Take Profit Trader Review for 2025

Last Updated: August 29, 2025

Author: Day Trading Insights Research Team

Editorial Note: Although we are committed to strict Editorial Integrity, this post could contain references to products made by our partners. This is how we make money. According to our Disclaimer, none of the information or data on this web page constitutes investment advice. Learn more about our affiliate policies and how we get paid.

Take Profit Trader

- Can get paid on day one of having a PRO account

- One-step evaluation process

- 90/10 profit, EOD drawdown, no buffer reqs with PRO+ upgrade

- 24/7 Live Support

Rating:

🌕🌕🌕🌕🌖 (4.4/5.0)

What is Take Profit Trader?

Take Profit Trader (TPT) is a U.S.-based proprietary trading firm (founded in 2021 by James Sixsmith in Orlando, Florida) that specializes in funding futures traders. Unlike a traditional broker, TPT provides a one-step evaluation program where aspiring day traders prove their skills on a simulated account (“Test”) to earn a funded trading account. The firm prides itself on a no-nonsense, streamlined process, advertising that successful traders can withdraw profits from the day they open their funded “PRO” account. In other words, TPT aims to let you “trade our capital, not your own,” offering a potential path to trade larger account sizes without risking personal funds.

Founded by a former professional athlete turned trader, TPT positions itself as a

transparent and trader-friendly platform. It has quickly gained popularity in the

prop trading community – as of 2025, TPT has an “Excellent” reputation on

Trustpilot (around

4.4★/5 from thousands of reviews). Many traders are drawn to its

futures-only focus (40+ futures instruments across CME, NYMEX, COMEX, CBOT, etc.) and the promise of

same-day payouts upon funding. However, the program’s

strict risk rules and fees mean it’s not a guaranteed shortcut to riches – the firm’s own data indicated only about

20% of users manage to pass the trading test in a given period. This review will break down TPT’s account offerings, rules, pros and cons, and what real users are saying, to help you decide if it’s the right choice for your trading journey.

How Does Take Profit Trader Work?

Take Profit Trader’s

funding evaluation process can be summarized in three stages: Test → PRO → PRO+. Here’s how it works:

Test (Evaluation Phase)

You start by selecting one of TPT’s five account sizes and paying a monthly subscription fee. The available account options range from $25,000 up to $150,000 in virtual starting capital (see table below for details). You trade in a simulated environment with real-time market data, aiming to hit the profit target without breaking any rules.

The evaluation is

one-step – there is no second phase or extended audition. Notably, TPT imposes

no maximum time limit on the challenge; you can take as long as needed (paying monthly) or pass in as little as

5 trading days (the minimum required). If you reach the profit goal

(+6% on the starting balance) while adhering to the rules (explained below), you “pass” and become a

funded trader.

