, requiring a minimum of profitable days before advancing to the simulated funded account.

- Profit Split: Start at 80/20, scale up to 90/10, and ultimately reach 100% profit retention.

- Minimum Trading Requirements: Achieve at least 0.5% profit on a minimum of 3 trading days per phase (non-consecutive).

- Simulated Drawdown Limits: Maintain a static maximum drawdown of 6% with a daily drawdown limit of 3%.

- Profit Target: 6% per phase to advance.

- Account Size: Ranges from $25,000 up to $2,500,000 through scaling.

- Payout Timing: Request withdrawals after 7 calendar days from the last payout, with a minimum withdrawal of $1,000.

- Maximum Simulated Leverage: 30:1.

- Weekend Holding: Allowed - hold trades through the weekend with no mandatory close times.

- Scaling Structure: Scale every 20% in simulated profit with account sizes growing progressively to $2.5M maximum.

Unique Feature: The static drawdown remains fixed at your starting balance, providing consistent risk parameters regardless of simulated profit growth.

Prestige Pro - 2 Phase Program with Highest Earning Potential

| Account Size | $25K | $50K | $100K |

|---|---|---|---|

| Platform Options | Match-Trader | Match-Trader | Match-Trader |

| Weekly Payout Split | 65% | 65% | 65% |

| Bi-Weekly Payout Split | 80% | 80% | 80% |

| Price | $139 | $259 | $469 |

Built for serious traders who demand clarity and control, the Prestige Pro program features a two-phase static drawdown structure with higher profit targets and more aggressive scaling opportunities. This program rewards confident traders who can navigate larger drawdowns while taking advantage of weekly payout flexibility.

- Two-Phase Evaluation: Complete a 10% profit target in Phase 1 and 5% in Phase 2 before receiving your simulated funded account.

- Profit Split: Choose between 65% weekly payouts or 80% bi-weekly payouts to match your trading schedule and cash flow needs.

- Minimum Trading Requirements: Achieve at least 0.5% profit on a minimum of 3 trading days per phase (non-consecutive).

- Simulated Drawdown Limits: Maintain a static maximum drawdown of 10% with a daily drawdown limit of 5%.

- Profit Target: 10% in Phase 1, 5% in Phase 2.

- Account Size: Start with $25,000, $50,000, or $100,000 accounts, scaling up to $2,500,000.

- Payout Timing: Begin requesting payouts 14 days after account activation with flexible weekly or bi-weekly options.

- Maximum Simulated Leverage: 30:1, depending on asset class.

- Weekend Holding: Allowed - full flexibility to hold positions through weekends.

- Scaling Structure: Scale every 20% in simulated profit with progressive account growth to $2.5M maximum.

Unique Feature: The static drawdown is locked at 10% of your starting balance, giving you greater room to implement aggressive strategies while maintaining structured risk management.

Is Funded Trading Plus Legit?

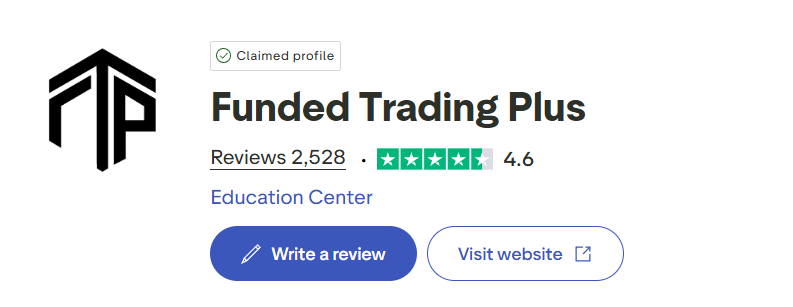

The answer is simple, yes, Funded Trading Plus prop firm is legit. We have found ample of evidence of traders getting paid out and barely any negative feedback. Negative feedback that we did find seemed to be more of a user error or risk mis-management than anything else. Their Trustpilot scores are very solid with only 2% of all of the reviews being 1-star (a rare find in this industry).

