Prop Trading vs. Self-Funded Trading

By the time you decide that trading is going to be a serious undertaking, you should be clear on how to raise capital. Before proprietary trading became a thing, the only possible way to raise funds was from one’s own pocket. But now, you can opt for a funded account from a prop trading firm. The choice between self-funding and prop trading shapes not only how you’ll operate in the markets but also your risk exposure, psychological approach, and potential for growth.

Proprietary trading (prop trading) describes the situation where you take positions in the market using a funding company’s money. You and the firm then decide how to split the profits. On the other hand, the self-funded route involves using one’s own money as capital. Of course, each approach has upsides and challenges. What are they? Which approach is right for you?

The difference between these approaches may appear obvious, but nothing can’t be too far from the truth. That explains the WHY of this article. The article unbundles the two trading models, covering everything from capital requirements and profit structures to psychological factors and regulatory considerations. The primary goal is to avail the insights needed to determine which approach best fits your trading goals, risk tolerance, and available resources. And as a matter of fact, it doesn’t matter what your current station in the trading career is; what’s more important is understanding these differences so that you can make the best decision possible. Let’s get to work.

What Is Prop Trading?

On the face of it, the term “prop trading” doesn’t refer to anything closer to funded trading. Instead, prop trading is when a financial firm, like an investment company or bank, uses its own money to buy and sell financial products like stocks, currencies, and futures. This implies that, normally, such firms trade with clients’ money and only earn through fees and commissions. That’s actually what happens.

But dig a little deeper, and you will find that prop trading can involve a firm providing capital to a trader to trade on its behalf. So, instead of the proprietary trading firm going into the market by itself, it subcontracts this activity to an individual trader. When the trader turns in profits, the firm takes a cut, and the trader pockets the rest.

A little confused? Let’s see if an illustration will make things clear.

How Prop Trading Works: An Illustration

Suppose a company, Company X, is a proprietary trading firm—it uses its own money to buy and sell financial instruments. But, having determined that hiring individual traders to take positions in the market on their behalf is much more profitable, the company recruits Trader A.

The company takes Trader A through an evaluation round to ascertain their suitability. After passing the challenge, the firm opens an account for the trader and funds it with $100,000. The firm instructs Trader A to only trade currency futures and follow specific rules.

After 30 days, Trader A earns a $10,000 profit. According to the firm’s profit-sharing agreement, Company X takes 20% ($2,000), and Trader A keeps 80% ($8,000). The firm also monitors the trader’s activity to ensure he manages risks appropriately. That way, the company can benefit from the trader’s skills while limiting potential losses.

Key Aspects of Prop Trading

This illustration reveals several facts about prop trading.

First, prop trading firms must test traders’ skills before they give them capital. The evaluations often have several KPIs—for example, a trader must hit a specific profit target while remaining within set risk limits.

Second, prop trading firms rely on several rules to guard their money. Once they fund you, you must operate within these guardrails, which typically include:

- Maximum drawdown limits (how much you can lose overall)

- Daily loss limits (how much you can lose in a single day)

- Position size restrictions (how much risk you can take per trade)

- Trading hour limitations (when you can and cannot trade)

- Minimum trading days (how active you need to be each month)

Third, traders earn from the profits they make. Prop trading firms usually spell out in their terms how much each party takes home. For example, Company X, in the illustration, claims 20% of any profits Trader A makes, leaving the trader with the largest share.

At the end of the day, this trading model benefits both the firm and the trader. For the former, it leverages the trader’s expertise to generate profits without directly managing the trades. On their part, traders can expect higher potential earnings because they have access to substantial capital.

What Is Self-Funded Trading?

Self-funded trading is exactly what it sounds like—you supply your own trading capital. There’s no middleman, no evaluation process, and no one looking over your shoulder. It’s just you, your capital, and the market.

But what does this really mean in practice?

When you open a trading account, you’re establishing a direct relationship with a broker who executes your trades. You deposit money, and that becomes your trading capital. Every cent in that account is yours—both the initial deposit and any profits you generate.

Example of How Self-Funded Trading Works

Suppose that the trader we met earlier, Trader A, has some money saved up and would rather not work with a prop trading firm. He opens an account with a retail broker and deposits $10,000. The broker offers him 30:1 leverage on forex pairs, meaning he can control positions worth up to $300,000.