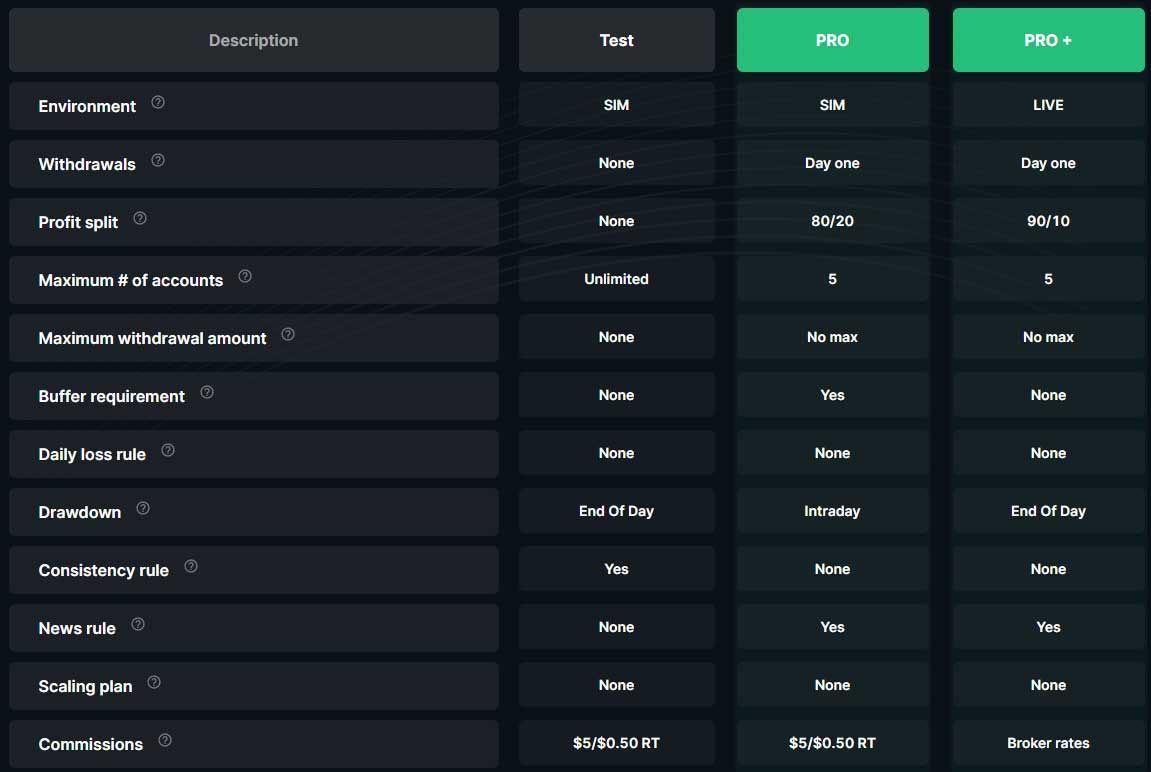

PRO (Funded Account)

After passing, you pay a one-time $130 fee to activate a funded PRO account in TPT’s system. This account still operates on TPT’s internal platform (initially a simulated account with real-time execution), but now any profits you earn are split 80/20 – you keep 80% and TPT takes 20% as the funding provider.

A big selling point is that payouts are available immediately – there’s no lengthy probation or minimum days before you can withdraw your share. However, the PRO account comes with a “buffer” requirement: essentially, your first profits, up to the drawdown amount, must remain in the account as a cushion. (For example, if your account’s max trailing drawdown is $2,000, you need to earn at least $2,000 before you can withdraw any profits, because that $2,000 acts as your safety buffer in the account.)

Once you’ve built up profit beyond the buffer, you can withdraw above that at will – TPT even allows

daily withdrawal requests if you’re in profit and above the buffer zone.

No monthly fees apply in the PRO stage (the evaluation subscription is waived once you’re funded).

PRO+ (Live Account Upgrade)

If you continue to trade successfully, TPT offers an upgrade to PRO+ after certain milestones (notably, earning $5,000 in profits on the PRO account triggers an invitation). The PRO+ account is a live brokerage account with TPT’s capital, featuring a more favorable 90/10 profit split (you keep 90%) and some relaxed rules – for instance, the drawdown is calculated on an end-of-day basis, and there is no buffer retention on withdrawals.

Do note that when you transition to PRO+, TPT “resets” your account balance (often effectively locking in the buffer profit you had accumulated as the cost of going live). In other words, your profit to date (e.g., that first $5k) serves as the capital to fund the live account, so you start PRO+ at a balance of $0 (but with no trailing drawdown eating into that initial profit since it’s now the starting capital).

Throughout each stage, the core idea is that

TPT bears the trading risk beyond the defined drawdown limits. If you lose beyond the allowed drawdown, you fail the account; however, your personal loss is limited to the fees you’ve paid (monthly fees, reset fees, etc.). This model appeals to traders who are undercapitalized or prefer not to risk their own money, as long as they can navigate the firm’s rules.