We have read every single review left on Funded Trading Plus along with the responses from FT+ team or CEO himself (Simon) and it is pretty clear that everything is by the book. Few things to note:

- You cannot be a trader that's already on a list of traders that are known for fraud, KYC, or have violated AML regulations.

- Do not violate daily drawdown rules which numerous traders found fairly restrictive.

- Don't hit your stop loss limit.

- Follow other rules.

Funded Trading Plus Rules and Things You Should Know

Tradeable Assets: What You Need to Know

Forex and CFDs: Funded Trading Plus provides a robust platform for Forex traders, offering various currency pairs. Major, minor, and exotic pairs are all part of the mix, giving Forex traders the diversity needed to employ various strategies, from scalping to long-term positional plays. The CFDs component extends to trading indices like the DAX, Nasdaq, and Dow Jones, which opens the door to Trading on the performance of market sectors and the broader economy.

Commodities and Metals: For those interested in the commodities market, Funded Trading Plus allows Trading in pivotal commodities such as natural gas and crude oil, which can be essential for traders looking to diversify their portfolios or hedge against market volatility. Metals trading includes opportunities in gold and silver, providing a classic hedge against inflation and currency devaluation.

Cryptocurrencies: In alignment with modern market demands, Funded Trading Plus has incorporated an impressive range of over 250 cryptocurrency pairs into its offerings. This variety caters to the burgeoning demand for digital asset trading and provides a fertile ground for traders specializing in the highly volatile crypto markets.

Funded Trading Plus offers a comprehensive array of tradable assets that can satisfy various trading preferences. The platform's ability to cater to different asset classes makes it an attractive option for traders looking to diversify their strategies across Forex, CFDs, commodities, metals, and cryptocurrencies. Also it is essential to note that, Single Stock Trading is not available. However, before engaging with the firm's services, potential users must consider the platform's pros and cons about their trading needs and strategies.

Withdrawal and Profit-Sharing Rules

I checked out this trading program where you start off earning big. Initially, you pocket 80% of the profits from your simulated account. Once you hit a 20% profit, your share jumps to an impressive 90% followed by pocketing a 100% once you reach 30% profit. And in the live account, you're withdrawing profits over $50 weekly, keeping a cool 70% for yourself. Plus, if you're nailing it, there's an option for a performance-based commission to boost your earnings even more. It's like leveling up in trading with each success!

The Payout Structure

As one of the best funded trader programs, FTP's profit split structure is carefully designed to motivate and reward successful trading.

- The initial profit split is 80% for instant funding. Traders can keep 80% of any withdrawal which can increase with consistent performance.

- Consistent performance can raise the profit split to 90% once traders achieve 20% of the profit. At 30% of profit, traders can upgrade to a 100% profit share.

Payouts are processed on a weekly cycle, Experienced and Advanced programs allow withdrawal from Day 1 of the funded phase, whereas Premium program allows first withdrawal after 7 days.

In Master Program, there is no evaluation, no profit target the traders need to hit before withdrawal. Traders can request a payout as soon as they are in profit.

Leveraging Trades Details and Tips

Funded Trading Plus offers a range of leverage options tailored to different asset classes.

- Forex - 1:30

- Indices - 1:30

- Metals - 1:30

- Commodities - 1:30

- Cryptocurrencies - 1:2

This variation in leverage is significant because higher leverage can amplify potential profits and risks. Therefore, traders must align their leverage use with risk management strategies.

A thorough understanding of market volatility, particularly in the highly fluctuating cryptocurrency market, is crucial for effective leveraging decisions. This knowledge helps traders make informed choices that suit their trading style and risk tolerance.

Funded Trading Plus uses leverage cap of 30:1 in most instruments to balance risks and 2:1 on cryptocurrencies given their volatility. This makes sure that the traders have ample amount of buying power along with encouraging risk management.

Who is Funded Trading Plus Best Suited For?

Funded Trading Plus is a good fit for most of the traders, mostly based on how many different trading account paths they allow you to choose from. However, as it goes with all of the programs, it is not for everyone. Funded Trading Plus is not the best fit for traders that do not know how to manage their risks well and not fall a victim to trailing drawdown resetting their accounts.

