Prop Firm Instant Funding vs. Evaluation

Prop firm money is sweet; if you pass the evaluation, you get a refund. But passing an evaluation can be challenging, especially when you are not prepared. Then again, some prop firms do not take traders through tests; they just give them real money and head straight to the market.

Let’s step back for a moment and consider what is happening here. Prop firms offer two main approaches to getting funded. Some give you the funds immediately after you sign up and pay the required fee. This is instant trader funding. Others, and these are the majority, require you to demonstrate that you can actually take positions in the market and turn up a profit. Also, they want to make sure that you can follow their rules. The path you choose defines your experience as a funded trader, so you must choose well. Choose poorly, and you might waste time and money on a program that doesn’t match your trading style or goals.

To a large extent, this guide is an attempt to help you make the right choice. We’ll compare these two approaches and help you figure out which might be better for your specific situation and trading style. We’ll look at the key differences that really matter:

How quickly you can access capital

- What fees you’ll pay upfront and ongoing

- The level of risk to both you and the prop firm

- How profits get split once you’re making money

- If you’re ready, then let’s begin from the very bottom: the basics.

What Is Instant Funding in Prop Trading?

Instant funding describes the approach where a proprietary trading firm (prop firm) provides capital to a trader immediately after signup. The trader doesn’t have to take any test. Pay the fee today and trade tomorrow. It’s that simple.

Like any other trader funding program, instant funding is not the same across the industry. You’ll find different companies doing it in a way that doesn’t align with others. Nevertheless, most programs work like this:

- You pay a higher upfront fee compared to evaluation programs

- The firm gives you access to trading capital right away

- You trade under their specific risk management rules

- You start earning profit splits once you meet the minimum requirements

The fees are steeper because the prop firm takes on more risk. They’re handing you serious capital without first checking if you can trade profitably or follow their rules. It’s a leap of faith for them, and the higher fee compensates for that unknown.

Some traders find the higher cost worth it. Why spend weeks trying to pass a challenge when you could simply pay to start trading sooner? If you already know how to operate a funded account and have the money to pay for a place, instant funding might make perfect sense.

But there is an important distinction to understand: some instant funding accounts are true live accounts, while others provide what prop firms call “demo-live” environments. The difference matters when it comes to execution quality and withdrawal expectations. Always check whether you’re trading actual market conditions or a simulation.

Many instant funding programs also use subscription models. Instead of paying the sign-on fee once, you might pay monthly to maintain access to capital. This arrangement changes the cost calculation in this situation. The bottom line is that instant funding is about speed and convenience, but that comes at a price.

What Is an Evaluation / Challenge Model?

This model is the more common approach in funded trader programs. Here, the trader must prove their skills by passing one or two evaluation phases before accessing a funded account. Prop firms that apply this model often want to ensure that they give trading capital only to traders who are profitable and disciplined.

Most evaluation challenges follow this structure:

- Trade a simulated account with virtual money

- Hit specific profit targets

- Stay within set drawdown limits

- Follow all trading rules and restrictions

- Successfully pass to earn a funded account

We’ve covered evaluation models extensively in a previous article Funded Trader Evaluations and Challenges, but here’s the quick version: funding companies offer either one-step or two-step evaluation processes.

One-step challenges require you to hit set targets in a single phase. On the other hand, two-step evaluations include an initial challenge followed by a verification phase. The latter is much more rigorous and provides a more comprehensive evaluation of a trader’s skills and consistency.

The evaluation approach offers some clear benefits for both the trader and the funding company. For starters, entry fees are usually lower, which means a lower barrier to entry for traders. And if you pass, many firms refund part or all of the evaluation fee. Plus, successfully passing a challenge proves something to yourself – that you have the skills and discipline to trade profitably. On the firm’s part, they give out money knowing that the trader is qualified to protect the funds.

But there’s the catch – passing isn’t easy. Many traders spend months (and multiple fee payments) trying to pass evaluations. Also, the wait to start trading real money can be frustrating, especially when you keep falling just short of targets or accidentally breaking a rule.

Capital Access & Account Sizes

The amount of money you get for trading depends on the funding model that a prop firm uses. It’s not just about the amount but also how quickly you can start trading and scale up.

Initial Account Sizes

Instant funding programs typically start smaller. Most offer accounts ranging from $2,000 to $50,000 when you first sign up. This makes sense – they’re taking a risk on an unproven trader, so they limit their exposure.

On the contrary, most evaluation programs often offer larger starting accounts. You’ll commonly see account sizes of $100,000, $200,000, or even higher. Of course, prop firms that follow the evaluation approach have an idea about what you can do. That is why they can even trust traders with even a seven-figure capital.