Account Options and Pricing

Before diving into the rules, let’s look at the

account options you can choose in the evaluation. TPT offers five tiers of starting balance, each with its corresponding profit target and fee structure:

| Account Size | Profit Target | Max Traildown | Max Contracts | Monthly Fee |

|---|---|---|---|---|

| $25000 | $1500 | $1500 | 3 (30 micros) | $150 |

| $50000 | $3000 | $2000 | 6 (60 micros) | $170 |

| $75000 | $4500 | $2500 | 9 (90 micros) | $245 |

| $100000 | $6000 | $3000 | 12 (120 micros) | $330 |

| $150000 | $9000 | $4500 | 15 (150 micros) | $360 |

As shown above, the profit target is 6% of the starting account value for all tiers. The maximum trailing drawdown is the key risk limit, ranging from $1,500 on the $25,000 account to $4,500 on the $150,000 account. This trailing drawdown is effectively the maximum loss allowed from your peak account balance during the test. Notably, TPT does not impose a fixed daily loss limit (marked “❌” in the table). You could theoretically hit the full drawdown in one day; what matters is not to exceed the total trailing loss. This is relatively unique, as many prop firms have a daily stop-loss – TPT’s approach gives you more flexibility intraday, though the trailing drawdown itself is quite tight (for example, only $2,000 on a $50k account, which is about 4% of the balance).

The monthly fee for the evaluation scales up with account size (from $150 to $360 per month). These are subscription fees that recur every 30 days until you either pass the test or decide to cancel. Once you pass and receive the funded account, the monthly fees stop (you no longer need to pay for that account). However, as mentioned, you’ll pay a $130 activation fee for the funded PRO account at that point. In practice, if you were to pass in one month on the smallest account, your total cost would be the first month’s $150 fee plus $130 activation, totaling $280. Many traders use promo codes (TPT frequently offers discounts, such as 40% off) to reduce the evaluation fees, which can be helpful if you need to make multiple attempts over several months.

If you

fail the evaluation by breaching a rule, your test account is closed. You have the option to start over by purchasing a new evaluation (or sometimes TPT may offer a discounted “reset” fee to continue). Similarly, if you

violate the rules in the funded PRO account, the account will be closed, and you will lose access to the funds. TPT does allow up to

3 “resets” of a PRO account – meaning you could pay a fee to reinstate a failed funded account without re-testing – but these

reset fees are reportedly steep (on the order of $1,500), so avoiding failure in the first place is crucial. In any case, whether in the test or funded stage, adherence to the rules is key.

Key Trading Rules and Restrictions

The TPT’s

funded trader program comes with a set of

risk management rules that traders must follow during the Test (and in a slightly modified form during the funded stages). Here are the

core rules and conditions to be aware of:

Profit Target – 6%

As noted, you need to achieve a +6% profit on the starting balance to pass the Test. For example, on a $50k account, you must profit $3,000. There is

no profit target once funding is secured (you don’t have to keep hitting 6% increments or anything); the target only applies to the evaluation phase.

Trailing Drawdown

The maximum trailing loss is the relative drawdown limit that follows the peak of your account. In the Test, TPT uses an End-of-Day (EOD) trailing drawdown – meaning the drawdown threshold updates only at the end of each day, based on your account’s highest closing balance. This is a bit more forgiving during the evaluation: intraday fluctuations won’t stop you out until the end of the day.

However, once you’re funded (PRO stage), the drawdown switches to a live intraday trailing drawdown calculated on unrealized profits. In practice, this means the funded account is harder to keep – if your trade goes up and then pulls back, that peak counts against your drawdown. Traders need to be cautious, as this change in the drawdown rule has caught some by surprise (it has been criticized as a “gotcha” that makes it easy to lose a funded account).

The trailing drawdown value itself is fixed per account size (as given in the table above).

Example: On a $ 100,000 test account, the trailing drawdown is $3,000. If, at any point, your end-of-day equity is $103,000, your new drawdown floor is $100,000 (starting balance). If your balance then falls to $99,000, you’ve exceeded the $ 3,000 drawdown and will fail. In the funded account, that same scenario would trigger based on an intraday peak – e.g., if you were up to $103k intraday but closed a trade at $102k, the drawdown would have trailed to $103k, and your closing balance of $102k would actually violate it, causing loss of the account.* Bottom line:

respect the trailing drawdown and be aware it tightens as you profit.