However, these are the things that are already super important in prop trading world. Therefore if you are serious about coming out in the green on your trading account, no matter the trading program, you must know how to manage your risks properly.

That being said, Funded Trading Plus is definitely not for traders that want to stick to futures trading since they do not offer funded trader accounts that focus on futures. So if you are futures trader, you can head on to our best futures prop trading firms list to choose another great brand to work with.

Trading Hours

Funded Trading Plus allows Trading during major market sessions, accommodating various trading styles, including overnight and weekend positions, depending on the program.

Only traders in programs that permit weekend holdings can keep their positions open into Saturday and Sunday, but others would need to be closed by the end of the day on Friday 4:30 PM EST. Understanding these hours is crucial for strategizing trades, especially for those interested in day trading or international markets.

How to Sign Up

Signing up for a program or service typically involves a few key steps. Here's a detailed guide on how to sign up for any program that is suitable for you.

- Visit the Official Website: Start by navigating to the Funded Trading Plus official website. This is usually the primary source for accurate information and the sign-up process.

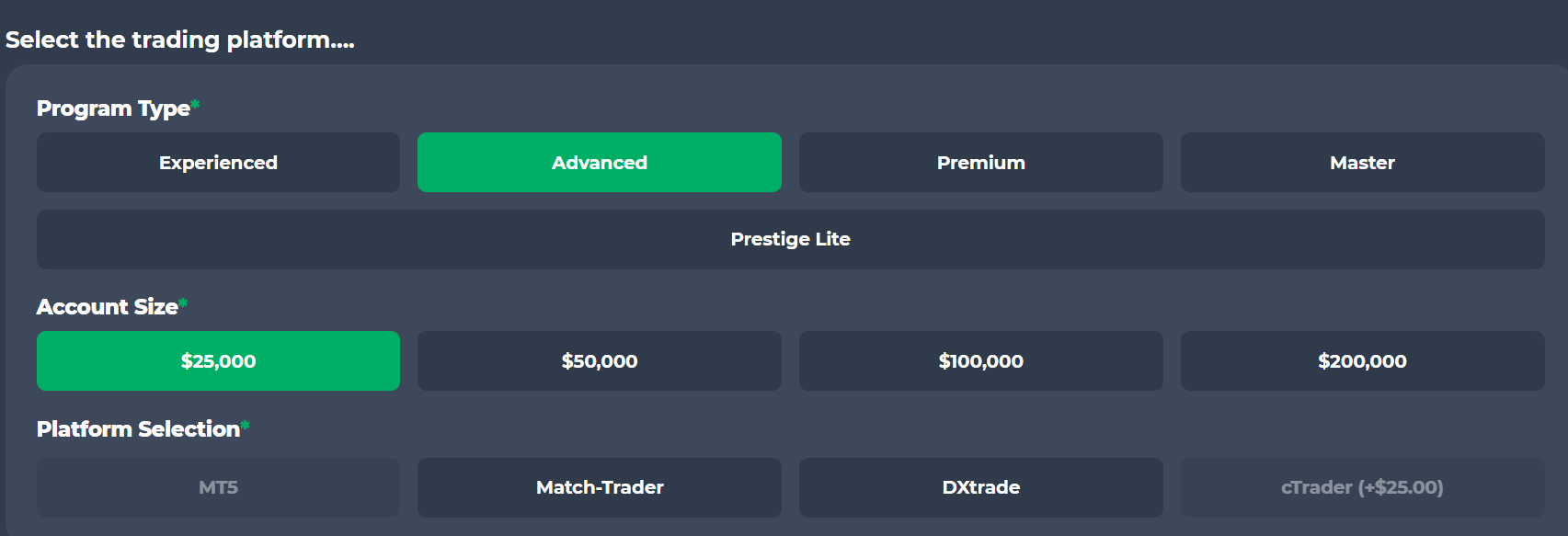

- Find the right program for you: From the drop down menu select the program you are looking for. You can chose from Master, Experienced, Advanced, Premium and Prestige Lite programs.

- Select the Account Size: Once you've chosen the Program, the next step is to select the account size. You will find an interactive table displaying comprehensive details about the Program and the chosen account size. This includes the number of phases, simulated profit target, simulated loss, refundable fee, and other pertinent information. Once you've chosen the Account size, click on Start Now.

