Funded Trader Evaluations and Challenges

Many traders want to work with proprietary trading firms because of the liquidity they provide. Prop trading firms, too, want to work with gifted traders who will grow their capital. But before they give out a trading account, the prop firms take traders through a series of evaluations and challenges.

These assessments are essential because they allow the funding company to determine if you are the right fit for their risk management profile. Traders, too, have a lot to gain from the tests. They can demonstrate their skills and implement the techniques they have learned over time. So, anyone with the right skills can attempt these evaluations and, hopefully, earn a funded account.

But trader appraisal isn’t all there is to the evaluations and challenges. The tests assess your discipline, emotional control, and ability to follow rules. Some traders may discover they have solid techniques for setting up positions but struggle with emotional control. So, the challenges are one way for traders to learn more about themselves. Others find that the evaluation process itself improves their trading by forcing them to develop better risk management habits.

The point is that funded trader evaluations and challenges reveal much when you get under the surface. However, many traders often remain stuck at only thinking of them as the hoops prop firms erect to find the right trader. This could be right, but only to some extent. That is why this article’s main objective is to explore every aspect of funded trader evaluations. It will take you through the evaluation model, common evaluation rules and requirements, discuss the passing criteria, and much more. So, read on.

Introduction to the Evaluation Model

For a start, we need to clarify one thing: funded trader programs provide capital to traders, but the trader must first pass specific tests or evaluations. Although most prop firms claim to have unique evaluation models, they rely on a standardized structure.

The Purpose Behind Funded Challenges

Funded trader evaluations are a filtering mechanism for prop trading firms. They help the companies to identify traders who can generate consistent profits while respecting risk management rules. If becoming a funded trader was a regular job, the challenges would be similar to job interviews. But, instead of telling the firm how good you are at trading, you demonstrate your abilities in real time.

The funding companies design the tests to simulate actual trading conditions. They have several hoops that you must clear to demonstrate their suitability. For example, can you handle different market scenarios, manage risk, and deal with the psychological pressure of trading significant capital? The evaluation might require you to trade in different market conditions, during which you must register consistent results.

The challenges also test traders’ capability to protect the firm’s funds from potential losses. No one can hand over $100,000 to someone without first verifying their ability to manage it responsibly, right? That’s precisely what prop firms would do without evaluations. In other words, the challenge phase is a low-stakes proving ground.

Also noteworthy is that the evaluations emphasize psychological and strategic discipline over short-term luck. Most, if not all, traders know that trading is inherently volatile. But one is likely to go against this wisdom, especially in the presence of lots of money. The challenges counteract this tendency by imposing rules prioritizing consistency and long-term viability. For example, daily loss limits prevent traders from “revenge trading” after a setback.

Typical Objectives & Metrics

If evaluations and challenges are a filtering system, how does it pick winners from the rest? It uses targets and metrics that traders must achieve or maintain. These aren’t arbitrary numbers – they reflect what funding companies consider essential for successful trading with their capital.

Profit Targets

This is the most obvious metric. This target validates that traders can generate consistent returns, not just sporadic wins. Companies typically set the profit target as a specific percentage of the account balance. So, if you’re trading a $100,000 evaluation account, and the target is 12%, you might need to make $12,000 in profits. But you should know that hitting this target is not all there is to this; the prop trading firm often wants to see how you get there and whether you can maintain returns within a safe range.

Drawdown Limits

Drawdown limits are like the trading account’s safety rails. The metric ensures that traders avoid catastrophic losses and manage risk responsibly. Put simply, drawdown limits enforce risk discipline.

Most firms implement three common types of drawdown limits: daily drawdown (daily loss limit), maximum drawdown, and trailing drawdown. Daily drawdown caps daily losses to prevent emotional “revenge trading” after a bad day. On the other hand, maximum drawdown is a total loss limit: it ensures traders do not blow up the account chasing recovery. Trailing drawdown is when the max loss threshold rises as profits grow. The idea is to prevent complacency after early gains.