No Daily Loss Limit

TPT does

not enforce a separate daily loss cap. You could theoretically use the entire drawdown in a single session. This can be a

pro for experienced traders who sometimes endure intraday swings, but it also means there’s no safety net if you have a bad day – the full drawdown is all you have. Many competitors impose a daily loss limit of ~5%, so TPT’s policy of

“no daily loss limit” stands out.

Minimum Trading Days – 5

You must trade at least

5 days in the Test phase before you are eligible to pass. This means even if you hit the profit target in one or two big trades, you still need to execute trades on a total of 5 separate days. This encourages consistency and prevents “one lucky trade” from qualifying a trader.

Consistency Rule (50/50 rule)

To further enforce consistent trading, TPT has a

profit consistency rule during the evaluation: no single day’s profit can account for more than

50% of your total profits. For example, if your profit target is $3,000, you cannot make $1,600 of it in one day and the rest in small increments – that would violate consistency (since $1,600 is more than 50% of $3,000). You’d need to either slow down that big day or make more profits on other days to balance it out. This rule prevents passing the test by one or two large gambles. Note that this rule applies

only in the Test phase – once you’re funded, TPT does not enforce the 50% profit-day limit on your withdrawals.

No Overnight or Weekend Holding

All positions must be flat by the end of the trading session.

Overnight holding is not allowed – you must close positions

at least one minute before the market’s daily close*. Similarly, you cannot hold over the weekend. If you violate this (hold a futures contract through the market close or into a market halt), it’s an automatic failure. This rule is common among

futures prop trading programs to limit gap risk. TPT is strictly for

intraday trading.

News Trading Restrictions

During the Test phase,

news trading is allowed – you can trade around economic releases if you choose. However, once funded, TPT expects traders to

avoid high-impact news events. In the PRO and PRO+ stages, you’re not supposed to trade from about 1 minute before to 1 minute after major scheduled news (such as Fed interest rate decisions or Non-Farm Payrolls). This is to protect against slippage or rule-breaching moves during volatile news spikes. Failing to adhere can lead to account loss.

Position Size Limits

Depending on your account, there is a maximum number of contracts you can have open at once, as listed in the table (e.g., 6 standard contracts on a $ 50,000 account). Exceeding this limit even for a moment is a violation. TPT gives both a mini and micro contract cap – essentially, you can trade micros at a 10:1 ratio (e.g., 1 mini = 10 micros). These limits are in place to ensure you don’t take on outsized risk relative to the account size.

Trade Frequency Limit

TPT imposes a daily limit of

50 executions

on all accounts. An “execution” refers to one order fill – either opening or closing. In practical terms, this means you could take up to 25 round-trip trades in a day (25 entries + 25 exits = 50 executions). While 25 trades/day is plenty for most day traders, it can constrain very high-frequency scalpers. This rule, combined with the tight drawdown, means you must be strategic – you can’t just machine-gun trade all day hoping to accumulate profit.

Weekly Activity Requirement

To prevent inactive accounts from lingering, TPT requires that you place

at least one trade per week during the evaluation. If no trades are taken in a 7-day period, your account may be considered inactive and could be closed. The trade doesn’t have to be a big one – even a single small trade (held for at least one minute) satisfies the requirement. This rule mainly ensures that traders don’t subscribe and then pause indefinitely.

No Automated Trading

TPT prohibits the use of trading bots or Expert Advisors (EAs) on their accounts. All trading must be done manually or with discretionary systems. They aim to avoid high-frequency algorithmic strategies that could exploit their systems or exceed execution limits.

These are the primary rules. In summary,

you need to trade like a disciplined day trader: hit a reasonable profit target with moderate positions, don’t violate the drawdown, avoid oversized or overnight bets, and show consistency. The conditions are

challenging – as TPT openly acknowledges, most traders will not pass on the first try (or at all). However, for those who can manage risk effectively, the reward is a funded account with very attractive profit-sharing opportunities.

Supported Markets and Platforms

Markets

Take Profit Trader is exclusively focused on futures contracts – this includes equity index futures (e.g., S&P 500 E-minis), commodities (crude oil, gold, grains, etc.), currency futures (6E Euro FX, etc.), financials (Treasury note and bond futures), and even micro futures across these categories. In total, they offer access to 40+ futures instruments from CME Group exchanges.