The trader develops his own trading strategy and risk management rules. Some days, he trades aggressively; other days, he sits on the sidelines. He can hold positions overnight, over weekends, or even for months if he wants to. When news events happen, he can choose to trade them or avoid them—it’s entirely his call.

After a month of trading, he makes a $1,500 profit. Unlike the funded account route, he keeps 100% of this money. However, had he lost $3,000 instead, that loss would come entirely out of his pocket too.

Key Aspects of Self-Funded Trading

If anything is clear as day in this trading model, it is that you must be able to raise the capital to fund your trading activities. This aspect alone locks out many traders who cannot marshal enough money to take meaningful positions in the market.

Other aspects of self-funded trading include:

- You have complete control over your trading approach

- There are no external restrictions on your trading style or schedule

- You keep 100% of your profits (after broker fees and taxes)

- You bear 100% of the losses

- You can only trade position sizes proportional to your capital (unless using leverage)

- There’s no evaluation process to pass before you start

- Your trading decisions affect your personal finances directly

Key Differences in Capital & Funding

Initial Costs

- Prop Trading (Firm-Funded) : Lower out-of-pocket costs upfront. This may include fees for training, desk, or access to capital.

- Self-Funded Trading: A high initial capital outlay is required; the trader must raise the entire amount of starting capital.

Financial Risk

- Prop Trading (Firm-Funded) : Lower personal financial risk: losses impact the prop trading firm’s capital, but the trader risks losing privileges or the account.

- Self-Funded Trading: This carries a high personal financial risk because losses directly reduce the trader’s own capital.

Rules & Autonomy

- Prop Trading (Firm-Funded) : The trader must work within the funding company’s rules, risk management policies, and trading restrictions.

- Self-Funded Trading: Traders operate with complete autonomy—the trader sets their own strategies, bound only by market regulations.

Profit Sharing

- Prop Trading (Firm-Funded) : The firm sets the profit split ratio, often starting from 70% to the trader.

- Self-Funded Trading: Traders retain 100% of the profits from their trades.

Scaling Potential

- Prop Trading (Firm-Funded) : Once the firm is certain that your skills are impeccable, they may increase capital allocation. The better your performance, the higher the allocation is likely to be.

- Self-Funded Trading: Your account grows according to how much profits you reinvest, or you can inject more personal funds to grow the capital.

Training & Support

- Prop Trading (Firm-Funded) : Often provided by the funding firm, including mentorship, advanced tools, and technology.

- Self-Funded Trading: Traders must independently seek education, tools, and resources.

Psychological Factors

- Prop Trading (Firm-Funded) : Trading with a firm’s money may reduce mental strain but can limit accountability. However, some traders might find this arrangement more stressful, especially with the prop trading firm watching every move taken.

- Self-Funded Trading: Trading with own capital increases emotional pressure and stakes. Others may not worry much because, after all, they will be losing money they can afford to lose.

Barrier to Entry

- Prop Trading (Firm-Funded) : The only obstacle to traders being funded is evaluation. Once you clear this, you’re in.

- Self-Funded Trading: The fact that you must raise the required capital raises the barrier to entry for some. To others, the barrier is low because all they need to do is raise sufficient funds.

Profit Sharing vs. Retaining Full Profits

One of the most significant differences between prop trading and self-funded trading comes down to a simple question: to whom does the profit go? You must know the answer because it affects your bottom line.

How Profit Sharing Works in Prop Trading

When you work with a prop trading firm, you’re essentially in a partnership. The firm supplies the capital, and you provide the trading expertise. Then, whatever is earned in the trading activity is split between you and the firm. Some prop firms allow traders to keep as much as 90% of the proceedings. That means that for every $100 made in a trade, the trader will keep $90, and the firm will only take $10.

Some prop firms may start low, say a 70/30 split, but then adjust upwards in the trader’s favor as their performance improves. They may also increase the account size. For instance, you might start at 70/30 and move to 80/20 after three consecutive profitable months. Others might offer better terms for larger account sizes.

You Keep All the Profits in the Self-Funded Model

The idea of profit-sharing doesn’t exist in self-funded trading. After all, why would anyone want a piece of your reward when you raised all the capital by yourself? The math is simple here: you keep 100% of what you make (minus broker fees and taxes, of course). Every dollar of profit goes directly into your pocket.

This straightforward approach has obvious appeal. If you make $1,000 in profit, it’s all yours—no splitting with anyone else.