Companies may also track consistency metrics like:

- Minimum trading days

- Maximum daily profit (yes, some firms limit how much you can make in a day)

- Average win rate and risk-reward ratios

- Position holding periods

Others have psychological thresholds that stress-test discipline. Such funded trader programs often implement the following rules:

- Rule violations = instant failure: Breaking even one rule (e.g., holding trades overnight if forbidden) leads to disqualification.

- No “second chances”: Many programs ban retries for 30+ days after failure, deterring impulsive re-entry.

Role of Risk Management in Evaluations

All evaluations and challenges are, in a real sense, attempts to determine whether a trader can manage risk effectively. So, risk management is the backbone of funded trader evaluations. It ensures that traders prioritize capital preservation over reckless profit-seeking.

Prop firms embed risk management requirements throughout their evaluation process. For instance, they might require you to maintain a specific risk-reward ratio for each trade. So, if a particular company enforces a 1:2 ratio, it means that if you risk $100 on a trade, your potential profit should be at least $200. This approach ensures you’re not taking unnecessary risks to hit profit targets.

Another crucial component of risk management is position sizing. Most prop trading firms require that traders limit their exposure per trade to a specific percentage of the account balance, often 1-2%. This means anything above $2,000 for a $100,000 account is an unacceptable position size.

Risk management rules are a “stress test” that forms the core of the evaluation process’s filtering system. They filter out gamblers but nurture traders who are eager to play safe. This mechanism ensures funded accounts are entrusted to those who can sustainably grow—not gamble—the firm’s money.

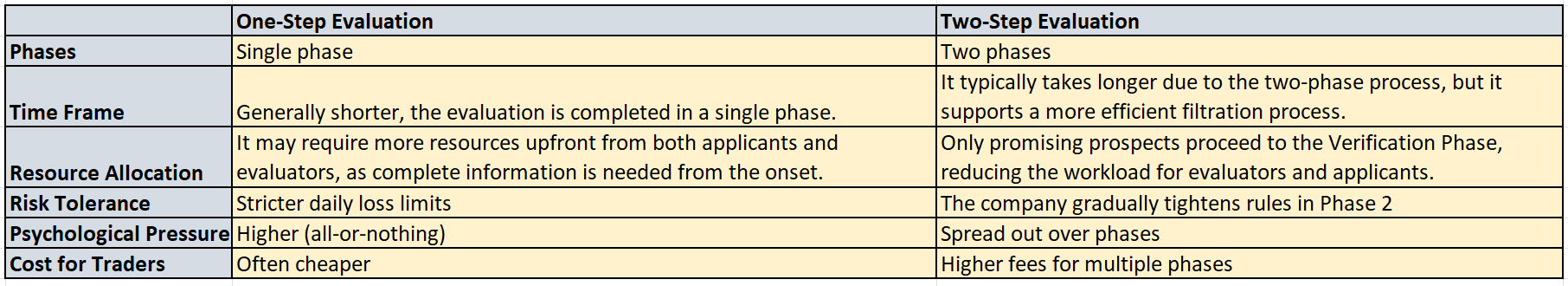

One-Step vs. Two-Step Evaluations

The prop trading industry is more mature today than a few years ago. Accordingly, the evaluation processes have evolved from the simplistic structures of before to more advanced (and simplified) processes. The industry appears to have settled on two main approaches for filtering traders: one-step and two-step evaluations.

Outline of One-Step Challenges

One-step evaluations are exactly what they sound like—you prove your suitability in a single phase. This version is more streamlined but retains the rigor required to ensure only the best proceed to live trading.

In this model, the funding company typically provides a simulated account with a specific balance. The firm sets a period when you must reach the profit target while staying within its risk parameters. You either pass and move straight to a funded account, or you don’t. It’s simple, just like that.

However, to be streamlined does not imply to be an easy challenge. These tests often have stricter profit targets and tighter risk limits. Why? You must work harder to convince the prop trading firm that you are the right pick and do it quickly.

The upside is that you can secure a funded account faster. If the firm charges evaluation fees, most do this, then one-step evaluations may have lower upfront costs. Of course, the short timeframe and tighter rules will subject you to immense psychological strain.