This is a wide selection, covering all the major liquid futures markets.

Forex, stocks, or crypto trading is not offered – TPT is for futures trading only (which aligns with its target audience of futures day traders). The inclusion of micros is great for fine-tuning position size. One limitation is that since no overnight holding is allowed, you can’t swing trade futures or hold multi-day positions here – it’s purely intraday action.

Platforms

TPT integrates with two major data/execution feeds, CQG and Rithmic, which allows compatibility with a large number of trading platforms. Traders can use popular platforms such as NinjaTrader, TradingView, Tradovate, R Trader, Quantower, Sierra Chart, Bookmap, and more. In fact, TPT advertises that it supports 15+ platforms.

For example, if you prefer TradingView for charting, you can connect via CQG; if you prefer NinjaTrader or other platforms, you have options. This flexibility is a plus – you’re not forced onto a proprietary platform. Do note that some platforms (like NinjaTrader full version) may require their own license, and exchange fees might apply for live data (TPT provides data during the evaluation, presumably built into the cost).

TPT uses

simulated brokerage accounts for the Test and PRO stages, so the trades do not hit the live market (until PRO+). Commissions are charged to make the simulation realistic: currently about

$5 per round-turn on standard futures, and $0.50 per round-turn on micros during the test/funded sim phases. Once you transition to PRO+ (live), commissions may vary slightly depending on the platform (e.g., approximately $1.29 RT on NinjaTrader for futures). These trading costs are worth considering, as active trading can incur significant fees.

Take Profit Trader Pros and Cons

Like any prop trading program, TPT has its strengths and weaknesses. Based on the features and rules, as well as trader feedback, here’s a breakdown of the

pros and cons:

Pros

- One-step evaluation gets you funded fast.

- No time limit to complete the test.

- Withdraw profits from day one.

- Keep 80–90% of profits.

- No monthly fees after funding.

- No daily loss limit.

- Trade 40+ futures markets.

- Supports many platforms.

- Strong user reputation.

- 24/5 responsive support.

- Clear rules and refund promos.

- No cap on withdrawals.

Cons

- Tight trailing drawdown, stricter when funded.

- First profits locked as a buffer.

- The consistency rule penalizes big wins.

- No overnight or weekend trading.

- News trading is restricted when funded.

- Max of 3 funded accounts per trader.

- Higher fees for larger accounts.

- Costly resets if you fail.

- New firm with a limited track record.

- Not beginner-friendly due to strict rules.

User Reviews and Community Feedback

Understanding real user experiences is crucial to evaluating a prop firm’s trustworthiness and suitability.

Take Profit Trader generally receives positive feedback from the trading community, but there are also some common complaints to be aware of.

Take Profit Trader Trustpilot Reviews

On Trustpilot, TPT holds a strong rating of 4.4 out of 5 (based on about 5,000 reviews). Approximately 81% of reviewers have given it a 5-star “excellent” rating. This is a good indicator that the company delivers on its promises for most users. Many traders praise TPT’s customer service and payout system. According to an aggregated Trustpilot review summary, customers frequently mention the responsive and helpful support staff, fast resolution of issues, and the ease of receiving payouts (with daily withdrawals being a notable advantage). It’s common to see users credit specific support reps for assisting with billing questions or platform setup. The fact that traders can earn their profits quickly – sometimes even on the same day – is a significant advantage that’s consistently highlighted in reviews.

Users also appreciate the trading conditions compared to other prop firms. For instance, some mention that the absence of a daily loss limit and the straightforward one-step evaluation made them choose TPT over its competitors. The variety of platforms (like the ability to trade via TradingView or NinjaTrader) is another aspect that gets positive nods.

However, not all reviews are glowing. The Trustpilot summary notes that a segment of users had

negative experiences, such as unexpected account closures or accusations of rule violations.

Examining those cases, it appears that many low-star reviews originate from traders who failed the evaluation or had a funded account and felt that something was unfair – for example, claiming that a rule wasn’t clearly communicated or that a sudden price move resulted in their account being closed. TPT typically responds to such reviews, explaining the rule in question (e.g., a trailing drawdown breach due to an

intraday peak in equity). In some instances, traders have complained that their

accounts were terminated for what appear to be minor reasons. This underscores that TPT’s system is very strict: if you break a rule, even unintentionally, the software will flag it.