Costs, Fees, and Evaluations

Trading isn’t free, regardless of which route you take. Do you prefer prop trading? It has a price tag. The personal account, too, has costs.

Prop Trading: The Upfront and Ongoing Costs

When you opt for funded trader programs, the evaluation fee is the first expense you’ll encounter. The fee is like the entrance ticket to the funded trading space.

Evaluation Fees

Some traders like to think of evaluation fees as their first investment. And they’re not wrong. One expects that the money they spend will be recouped at a later date.

Each prop trading firm conducts its own version of evaluation, although the general principle is the same. You pay for a challenge, take the test, and proceed depending on your performance. The price you’ll pay for a specific challenge depends on the firm’s rates and the account size you’re aiming for.

But there is no guarantee that you’ll pass on the first attempt. If you fail, most firms require you to pay again for another shot. Some spend thousands of dollars on evaluation fees before finally securing a funded account. Looking at this from another perspective, it is like paying for education in risk management the hard way.

Recurring Costs With Funded Accounts

Evaluation fees are only upfront costs. Once you pass and get funded, you’re likely to encounter additional costs, such as:

- Monthly subscriptions to maintain your account

- Fees for trading software access

- Real-time market data fees

These recurring costs chip away at your profit share, so always factor them in when comparing offers from different firms.

Self-Funded Trading: The Hidden Price Tags

You might think that going it solo is much more straightforward cost-wise, but expenses can add up here too.

Brokerage Commissions and Spreads

Every trade you make comes with a cost that manifests in the form of forex spreads and futures commissions. If you prefer stock trades, the broker may charge a certain amount, typically under $5, for each position.

Your trading strategy may also impact your costs. For example, a high-frequency trader might rack up hundreds of dollars in commission costs monthly, while a swing trader might pay significantly less.

Platform and Data Costs

Professional trading requires professional tools:

- Charting software: $20-$300 monthly (TradingView, NinjaTrader, etc.)

- Scanner subscriptions: $50-$200 monthly

- Market data feeds: $20-$100+ monthly depending on markets traded

Unlike prop trading, where these costs might be bundled or covered, self-funded traders pay for each service separately.

Don’t forget the time aspect. If you consider the time spent taking challenges as a cost center, then the prop trading route has a few more hidden costs. Although, one may consider this a small price to pay compared to the money one might lose in the first few trades in a personal account. Traders that take this route might want to cut corners because, after all, it’s their money, and they can do whatever they want.

Risk Management & Drawdown Rules

Much of trading is all about managing risk. With serious money on the line, especially for funded accounts, you must have a solid plan to protect against downside risks.

Prop Firms Have Strict Risk Management Requirements

We stated earlier that prop trading firms require prospective traders to undergo rigorous testing before they earn a funded account. The primary objective, as we also stated, is to ascertain that the trader in question can deliver profits. However, we should add that the evaluation also seeks to determine your ability to play by the rules.

Prop firms have a number of rules that guide traders to protect their money, including:

Daily Loss Limits

These limits are the maximum amount of money the funding company will let you lose in a single trading day. Lose anything above this limit, and the firm will stop you from trading for the rest of the day.

Maximum Drawdown Thresholds

Beyond daily limits, there’s usually an overall account drawdown limit. This is the largest acceptable decline in your trading account’s value from its peak. Most funding companies will close your account if you exceed this limit.

These rules may be rigid but necessary from the funding company’s perspective. From the trader’s perspective, however, they create an environment where they feel like they’re trading with training wheels that they can never take off. Be that as it may, the restrictions enforce discipline that many traders struggle to maintain on their own.

Self-Funded Means Freedom, but Can Also Mean Self-Destruction

With the training wheels off, you have the freedom to bite as much as you like in terms of risk-taking. But this scenario can be liberating and dangerous at the same time.

Usually, there is a psychological difference between following someone else’s rules and sticking to your own. For instance, when a prop firm says, “You cannot lose more than 5% in a day,” the consequence of breaking that rule is immediate—your account gets suspended or terminated.

But when you set your own risk limits, you’re both the player and the coach. After a bad trade, your inner voice may convince you to ignore the limits and stretch the luck further. Suddenly, a 2% rule becomes 5%, then 10%.

The difference often comes down to accountability. External rules create external accountability, while self-imposed rules require something much harder to maintain – self-accountability. It’s the same reason people hire personal trainers when they could just follow a workout routine on their own.