- Now Chose your Platform: Here you have a few platforms to chose from depending upon your country or residence.

- For US traders, you can chose from Match-Trader and DXtrade

- For others, you can chose from MT5, Match-Trader, DXtrade and cTrader (+$25k)

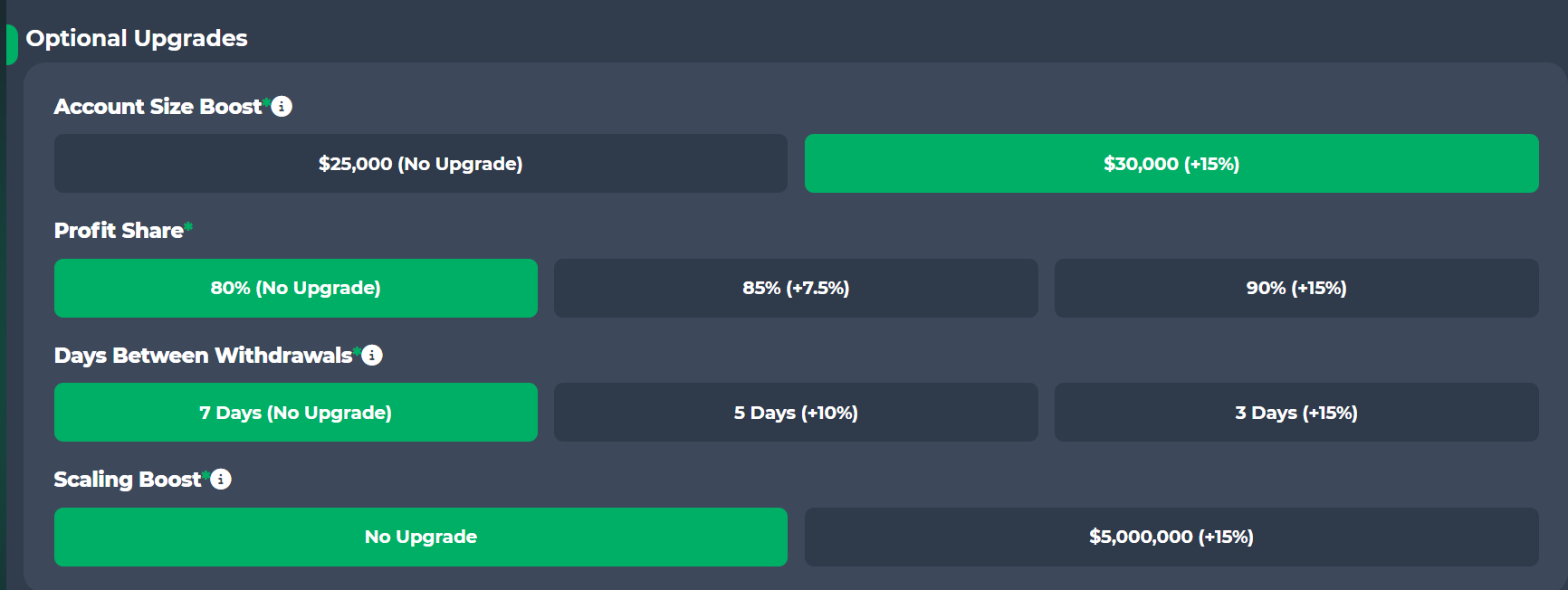

- You can also chose to boost your account under Optional Upgrades. Depending upon the upgrade. Here you can boost account size, profit share, days between withdrawals and scaling boost.