Scaling Possibilities

The beauty of proving your skills before getting funded is that the prop firm often provides generous scaling options. Many prop firms double your account size without additional fees if you trade profitably for a consistent period. Some traders who start with as low as $50,000 can scale to $1 million or more through consistent performance.

However, the same can’t be said for the instant funding model. Although some firms may let you grow your account if you perform well, the options are usually limited. Also, you might need to pay additional fees to upgrade your account size or meet stricter performance metrics to qualify for scaling.

Capital Access Timeline

The timeline difference is straightforward:

- Instant funding: Capital access within 24-48 hours

- Evaluation model: You have to pass a challenge first, which takes time (days or weeks).

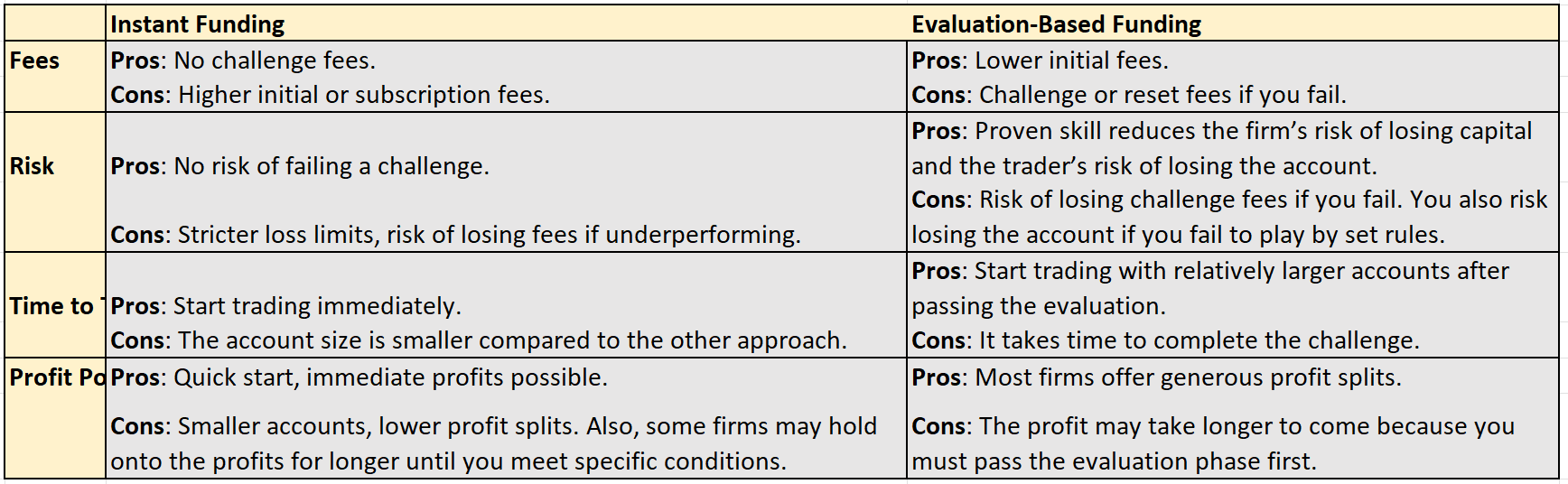

Costs & Fees

Regardless of the route you choose to enter the funded trading space, you must give up money one way or another. We saw earlier that the instant funding approach has higher upfront costs, but how does this compare to the alternative? The table below provides a detailed breakdown:

| Instant Funding | Evaluation-Based | |

|---|---|---|

| Initial Fees | Higher initial fees (one-time or monthly) because you skip the challenge. | Often lower initial fees, but you pay challenge fees to participate in the evaluation. |

| Ongoing Fees | Possible subscription fees to maintain access to the funded account. | Often no subscription fees, but reset fees may apply if you fail and need to restart. |

| Profit Splits | Possibly smaller profit splits to offset the firm’s higher initial risk. | Typically higher profit splits once you pass the challenge. |

| Risks | Higher upfront cost, but no risk of losing fees due to failing a challenge. | Risk of losing challenge or reset fees if you fail, though initial costs are lower. |

Risk & Drawdown Rules

Prop firms subject traders to specific rules to protect their money. However, these rules apply differently depending on the funding approach.

Daily Loss Limits

The daily loss limit is one of prop firms’ most used risk management tools. It defines the maximum amount of money the firm can allow the trader to lose in a single trading day. The limit is like a safety net to prevent traders from incurring catastrophic losses.

Prop firms that support instant funding programs typically enforce tighter daily loss restrictions. When you haven’t proven yourself through an evaluation, companies compensate by giving you less room for error. For example, you may find that an instant account caps daily losses at 3-4% of account value while evaluation-based ones allow 5-6%.