Trading Psychology & Accountability

If you’ve spent some time in the market, you’d know that trading is more than just numbers and charts. It’s a mental experience that can feel like an emotional rollercoaster. How your brain handles this rollercoaster differs depending on the trading approach.

Mental Pressure in Prop Trading

Prop trading firms impose rules on traders to guard their money. These restrictions can be beneficial and detrimental at the same time.

How Rules Force Discipline

We saw earlier that funded traders must operate within set guidelines. Funding companies have tight control over most aspects of trading, including how much loss you can make and even how many times a month you can be active. These guardrails keep you from making the classic emotional mistakes that destroy trading accounts.

The Flexibility Trade-Off

But that discipline comes at a cost. What if your strategy occasionally needs room to breathe? What if your best set-ups happen during news events that your funding company prohibits?

The rigid rule structure can prevent you from executing your full trading strategy. Some traders find themselves constantly looking over their shoulders, second-guessing trades that might push close to rule violations, even when those trades align with their strategy.

The Psychological Weight of Self-Funded Trading

Trading your own capital also can burden your mind. But this experience creates an entirely different psychological environment.

There’s something different about watching the money you struggled to earn fluctuate with each market move. This direct connection to your personal finances can lead to:

- Hesitation to enter valid trades (fear of loss)

- Premature exit from winning positions (fear of giving back profits)

- Overtrading to “make back” losses quickly

- Decision paralysis during volatile market conditions

On the flip side, there is the kind of autonomy that funded traders can never dream about. You can trade exactly how you want, when you want, without anyone looking over your shoulder. You can modify your approach on the fly, take calculated risks when opportunities arise, and learn from mistakes without immediate punishment.

This freedom can be incredibly valuable—if you have the discipline to handle it.

Building Psychological Resilience in Either Model

Regardless of the situation, developing mental toughness is non-negotiable.

For Prop Traders:

- Embrace the rules as protective rather than restrictive

- Practice trading within constraints, even in demo accounts

- Develop strategies that thrive within the rule structure

- Focus on consistency rather than home-run trades

For Self-Funded Traders:

- Create your own firm rules and write them down

- Set up automatic stops to remove emotional decision-making

- Consider using trading journals to track adherence to your rules

- Practice stepping away after losses to prevent emotional decisions

For Everyone:

- Develop a detailed trading plan before the market opens

- Track your emotional state along with your trades (embrace journaling!)

- Remember that one trade doesn’t define your trading career

Flexibility & Autonomy

We’ve touched on many differences between prop trading and self-funding so far, but the degree of freedom you have in your day-to-day activities deserves special attention.

The Freedom Factor

As mentioned earlier, prop trading firms can be controlling. They implement strict rules to ensure that traders prioritize risk management over pyrrhic victories. And these restrictions go beyond just drawdown limits. Many firms also limit:

- When you can trade – Some prohibit trading during major economic announcements

- What you can trade – Certain instruments might be off-limits

- How you can trade – Some strategies deemed too risky may be prohibited

We’ve also seen that self-funded traders are free to trade as they please. This difference in flexibility affects traders in ways that go beyond the obvious.

When Restrictions Actually Help

Interestingly, some traders find that the strict rules of funded accounts align with best practices they should follow anyway. For instance:

- Avoiding high-risk news events often preserves capital

- Focusing on liquid, major instruments typically reduces unexpected risks

- Removing exotic or high-risk strategies can improve long-term performance

When Freedom is Ideal

Sometimes rigidity could deny you the chance to execute a life-changing set-up. Your trading edge might require flexibility that prop trading firms don’t allow. For instance:

- If your strategy works best by holding positions through multiple sessions

- If you specialize in trading volatility during major news releases

- If your approach requires trading correlated instruments simultaneously

In these cases, the autonomy of self-funding might be worth the additional capital investment.

Regulatory, Tax, and Legal Considerations

Many countries recognize trading as a legitimate job. In the United States, for example, the government created an organization (the Commodity Futures Trading Commission (CFTC)) that oversees trading activities in futures and options markets.

However, codifying trading as a genuine income stream has implications. For a start, your trading activities must take place within the law. Most importantly, you are expected to submit a piece of your earnings to the tax authorities.

Different Tax Treatments

The way you receive money from trading affects how it’s taxed. For instance, income from prop trading arrangements typically comes as profit shares paid to you personally. As such, this can possibly be categorized as independent contractor income. In places like the US, this kind of income often requires quarterly estimated tax payments.