Outline of Two-Step Challenges

Two-step evaluations mean the test will be split into two phases. You can proceed to the second phase only after passing the first one. This approach may appear drawn out but gives traders sufficient time to show why they deserve a funded account.

Each phase comes with its own set of targets and rules. The first phase, often called the Challenge Phase, typically requires you to reach a specific profit threshold while respecting drawdown limits. Once you pass this phase, you move to Verification.

The company provides a fresh trading account for the new phase. Although the rules may be similar, the firm might adjust the targets. For instance, some prop trading firms reduce the profit target in the verification phase to make it more achievable.

It’s easy to guess why a funding company may choose two-step challenges. For a start, this approach provides a better picture of the prospective trader’s trading consistency. Anyone can get lucky and have an excellent trading month. But maintaining disciplined trading through two separate phases? That’s harder to fake.

However, the longer evaluation period means higher upfront costs for traders, especially if the funding program requires evaluation fees. You’ll also need more patience – even if you pass the Challenge Phase quickly, you must start fresh in Verification. Some traders may find this frustrating, especially when they’ve just passed the first phase.

Comparing the Evaluation Approaches

Time Frames, Daily Drawdowns & Consistency Rules

A funding company will take prospective traders through rigorous evaluations to protect their money. That is why “risk mitigation” is a phrase you’ll often hear when in the test phase. This is not to say that the emphasis reduces when you earn the trading account.

Risk mitigation has three pillars: time frames, drawdown limits, and consistency rules.

Time Frames

A prop trading firm will allow you several days to train with a simulated account, and as stated earlier, the period depends on the approach. If the challenge only lasts a single stage, you’ll likely get 30 days to complete the challenge. You might get another 30 days to complete the second stage in two-step challenges. The 30-day timeframe may appear random, but it’s not. In a month, you’ll likely encounter trending markets, sideways markets, and even some volatile periods.

Daily Drawdowns

These rules exist to check your risk-taking appetite. They are like speed limits on a highway that you must obey. Each funding company selects a specific daily drawdown, although the standard figure is 5% of the account balance.

Consistency Rules

One of the reasons trading is challenging is that it is possible to make a considerable profit today only to blow the account tomorrow. Prop firms know this, so they need several days to test your skills. We understand that some may require 60 days to see if you can stay within their consistency thresholds.

A typical firm requires traders to be active at least 10 days a month. This is important because if you can post steady performance a third of the time, you qualify to manage a larger pool of money. Some even monitor your trading patterns. So, if you make 80% of your profits in one day and barely trade the rest of the month, this is a red flag. It doesn’t matter whether or not you jump through all the other hoops.

Common Evaluation Rules and Requirements

What is the point of a test if participants don’t have to play within certain bounds? Rules are the guardrails that make the filtering mechanism effective. Of course, each firm may have specific requirements, but they have few, if any, differences in substance. Some of the common rules every evaluation has include:

Typical Profit Targets

We learned earlier that profit targets allow a firm to determine whether you fit the profile of the kind of trader they want. Although this varies greatly, most prop trading firms set profit targets between 8% and 10% of the account balance. It sounds uncomplicated, but it is not for all funded trader programs.

Some firms may mandate that you hit this target anytime during the evaluation process. Others may be in favor of you doing it through steady progress. So, it might be easy to hit 10%, but can you do it within a specific number of hours or days? This is what makes funded trading a whole different game.

Maximum Drawdown Thresholds

Drawdown is the decline in your account’s balance from its highest point to the lowest point before it recovers. Therefore, a drawdown limit is a preset threshold beyond which the decline is not allowed. Put simply, this is the maximum allowable loss from your account’s peak value.

Most firms set two types: maximum drawdown (usually 10%) and daily drawdown (typically 4-5%). But these limits often include floating losses. You might be down $3,500 for the day, feeling safe under your $4,000 limit, but if your open position shows another $600 loss, you’ve just failed the challenge. That’s why experienced traders often close their day well before hitting these limits.