Take Profit Trader Reddit Reputation

On community forums like Reddit, you’ll find a mix of opinions. In the r/Daytrading subreddit, one discussed thread had experienced users warning that Take Profit Trader is easy to pass but “very easy to lose the account” after funding. The main gripe was the switch from end-of-day to intraday drawdown once funded – a user noted this made it “kinda scummy” in their view, because a trader could pass under forgiving conditions then quickly hit a loss under stricter conditions. That user and others favored some competitors that keep drawdown calculations consistent. Additionally, the costs of resetting accounts in the event of a breach were criticized; paying up to $1,500 to reset a live account was seen as prohibitive and gave “big scam energy” to one Redditor. On the other hand, even that user conceded that TPT’s customer service was very responsive despite his issues.

Overall, the sentiment is largely positive among those who successfully navigated the program – they report receiving payouts and having a good experience with TPT’s team. The negative voices mostly come from those who encounter stumbling blocks with the rules or a lack of support. It’s worth mentioning that TPT’s Better Business Bureau (BBB) profile also displays a few complaints, primarily related to customer support delays or disputes regarding refunds. TPT has responded to those with apologies or clarifications (for example, explaining that slippage can cause stop-losses to breach drawdown in fast markets, which isn’t something they can prevent). The existence of some complaints is not unusual for a prop firm that has grown quickly; what matters is that none of the issues indicate non-payment or any fraudulent activity, just the typical frictions inherent in this business model.

In summary, user reviews suggest that

Take Profit Trader is a legitimate prop trading firm that, for the most part, pays out successful traders as promised. The platform’s support and policies are viewed as superior to those of many peers. Yet, traders also caution that you must thoroughly understand TPT’s rules – many dissatisfied users simply didn’t realize a specific rule (such as the news trading or weekly trade requirement) and got caught out. The prop trading community often advises: if you go with TPT,

be disciplined and treat the evaluation as seriously as trading real money, because the rules will be enforced to the letter. Those who do so have found TPT to be a valuable avenue to trade futures with funded capital.

Regulation and Tax Considerations

Because Take Profit Trader is not a broker but a provider of a trading evaluation service, it operates a bit differently from a traditional brokerage account. U.S. financial authorities, such as the SEC or CFTC, do not regulate TPT in the same manner as a broker or investment advisor. Essentially, when you trade in the evaluation or PRO phases, you are trading on a simulated account under TPT’s program rules, not placing trades on a live exchange on your own behalf.

Only at the PRO+ stage might you be trading a live account (which is under TPT’s master brokerage). Prop firms like TPT typically position themselves as education or training services to avoid needing broker registration. This means that, as a user, you don’t have the same regulatory protections as a brokerage client – for example, your funds paid in fees aren’t insured, nor are they protected in any other way (though you’re not depositing trading capital, just paying for the service). The model relies on trust in the company’s reputation and contract. The good news is that TPT has thus far maintained a good reputation for honoring payouts. Being U.S.-based (in Orlando, FL) provides some jurisdictional comfort compared to an offshore entity.

From a tax perspective, any profits you receive from TPT (payouts) are typically treated as ordinary income. You’re essentially working as an independent contractor/trader for the firm. In the U.S., prop firms typically issue a Form 1099 for payouts that exceed the IRS reporting threshold. You should be prepared to pay income tax on those earnings, just as you would for any freelance or trading income. Consult a tax professional, but note that these payouts are not capital gains from your own trading account – they are compensation, so they don’t get special tax treatment. Please also keep track of fees, as in some cases, you may be able to deduct them as business expenses (again, seek professional advice).

For international traders, TPT does accept traders from many countries. They support multiple payment methods, including credit/debit card, PayPal (with fees), bank wire, and ACH for withdrawals, to accommodate different regions. If you’re outside the U.S., ensure that prop trading is permitted in your country and consider how you’ll receive payouts (via PayPal or bank transfers) and the associated currency conversion fees.