On the other hand, income from personal trading activities is often treated as capital gains, which may attract lower tax rates in places like the US. You may also offset gains with losses when they happen.

The point is that the tax treatment you get on your income depends on where you live. Some jurisdictions may classify funded traders as employees, and others view them as contractors. This impacts how tax is applied to the income. For this reason, you may have to do more research work on your end to understand how taxes and other regulations apply to you as a trader—funded or not.

To that end, you might want to get clarity on issues such as:

- How trading income is classified in your jurisdiction

- Whether prop trading creates an employer-employee relationship

- Tax deductions available to each type of trader

- Reporting requirements for foreign trading accounts (if applicable)

Which Is Right for You?

By now, you know that a funded trader has some undeniable advantages over a self-funded one. The opposite is also true. So, how do you know which model is right for you?

For starters, you must “know thyself”. Evaluate your situation and see if you fit one of the following profiles:

Traders Who Might Prefer Prop Trading

You might thrive with a funded account if:

- You have trading skills but not enough money to make meaningful returns

- You value structure even if it is externally enforced

- You want to scale quickly

- You are flexible enough to fit your strategy within the constraints of a funding company.

Profile of a Self-Funded Trader

The self-funded path might be better if:

- You can raise sufficient capital to deploy in your trading

- Your edge requires freedom to trade any market, any time

- You can stick to your rules without external enforcement

- Your jurisdiction offers better tax treatment for personal trading

- You want to build your account over years without withdrawals

How do you know where you belong? Ask yourself these questions:

- How much capital can I comfortably risk without affecting my lifestyle?

- Does my strategy work within typical prop firm restrictions?

- How do I respond emotionally to losses?

- Do I prefer short-term income or long-term account growth?

- How important is trading autonomy to my approach?