Minimum Trading Days & Consistency Rules

Hitting profit targets and managing risk effectively is excellent. But can you do this for most of the days you are active in the market? Consistency is supreme. If you’ve ever wondered why a firm will tell you that you must trade for at least a specific number of days? They ask that during this period, you must satisfy the evaluation guidelines most of the time.

The objective is to see if you can maintain discipline over an extended period. These consistency rules ensure that the trader is not only capable of making money, but they can do so reliably.

Permitted Trading Instruments & Strategies

Each firm specifies which assets can be part of your portfolio. This rule ensures that traders avoid instruments that may be too volatile for the prop firm’s liking, even though their return potential is high. It is the same as the trading strategies you can deploy. The firm will restrict some strategies if they deem them too speculative.

Common restrictions include:

- No trading during major news events

- Limited or no overnight positions

- Specific trading hours (usually following main market sessions)

- Restrictions on correlated pairs

Passing Criteria & Reasons Traders Fail

Traders enroll in funded trader programs to win a trading account. Yet, not all achieve this goal. Some make money, all right, but fail to pass the evaluation because they do not follow the rules. If this tells you anything, it is that prop firms have specific passing criteria, which is, “Make profitable trades but do not break our rules.”

What pitfalls may deny you the chance to operate a funded account?

Emotional Pitfalls

Your emotions are the biggest enemy. Have you ever lost a trade and immediately felt you needed to get the money back? That’s revenge trading, and it’s a challenge-killer. Many traders blow past their daily limits, trying to recover one bad trade.

Overtrading is another emotional trap. Some traders feel pressured to hit profit targets quickly, so they take every setup that looks remotely promising. It is common for traders to admit that they failed evaluations because they traded too much. But everything changes when they learn to wait for perfect setups.

Account Violations & How to Prevent Them

Every time you break a rule, you violate the account. This happens mostly when the rules aren’t entirely clear to you, or you have just chosen to operate outside them. Some common violations include:

- Trading outside permitted hours

- Exceeding position size limits

- Missing minimum trading days

- Holding positions during restricted news events

Fortunately, you can prevent this. For a start, create a checklist. Before every trade, verify that you’re within all limits. You can keep a sticky note on your monitor with “Size? Time? News?” written on it. Yes, this is simplistic, but is it effective? Yes.

Meeting Profit Targets vs. Exceeding Risk Limits

If there is a message that emerges strongly from our discussion so far, it is that prop trading firms care more about how you manage risk than how quickly you hit profit targets. You might be just $100 away from your profit target, but you fail if you break a risk rule trying to get there. Period.

The strictness makes sense when you think about it. In a non-simulated funded trading environment, firms can help you become more profitable, but they can’t teach discipline. That’s why they prioritize seeing traders who:

- Consistently stay within risk parameters

- Take measured trades rather than gambling

- Show steady progress toward profit targets

- Maintain emotional control during drawdowns

Strategies & Tactics for Success

You pass evaluation tests not because you have superior trading skills. Instead, how you approach the challenges – the strategy and tactics you deploy – wins the race. Let’s discuss some of the tactics you may find helpful:

Adapting Your Strategy to Challenge Rules

Every trader funding program implements challenges with unique rules. From the outset, some of the requirements might not match your usual trading style. Perhaps you love holding positions overnight, but the evaluation prohibits it. Or maybe you trade multiple correlated pairs, but the rules restrict this.

What to do? Adapt without compromising your principles and edge. You may want to:

- Test the prop trading firm’s modified strategy on a demo account first

- Scale down position sizes to accommodate stricter risk limits

- Adjust trading hours to match challenge requirements

- Document how each rule affects your usual approach

Technical & Fundamental Analysis Approaches

Trading strategy is a broad concept that encompasses aspects like market analysis. Normally, traders focus on either price action (technical) or economic trends (fundamentals). Some choose to rely solely on technical analysis, while others may only focus on fundamental analysis.

The best approach combines both approaches to market analysis but with a twist. When tackling the evaluations, focus on setups that align with both:

- Clear technical patterns that offer defined entry and exit points

- Major support and resistance levels

- Trend-following opportunities that reduce overnight exposure

- Fundamental events that don’t break news trading rules

Position Sizing & Risk/Reward Considerations

The amount of money you decide to invest in a particular trade can make or break your challenge attempt. By the way, deciding how much to dedicate to a particular trade is what traders call position sizing. It is a key part of managing risk and potential returns.