Additionally, check your local tax laws – you will most likely be required to pay taxes on income received from abroad. One thing to clarify: since TPT’s program is not trading your personal money, there is usually no concern about the pattern day trader (PDT) rule or other retail trading regulations. You are free to day trade futures in the program regardless of personal account size, because you’re using TPT’s provided accounts.

In summary, TPT is an unregulated entity (like most prop firms), so due diligence is important, but their track record and U.S. location provide some confidence. Always trade within the legal guidelines of your region, and report any income from prop trading to the tax authorities as required.

Bottom Line: Is Take Profit Trader Worth It?

Take Profit Trader has proven itself to be a credible player in the prop trading space, especially for futures traders. The firm is legitimate – it offers what it advertises (funded accounts with fast payouts), and numerous verified success stories attest to its credibility. If you are an experienced day trader with a solid strategy and you’re confident in your ability to stay disciplined, TPT could be an excellent choice. The one-step evaluation and absence of a time limit allow you to attempt the challenge without undue pressure, and the immediate withdrawal policy is among the best in the industry for those who pass. Furthermore, the 80%–90% profit split is highly favorable, allowing skilled traders to retain the majority of their gains.

However, TPT is not the best fit for everyone. Day trading beginners or traders still finding consistency may find TPT’s challenge a costly trial-and-error. The firm itself notes that fewer than 1 in 5 traders pass the test – so you should realistically expect that you might need multiple attempts (and thus pay multiple fees) before succeeding, if at all. For someone still learning, those fees could be better spent on education or practicing on a simulator. In other words, TPT is best suited for traders who have already demonstrated (to themselves) in demo or small live accounts that they can trade profitably within similar risk limits.

It’s also worth comparing TPT to its competitors to see which prop firm aligns with your needs. For instance, if you desire to trade forex or hold positions overnight, a firm like FTMO might be more suitable (FTMO allows swing trading and has a longer evaluation, though it focuses on forex/CFDs). If you require a larger drawdown or a two-step evaluation that necessitates more practice, Topstep or other options might be a better fit.

TPT’s niche is clearly the trader who wants to focus on futures, get funded fast, and withdraw profits fast, with minimal restrictions on trading style (intraday) beyond the risk management rules. In that niche, TPT competes closely with programs like Apex Trader Funding, Leeloo, and Earn2Trade. Each has slightly different rules (for example, some have larger drawdowns but enforce daily loss limits or have two-step challenges). TPT’s unique selling points are the day-one payout and one-step simplicity, whereas its main drawbacks are the intraday drawdown in funded accounts and the strict profit buffer.

From a value perspective, TPT’s fees are reasonable for the service, especially if you catch a discount. Be mentally and financially prepared to pay for a few months or resets if things don’t go perfectly. Think of it this way: if you succeed, the cost is trivial compared to getting a $50k–$150k account to trade. If you don’t, those fees are the price of learning under real market pressure.

Our verdict: Take Profit Trader is

worth considering for skilled futures traders seeking funded capital, thanks to its quick route to funding and trader-friendly profit policies. It has a strong reputation and isn’t a scam or “money grab” – many have been funded and paid. But it’s also

not an easy mode for trading; the requirements demand solid

risk management and consistency. If you decide to pursue TPT, ensure that you thoroughly understand the rules (including no overnight positions, 50% consistency, and trailing drawdown mechanics) and consider starting with a smaller account to get a feel for it. With preparation and discipline, TPT can be a legit pathway to trading with significantly larger capital than you might otherwise access, all while limiting your personal downside to fixed fees. Ultimately, success will depend more on the trader than the platform – TPT provides the opportunity, but it’s up to you to capitalize on it and generate a profit.

Day Trading Insights Research Team

Day Trading Insights Research Team publishes articles written by active day traders, financial market researchers, or aspiring traders who are actively learning and investing on a regular schedule. Our research team brings formal training in finance and computer science, blending market theory with code-driven testing and tools. We’re passionate about understanding how trading works, how markets evolve, and how technology can sharpen professional decision‑making. Our content is education‑first and independently produced, free from outside bias.