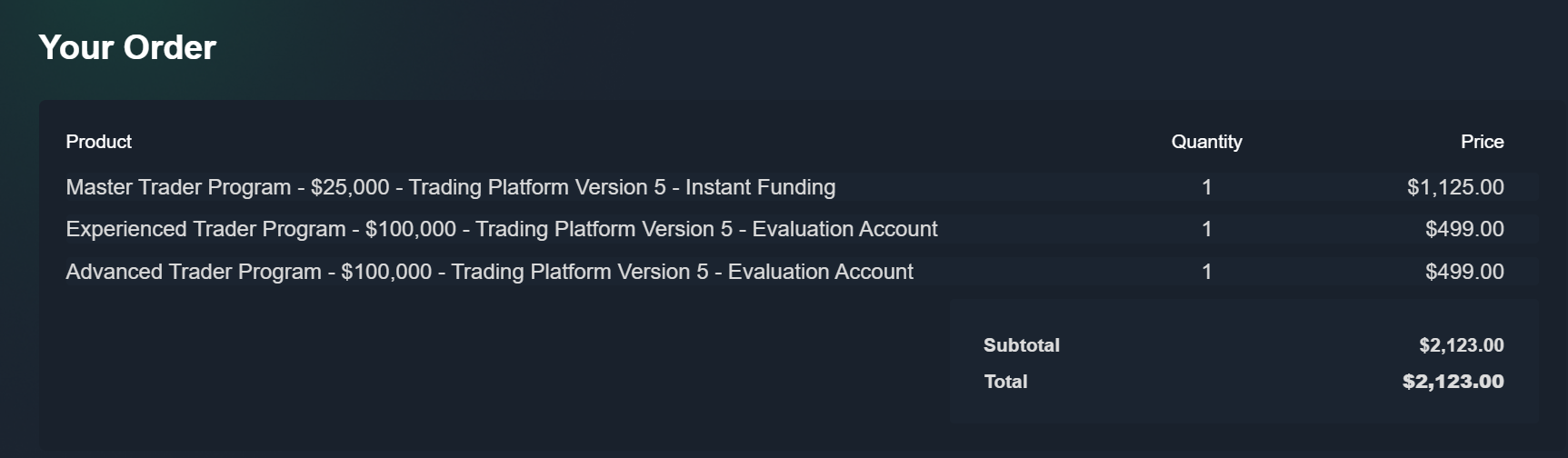

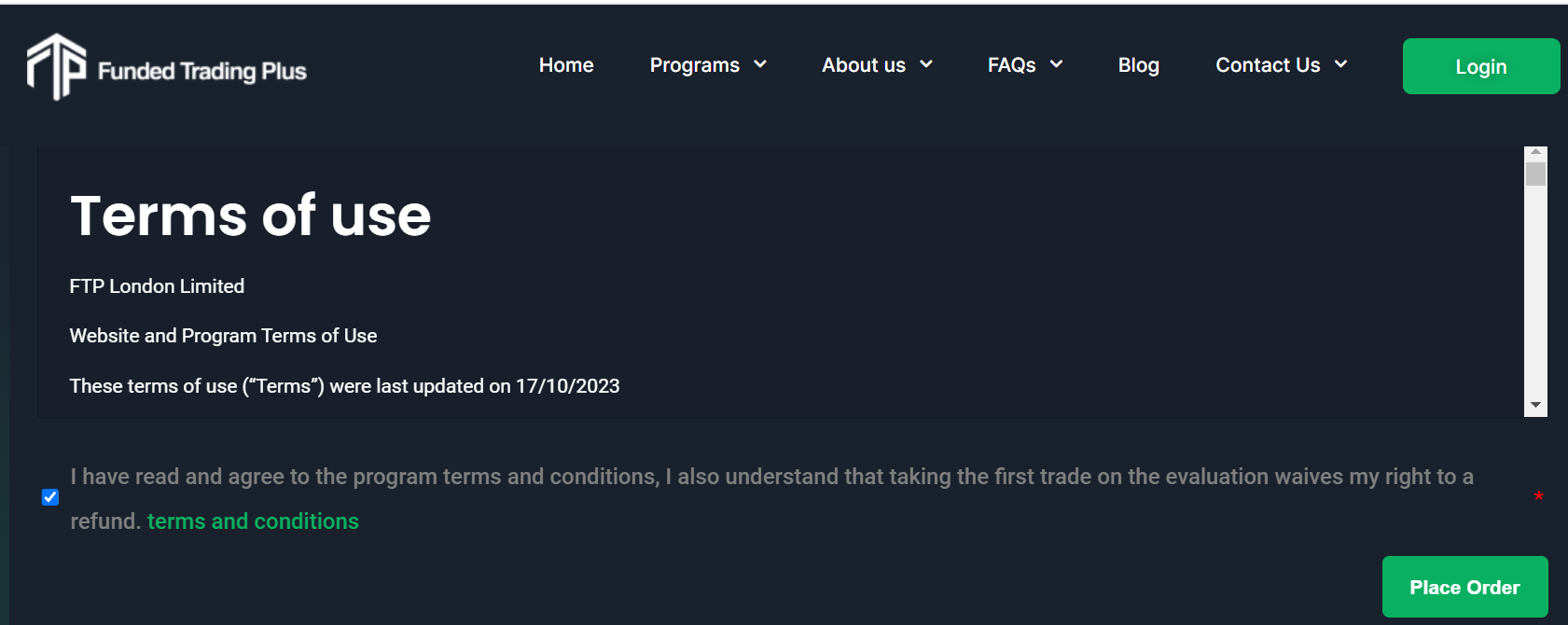

- Check out, Review order and Apply: Now that you've made your choices, it's a good idea to take a quick look at your order and confirm that everything is correct. Go through your selected items thoroughly, input your billing details, and fill in all the essential information. Choose the payment method that works best for you. If you have a coupon code, remember to include it too. Be sure to read the Terms of Use carefully. Finally, click 'Place Order' to finish your transaction.

Reputation and User Experiences

Funded Trading Plus has built a reputation for trustworthiness by adhering to regulatory standards, providing consistent payouts, and fostering a transparent trading environment. With a focus on trader education and robust customer support, the platform is committed to its users' success and trust.

Trustpilot has awarded an impressive 4.9-star rating to Funded Trading Plus based on over 25 thousand reviews. Among these, 91% of reviewers gave the trading firm a 5-star rating. This is followed by 5% who were awarded four stars. Notably, less than 1% of reviewers have rated the firm with three stars and two stars and 2% with 1 star. These ratings underscore the firm's credibility and trustworthiness.

You can stay updated with the latest information and news from Funded Trading Plus by following their Instagram account. With over 185 posts and a growing follower base exceeding 31k, they regularly share a variety of content. This includes trading tips, the latest discount coupons, and other news. Additionally, you have the option to send them a direct message for personal communication.

Funded Trading Plus also maintains a Facebook account, boasting over 23,000 follower. On this platform, you can engage with both the firm and its community by exploring reviews, questions, and mentions on their wall. Additionally, you can comment on posts and stay informed about the latest updates, including discount coupons and news. For more private inquiries, the option to send a direct message to the firm is available, should you prefer not to post publicly on their wall.