Be careful when determining the size of each trade. But how?

- Start with smaller positions to build confidence

- Increase size gradually as they prove consistency

- Keep position sizes relative to account balance

- Never risk more than 1% per trade, even if rules allow more

Trade Journaling & Performance Reviews

Trade journaling refers to keeping a detailed record of each trade you make. You may note down the reasons for entering the trade, the strategy used, the outcome, and your emotions during the process. The journal allows you to review decisions, identify behavioral patterns, and learn from successes and mistakes.

In fact, journaling is what makes performance reviews possible. Performance reviews are regular evaluations where traders analyze their overall trading activities over a specific period. This involves assessing win rates, average profits or losses, and risk management effectiveness. Conducting these reviews allows traders to gauge their progress, identify improvement areas, and adjust their strategies to increase the chances of passing evaluations.

Fees, Refund Policies, and Additional Costs

Earning a funded account isn’t free. Prop trading firms charge various fees throughout the evaluation process. Understanding these costs is an essential part of preparing to pass the challenges.

Challenge Fees & Subscription Models

Most prop firms charge an upfront fee to attempt a challenge. These evaluation fees may vary greatly but are within a specific range, depending on the company’s policy and account sizes.

Prop trading firms use two main pricing models:

- One-time challenge fee: You pay once to attempt the evaluation.

- Subscription-based model: You pay a monthly fee to keep attempting the tests.

- Hybrid model: Combines both one-time and subscription elements.

Refund Policies Upon Passing or Failing

Each funding company has a unique funding policy. So, it helps to read the terms and conditions keenly before taking up any offer. For example, some prop trading firms return the evaluation fee when you pass, while others consider it a cost of entry.

You should know that:

- Some firms return 100% of your fee upon passing

- Others might return a percentage of the fee

- Many keep the fee regardless of the outcome

- A few firms return fees based on trading performance

Potential Hidden Costs

Challenge fees aren’t the only costs you’ll encounter. Additional expenses might include:

- Trading platform fees

- Real-time market data subscriptions

- Educational resources or required training

- Account maintenance fees

- Payment processing charges

Some firms include these costs in their evaluation fee, but others may charge them separately. Again, please read the terms carefully to understand the total investment required.

Reset or Retake Fees

Did you fail your first attempt? Most firms allow more than one attempt—of course, for a price. This price is what traders call reset/retake fees. The fees can work in several ways:

- You pay the entire challenge fee again

- You pay a reduced fee for subsequent attempts

- You buy multiple attempts at a discounted rate

- Or you wait for a specific period before retrying

These costs add up quickly if you keep failing the tests. Failed attempts with multiple resets could significantly increase the total investment. That’s why you should prepare adequately before signing up for the first challenge. You will save a lot.

Psychological Considerations & Mindset

Trading is a mentally draining activity. Funded traders face even more intense pressure because prop trading firms always breathe down their necks. This pressure can generate fear. However, traders may also feel greedy in the face of a large pool of money or overconfident when they ace the initial stages of the evaluation.

The point is that traders must develop a disciplined mindset no matter the situation. This helps them stick to their strategies and achieve consistency.

Managing Evaluation Anxiety

Evaluation anxiety is normal. It is the same feeling you have when showing up for a job interview. One might say that the stress you feel when taking funded trading tests is more intense because every move you make is monitored, and you are under pressure to adhere to strict rules. This is true.

But how do you know that you have evaluation anxiety? Some common symptoms include:

- Hesitation to take valid trading setups

- Over-analyzing simple decisions

- Fear of breaking the rules accidentally

- Constant checking of account metrics

You can easily manage the anxiety. Just practice patience, adapt your strategies to the firm’s rules, and exercise resilience in the face of market fluctuations.

Discipline & Emotional Control

Discipline in funded trading has two sides. One involves adhering strictly to your trading plan, and the other involves playing by the rules of the funding company.