This might not seem like a big difference, but it adds up. On a $50,000 account, a 4% daily limit means you can only lose $2,000 in a day before getting locked out. That same account, after passing an evaluation, might allow $2,500-$3,000 in daily losses.

Maximum Drawdown Thresholds

The overall account drawdown limits tell a similar story. An instantly funded account may set a maximum drawdown at 6-8% of starting capital. Miss this threshold, and your account is closed without any second chance.

On the contrary, an evaluation-based account slackens the rope a little. It typically allows 8-10% maximum drawdowns. Some even offer “trailing drawdowns” that protect your profits while giving more breathing room.

Why the difference? It’s simple risk management. Prop firms have seen you handle drawdowns properly if you’ve passed their evaluation. With instant funding, you’re an unknown quantity.

The scenarios we’ve described above are mere generalizations. As such, you must always check the exact risk parameters for any program you’re considering. Some instant funding programs compensate for higher fees by offering more flexible trading conditions, while some evaluation programs maintain strict rules even after you’ve proven yourself.

Profit Splits & Payout Structures

We know that funded traders earn via profit splits. If this information sounds unfamiliar to you, you will find our previous article How Do Funded Trader Accounts Work on this subject very helpful. It helps to know that the funding approach a prop firm adopts will affect how it splits the profits.

Typical Profit Sharing Arrangements

We explained earlier that instant funding programs often come with lower profit splits. And the primary reason is that the company doesn’t really know you and would want to recoup as much of their money as they can before the worst happens. In other words, the firm in this arrangement takes on more risk and wants more reward. That’s why you’ll find that the trader in this arrangement may keep as low as 50% of the profits.

However, evaluation-based funded accounts typically offer more generous splits. Many start at 70% and can go up to 90% for consistently profitable traders. The higher profit-sharing arrangement is because you’ve already shown you can make money, so the funding company is more willing to share the rewards.

Payout Timing and Requirements

Again, because the prop firm has limited knowledge of you as a trader in instant funding programs, you may have to wait longer before your first withdrawal. For example, a company may say that you can’t withdraw until your balance hits a specific sum. Others may demand that you trade for at least 30 days before requesting profits, or maintain consistent performance without major drawdowns.

Of course, many of these conditions are integrated into challenges for evaluation-based accounts. That’s why when you start trading with real money, most (if not all) prop firms allow quicker access to your earnings.

Psychological Considerations

Trading requires that you are at the top of your game in terms of mental clarity. That’s why some traders find this activity mentally draining. And trading psychology plays a major role in your success regardless of which funding model you choose.

Evaluation Creates More Pressure

Evaluation is one of the most psychologically draining activities. As we have covered in a previous article Evaluations and Challenges, prop firms use this phase to push all the buttons and evaluate how you navigate the challenges. For example, the firms will set profit targets and drawdown limits for every trade you make. This environment often leads to:

- Second-guessing valid trading setups

- Exiting profitable trades too early out of fear

- Hesitating when clear opportunities arise

- Overthinking simple decisions

Performance anxiety doesn’t just feel uncomfortable—it can fundamentally alter your trading behavior. Traders who perform well with self-funded accounts may struggle when required to hit specific targets while being monitored. You can read more about these psychological factors in our previous post Psychology of Funded Trading.

The Freedom (and Risk) of Instant Funding

Skipping straight to a funded account feels liberating. There’s no artificial profit target hanging over you. No 30-day deadline ticking away. You can just... trade.

This reduced anxiety can help some traders perform more naturally. You’re not making decisions based on “Will this help me pass?” but rather “Is this a good trade?”

On the flip side, jumping straight to funded trading could be detrimental because it means you miss developing discipline. The challenge phase is like trader boot camp—it forces proper position sizing, strict risk management, and emotional control that many traders wouldn’t impose on themselves.

Time to Live Trading

Most traders want to lay their hands on a prop firm’s deep pockets as soon as possible. That’s why many may opt for the instant funding model regardless of the high upfront costs. But, as we have noted many times previously, skipping evaluations has its downsides.

Instant funding, as the name suggests, allows traders to start leveraging real money almost immediately. Impatient traders will like this approach. However, it helps to note that this approach may work only for those capable of fitting into a new environment quickly and without preparation.

On the contrary, the evaluation route requires patience. And this timeline may become even longer if the funded trader program requires prospective hires to undergo a two-step evaluation process. Add to that the possibility of failing in the first few attempts, and you have a trader who may have to wait for months before they can trade with real capital.

Of course, the waiting game affects more than just your calendar. The prolonged evaluation process tests your patience and discipline. Some traders rush their challenge, taking excessive risks to speed things up—often leading to failure.