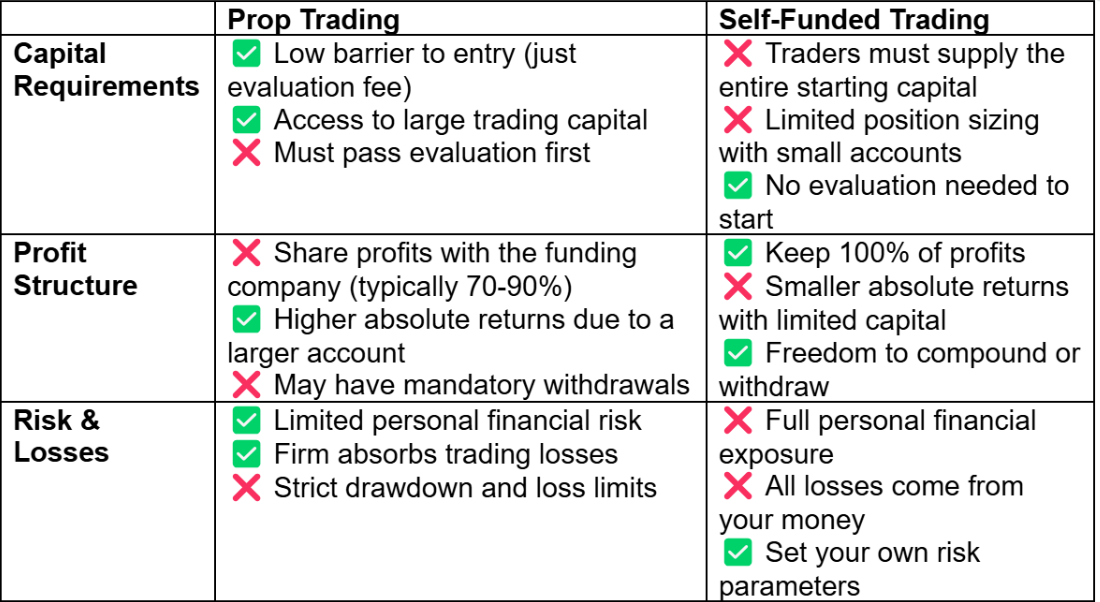

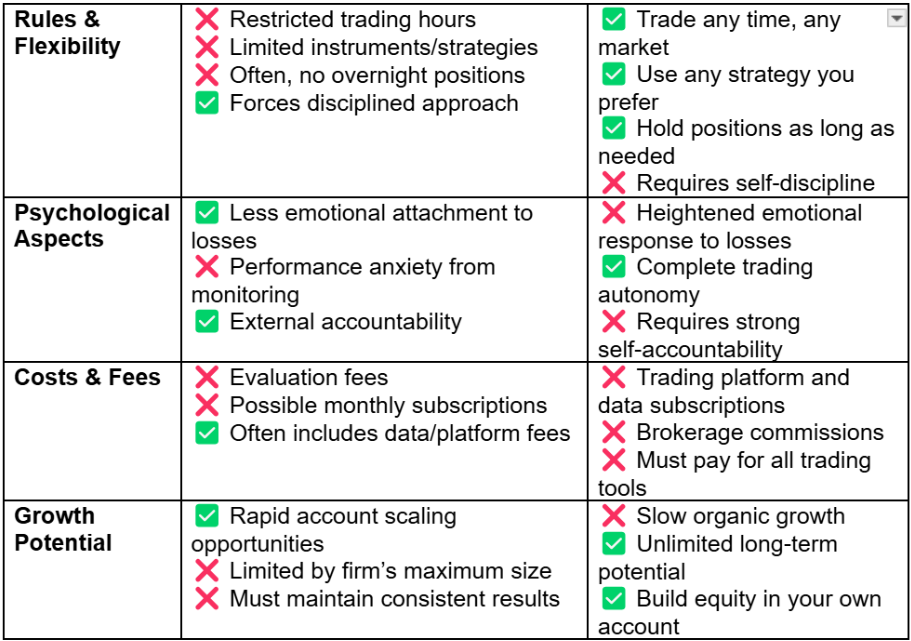

Pros & Cons Quick Reference Table

Tips for Transitioning Between Models

You may have noticed that a personal trading account is very different from a funded account. This is despite there being nothing out of the ordinary when speaking about actual trading. As such, it may not be that easy to switch from one trading model to the other, unless, of course, you get help.

If you’re considering leveraging the earning potential of prop trading, you can:

- Practice with simulation first: Try trading with prop firm rules in a demo account before paying for an evaluation

- Start with smaller challenges: Begin with a modest account size to reduce evaluation costs

- Adjust your risk metrics: Scale back your position sizing to accommodate stricter drawdown limits

- Document your performance: Keep detailed records that show your ability to stay within typical prop firm parameters

If, however, you feel the time is ripe for you to enjoy the freedom that comes with being self-funded, you can:

- Build capital gradually: Save a portion of your prop trading profits until you have sufficient personal capital

- Maintain discipline: Keep following the prop firm’s risk management rules with your own money

- Start smaller than your funded account: Trade a fraction of the size you’re used to until you adjust

- Create accountability systems: Find ways to replace the external oversight you’ve become accustomed to

You may also continue to operate a funded account while running a personal account. This approach diversifies your risk and increases the scope of income growth. However, be cautious about your capacity to juggle multiple trading accounts. To avoid spreading yourself too thin:

- Be realistic about your attention capacity

- Don’t double your risk exposure: If trading similar strategies in both accounts, consider your total position size across all accounts

- Maintain separate tracking: Keep detailed records for each account to understand performance differences

Bottom Line

The choice between prop trading and self-funding isn’t just about money—it’s about finding the trading environment that brings out your best performance.

Throughout this discussion, we’ve explored how these two approaches differ in fundamental ways. Prop trading offers access to substantial capital without requiring a large personal investment, but it comes with profit-sharing and several restrictions. Self-funding, on the other hand, gives you complete autonomy and lets you keep all your profits, but it demands significant personal capital and robust self-discipline.

We’ve also seen how these approaches create different psychological environments. In prop trading, you must learn to cope with external accountability. Although this arrangement forces beneficial discipline, it might create performance anxiety. In contrast, self-funding offers complete freedom but requires facing the emotional challenge of risking your money.

That brings us to what to consider when choosing which direction to go. Some critical factors include:

- The available capital and your risk tolerance

- Your preferred trading style. Do you thrive with structure or flexibility?

- If you prefer immediate income or long-term account building

If prop trading appeals to you:

- Research reputable firms with fair evaluation criteria

- Practice trading within typical prop firm parameters

- Prepare for the psychological shift of trading someone else’s money

If self-funding feels right:

- Develop a detailed trading plan with clear risk parameters

- Set up proper monitoring systems for accountability

- Consider working with a mentor for objective feedback