Good discipline includes:

- Sticking to predefined entry and exit points

- Following position sizing rules strictly

- Trading only during allowed hours

- Maintaining consistent risk levels

Emotional control has a lot in common with evaluation anxiety. It is all about managing fear, greed, and overconfidence. For instance, fear might prevent you from entering a promising trade. On the contrary, greed could lead to excessive risk. So, maintaining emotional control ensures that your decisions are based on logic and strategy rather than emotional reactions.

Together, discipline and emotional control help traders stick to their strategies, manage risks effectively, and make rational decisions. All of these are central to passing evaluations and challenges.

Handling Losses & Drawdowns

Losses hit differently when attempting trader funding evaluations. A normal loss might frustrate you, but a loss during tests brings you closer to failure. So, you should have a mechanism to manage this scenario. You could:

- Accept losses as part of trading

- Avoid revenge trades after losses

- Track distance from drawdown limits

- Take breaks after significant losses

Balancing Confidence vs. Overconfidence

You need confidence to believe you can manage a prop trading firm’s capital in a risky industry. But things could start going downhill if you get so carried away that you forget that confidence should have limits.

In other words, the line between confidence and overconfidence is thin in trading. Confidence helps you take valid trades; overconfidence leads to rule breaks. You can play the middle using these tactics:

- Trusting your strategy

- Knowing when to step back

- Respecting challenge rules always

- Maintaining realistic expectations

For more detail, please check out our page

Trading Psychology.

Next Steps and Practical Tips

Anyone can pass funded trading evaluations, but this requires proper planning and execution. We have seen that you need discipline when setting up and managing positions and must learn to balance confidence and overconfidence. Most importantly, you must learn to accept that trades can lose money.

But you will need more than that to guarantee a funded trading account. Other considerations and steps you should take include:

Choosing the Right Funded Program Based on Personal Style

Not all funded trader programs suit your trading approach. The key is finding one that aligns with your trading style. Consider factors like:

- Trading hours that match your schedule

- Instruments you understand well

- Risk parameters that fit your strategy

- Challenge duration that suits your trading pace

- Fee structure you can afford

Additional Resources

Knowledge allows you to make better trading decisions. The most appropriate funded trader program should provide resources to help you succeed. These include:

- Trading education platforms

- Strategy guides and tutorials

- Community forums for peer support

- One-on-one mentorship options

- Regular webinars and workshops

Checking Platform Features & Community Support

If you don’t already know, most prop trading firms approve the platforms their funded traders can use. The right trading platform is critical to your success. So, ensure that the recommended platforms are tools you are familiar with.

Sometimes, the suggested platforms are not what you’re used to. The good news is that most of these tools are easy to learn. Give them a few weeks of intense practice, and you’ll be ready. Just ensure they have:

- User-friendly trading interface

- Reliable execution speeds

- Clear reporting tools

- Responsive customer support

- Active trader community

You may consider another trader funding program if none of these features are available.

Final Reminders on Risk Management & Expectations

The overarching theme throughout this discussion is that working with a prop trading firm requires a solid grasp of risk management and setting realistic expectations. In this regard, the following insights might be helpful:

1. Adhere to Risk Management Protocols

Prop firms have stringent risk management rules. So, it is crucial to understand and comply with these guidelines to maintain your standing within the firm. Ensure you adhere to position size limits, daily loss limits, and other risk parameters.

2. Set Realistic Profit Expectations

It is very much possible to generate substantial profits with a funded account. In fact, this is why many individual traders jostle for the opportunity to work with prop firms. Nonetheless, it helps to set achievable goals. Recognize that consistent, modest gains are more sustainable than aiming for unrealistic returns. Most importantly, understand that profitability varies based on skill, market conditions, and account size. This will help you maintain a balanced perspective.

3. Learn Continuously and Focus on Adaptation

The trading environment is constantly changing. As such, you should commit to ongoing education and be prepared to adjust your strategies in response to evolving market conditions.

Earning a funded account isn’t the end goal but the beginning of your professional trading journey. Take time to prepare, choose the right program, and maintain disciplined trading habits throughout the process.