Funded Trading Plus: Final Thoughts

So, my experience with the Funded Trading Plus, and let me tell you, it's like the cool kid on the block of proprietary trading. They've got a shiny 4.6 rating on Trustpilot, which is pretty impressive. They cater to everyone from newbies to trading gurus with various programs and multiple trading platforms to options to chose from.

What really caught my eye is how they adapt their accounts to fit all kinds of traders. They offer everything from beginner levels to a 'Master Trader' program, from one step challenge to instant fundings. It's like choosing your adventure in the trading world. And the profit sharing? It's pretty generous. You get to trade in all sorts of markets - Forex, indices, commodities, crypto - it's like a trading buffet.

But here's the catch: there's no free trial, and if you're into trading while everyone else is sleeping, overnight trading isn't on the menu.

They also talk a lot about being on the up and up with regulatory stuff and being transparent, which is a big plus. They're also big on teaching and supporting their traders, so they're really in it for your success. If you're looking to get into or level up in trading, Funded Trading Plus might be worth a look.

FAQs

Day Trading Insights Research Team

Day Trading Insights Research Team publishes articles written by active day traders, financial market researchers, or aspiring traders who are actively learning and investing on a regular schedule. Our research team brings formal training in finance and computer science, blending market theory with code-driven testing and tools. We’re passionate about understanding how trading works, how markets evolve, and how technology can sharpen professional decision‑making. Our content is education‑first and independently produced, free from outside bias.