Meanwhile, instant funding lets you develop your strategy at a natural pace without artificial deadlines. You can focus on consistent growth rather than hitting specific targets within a limited timeframe.

Long-Term Growth & Scaling

You fight for a funded account knowing that with time, the prop firm will increase the size of the trading capital. Both funding models offer pathways to larger capital, but they work quite differently.

Most, if not all, evaluation-based funded accounts have clear scaling programs. All you need to do is prove that you can consistently reach targets without breaking a rule. For instance, a firm could specify that anyone who trades profitably for 3-4 months and maintains a maximum 5% drawdown may receive double the initial account size. This can happen several times over the duration of the relationship.

Scaling with instant funding programs tends to be more restrictive. Unlike the evaluation-based pathway, this approach may require traders to pay for larger account sizes (essentially buying your way up). Other firms may require traders to meet extremely strict performance metrics or maintain perfect consistency for longer periods. Some instant funding firms don’t offer meaningful scaling at all.

Obviously, the scaling difference significantly affects your long-term earning outlook. For example, consider a trader starting with a $25,000 instant-funded account. This individual might still be trading that same size a year later. Meanwhile, someone who started with a $25,000 account after passing an evaluation could be managing $200,000+ in the same timeframe if they’ve followed the scaling program.

With profit splits typically between 70% and 90%, that capital difference translates directly to your bottom line. Trading the same percentage return, the scaled account earns 8x more than the stationary one.

Common Trader Profiles: Who Should Choose Which?

Instant Funding

You know you should choose this funding model if you fit the following profile:

- You want to trade immediately without evaluations

- You are okay with smaller account sizes

- You’re willing to pay upfront for speed.

- You have a proven track record in the market

How do you find out such details about yourself? Ask yourself the following questions:

- Do I need to start trading with real capital right now?

- Am I comfortable paying a higher fee for immediate access?

- Is my trading style already proven profitable?

Evaluation-Based Funding

If that profile doesn’t look like somewhere you’re comfortable, perhaps this other one could fit. Evaluation-based funding is ideal for:

- Patient strategists: Willing to grind through a challenge for bigger rewards.

- Long-term growth seekers: Aim for $100k+ accounts and scaling to seven figures.

- Cost-conscious traders: Prefer lower upfront fees (but accept reset costs if they fail).

- Disciplined risk managers: Can stick to rules under pressure.

Questions to ask yourself:

- Am I patient and disciplined enough to pass a multi-stage evaluation?

- Am I willing to invest time to prove my skills for access to larger capital?

- Is long-term growth and better profit split my primary goal?

- Am I confident in my ability to hit profit targets without breaking rules?

Potential Hybrid or Bridging Approaches

The trader funding industry hasn’t been around for long, but even in that short period, a lot of evolution has taken place. One of the major developments in the recent past is the rise of prop firms that blend the elements of instant and evaluation models. The goal is to offer flexibility and tap traders who may prefer a hybrid funding approach.

If you get such an opportunity, you can leverage the elements to start trading sooner and still be able to scale the account substantially in the future. For instance, you could begin with a small instant-funded account. Use this opportunity to prove your suitability and then graduate to larger evaluation-based programs with better terms.

This approach gives you the best of both worlds—immediate access to capital plus a pathway to larger accounts typically reserved for evaluation graduates. For example, you might pay for instant access to a $10,000 account. After demonstrating consistent performance for 2-3 months, the firm might offer you a fast-tracked evaluation for a $100,000 account.

Most importantly, always verify the specifics of these hybrid approaches. Some firms advertise “instant” funding that actually comes with mini-challenges or probation periods. Others promote “no evaluation” but impose such strict initial rules that they function similarly to challenges.

Pros & Cons Quick Reference Table

Conclusion & Final Thoughts

Instantly funded trader accounts and those that require traders to pass an evaluation phase may seem so different, but this boils down to a few trade-offs. Instant funding offers immediate access to capital but comes with higher fees and possibly stricter rules. On the other hand, evaluation-based models delay your start but potentially reward you with better terms, larger accounts, and clearer scaling options.

Your ideal choice depends on three key factors:

- First, consider your financial situation. Can you afford the higher upfront costs of instant funding? Or would you rather pay less initially, even if it means risking reset fees if you fail an evaluation?

- Second, be honest about your trading experience. Seasoned traders may benefit from skipping straight to funded accounts. The less experienced might actually need the discipline that evaluations build.

- Finally, assess your risk tolerance. Some traders thrive under the pressure of strict drawdown limits, while others need more breathing room to execute their strategy effectively.

There’s no universal “best” option here. The right choice is the one that aligns with your specific circumstances, goals, and trading personality. Think about which approach makes the most sense for your unique situation rather than what works for someone else.